The fact is that many countries around the world were ahead of Australia and many global players – investors and companies – were aggressively pushing ahead on carbon reduction programs years before.

Fast-forward to post-election Australia, where climate change and green policies were pivotal, and an Albanese government has formally committed Australia to a more aggressive carbon reduction policy, reducing greenhouse emissions by 43 per cent by 2030.

Lest it soften its resolve, it will be under continued pressure to outline more detailed policies on climate change from an upper house where the Greens will hold the balance of power.

The economies of carbon markets and carbon reduction are now moving into centre stage as players work out what the policy will mean in practical terms and watch the evolution of a carbon market in Australia.

Corporate Australia is now well and truly on notice that it is under pressure not only to make vague commitments about reducing emissions in its operations but to provide detailed pathways on how it plans to get there.

Almost daily, the fund management community – led by a combination of global players and increasingly the $1bn industry fund sector – is stepping up pressure on companies to decarbonise.

The fight over the future of AGL and its power station was a milestone.

The issue saw super fund HESTA come out weeks before a planned shareholder vote saying it would oppose the AGL’s demerger plans, supporting the stance taken by Atlassian co-founder Michael Cannon-Brookes.

Its public move saw other super fund investors, which were taking a lower-key approach, fall into line. Not only did the AGL board drop the idea but key directors and management announced their resignation.

The changes highlight a growing tension for both companies and funds in 2022 and going forward – carbon reduction vs profits and returns.

Two small events this week highlight the shift. IFM Investors, an industry super-backed vehicle, is launching a new climate transition fund for Australian listed equities.

The fund is a pooled fund which will invest in a climate-enhanced index of shares, primarily investing on behalf of Australian super funds which are themselves under pressure to be more proactive in reducing the carbon emissions in their portfolios.

While some of the big funds such as the $260bn AustralianSuper manage a large proportion of their money in house, many smaller to mid-sized ones don’t have the expertise.

Investing in shares and even property is one thing, but how to judge the carbon emissions of each company as a trustee of a small to mid-sized super fund?

IFM is stepping in here using its expertise in investing with an eye to reducing the carbon emissions in its own portfolio.

The fund announced plans to reduce the carbon emissions in its portfolio to zero by 2050 two years ago and has followed up with more specific announcements, including one in September last year to reduce the carbon emissions in its key infrastructure portfolio by 40 per cent and exiting its coal portfolio by 2030.

Announcing its new fund this week, IFM pointed out that as one of the largest local investors in Australian shares it is better placed to press companies to get a move on in reducing their carbon emissions.

“The fund’s investment strategy includes leveraging IFM’s scale as one of the largest equity managers to actively engage with companies and advocate for greater corporate accountability and positive climate outcomes,” it says.

Add HESTA’s confident AGL management challenge and IFM’s words, which are among many similar comments by big fund managers, and corporate Australia has nowhere to hide from the investor pressure.

Despite IFM’s expertise as a major investor, it is not choosing the shares itself for the index but relying on data from third parties which closely track and quantify individual company’s Scope 1, 2 and 3 emissions.

IFM is using its quant jocks to put the index together in a way which cannot stray too far from the performance of the ASX 300 index to reduce its fund manager investors falling foul of the Your Future, Your Super performance tests. Super funds and others in the ESG investing industry have been complaining for some time that the Your Future, Your Super benchmarks are too narrow and make investing with an eye to lower carbon emission difficult.

The incoming Superannuation Minister Stephen Jones has promised to take a look at the benchmarks with some of these complaints in mind, but doesn’t seem to be in too much of a hurry.

But the tension is there – how does increasing pressure for the reduction in carbon-emitting activities impact on short-term profits and returns for both companies and fund managers?

A new report by the Australian arm of the Boston Consulting Group this week also points out that companies can no longer just cheerfully announce plans to reduce carbon emissions, or being more green, and expect automatic shareholder applause.

It warned that companies need to provide a lot more detail on the sustainability and ESG announcements, including plans to achieve their targets, the cost and the specific advantages to the company itself.

The report, by Boston Consulting partner Sam Farley, studied announcements by top ASX companies over four years from 2018 to 2021.

After dealing with company executives who were disappointed that their environmental and sustainability-related announcements didn’t get the shareholder support they expected, his report sets out a list of criteria needed.

They basically involve the need to give a lot more granular detail about their plans.

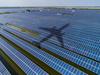

In short, 2022 is when the rubber is hitting the road in Australia when it comes to companies and what they are doing to reduce their carbon emissions.

Their emissions are being watched, studied, quantified and compared with their peers and by investors.

Australia’s $1 trillion-plus industry super fund movement is at the forefront of the pressure as increasingly active and vocal investors in ASX shares.

The green industry is only going to get bigger.

It’s hard to believe that it was only in November that Scott Morrison was able to muster enough support within his governing party to make a speech committing Australia to target of net zero emissions by 2050.