Origin: It can’t be business as usual after Brookfield defeat

Sending Canadian giant Brookfield packing is just the beginning of a bigger battle. A different approach is needed by Origin’s board, starting with a new chairman.

It’s been little over a year since Origin’s board led by Scott Perkins first revealed it was ready to be acquired by Canadian fund major Brookfield.

And before that, there were another three months of behind-the-scenes meetings between Brookfield’s Asia boss Stewart Upson and the board to agree on the carve-up and sale of Origin under a plan dubbed by the energy major as “Project Webb”.

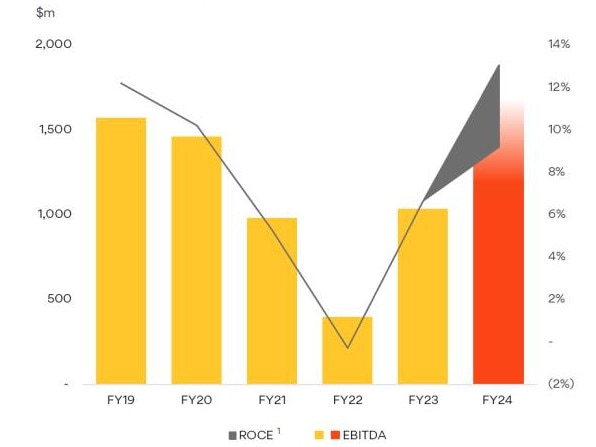

Since then, Origin has taken its shareholders through a wild-ride of emotions and twists of buyout talks – only to end up in exactly the same place. That is, the ASX-listed Origin remains intact as Australia’s biggest integrated energy retailer, although its shares are up 45 per cent since the bid was made public.

The fallout from Monday’s defeat of Brookfield’s $20bn takeover and its tricky “Plan B” alternative offer, means it can’t just be business as usual for Origin now.

Regardless that it was Brookfield that lobbed the unsolicited approach last year, Perkins’ warm embrace of the suitor through the process (and later willingness early this year to accept a discount) means his position as chairman remains untenable.

His board became much too blinkered by Brookfield by eyeing the near-term value over the bigger longer term ambition. It seemed no one inside Origin was asking why Brookfield and its backers was so eager to pay just a fair price for a very good company.

Origin’s camp argues that Perkins secured a substantially higher offer from the first Brookfield approach and after a scheme deal had been signed he was bound to support the deal. They also argue shareholders were initially supportive of the deal as was an independent expert.

Even though AustralianSuper represented 17.5 per cent of the vote with its blocking stake, the defeat of the scheme of arrangement with the help of fund manager Perpetual and other big funds shows wider discontent and a failure by the board to anticipate investor resistance to the deal particularly as energy markets quickly turned more bullish.

Brookfield needed 75 per cent for its offer to get across the line, and in the end it failed to secure this. It was a rare miscalculation from the fund that counts former Bank of England governor Mark Carney on the payroll and could only muster 68.9 per cent.

Regardless of how the vote was cut, scheme didn’t have support on the day. The loss drew a round of applause from the more than 150 or so retail shareholders who attended the vote and mostly just wanted to keep Origin and its juicy dividend stream in public hands.

Time to go

Perkins, who has been on the board for eight years, including the past three as chair, needs to go. To his and his predecessor’s credit, Origin’s board in general has relative new talent and experience with Mick McCormack, Nora Scheinkestel, Joan Withers and Ilana Atlas each serving less than three years on the board. Although Maxine Brenner is now pushing 10 years and her position has most certainly been delayed by the Brookfield approach.

After the meeting Perkins sidestepped questions about his future but said feedback from shareholders offered uniform support of the way the company had conducted itself.

Perkins too says there’s no pressure for Origin to change strategy.

But there are real questions over how much longer well-regarded chief executive Frank Calabria who has been in the role seven years. The Brookfield proposal was set to neatly bookend to his extensive executive career. After the meeting Calabria said he remains energised in the role.

“It’s been a big 12 months, but I’ve got no other plans. I’m very happy leading the company,” Calabria says.

Brookfield has vowed to come back. If it musters the energy, the Canadian charm will be gone and things will turn hostile. It has previously threatened a lower price with an on market bid. Technically it could come back as early as tomorrow, but its more likely it will figure out its position over a period of months.

To get control of the energy company, Brookfield and its partners only need to secure 50.1 per cent in any on market deal.

An aggressive suitor on the outside armed with all of Origin’s sensitive financial data will need a different mindset inside the boardroom, not the handshakes and goodwill of the past 16 months.

Origin’s relationship with its biggest shareholder, AustralianSuper, also needs to be rebuilt. The $300bn industry fund has shown it’s now prepared to flex its financial muscle to get its way, but the boardroom needs to be firm enough to show that AustralianSuper doesn’t control Origin with its minority stake.

AustralianSuper has repeatedly declared it is prepared to back Origin’s renewable investments through its $20bn of annual inflows and reiterated its commitment Monday. Origin should move quickly to tap this cheap capital, but it can’t come at the expense of other shareholders.

Aim high

Finally, Origin badly needs to reset its own strategy in order to maximise its position in the green energy transition.

Brookfield came to the table with a promise to spend tens of billions building up a formidable portfolio of generation and storage assets. Many of these plans have yet to be pinned down, but the promises helped secure its social licence. Origin should learn from the ambition.

There is a land grab underway in green energy, and Origin’s 18 months lost through a friendly auction with Brookfield has left it starting from a long way behind.

That doesn’t mean Origin’s place in the market has become any less attractive, in fact, as the fight between AustralianSuper and Brookfield has shown, it’s just the opposite.

However, with 4GW of planning for renewable generation by the end of the decade this is decidedly unambitious for a company with the size, heft and energy expertise of Origin.

Much of these greenfield solar, wind and battery projects are still sitting on the Origin drawing board and chief executive Frank Calabria and his team need to get cracking.

The most advanced of these in place is a 460MW battery now being progressed at its massive Eraring power station in the Hunter Valley. There is an option to increase this to 700MW in years to come, and this forms the backbone of the 4GW target. In addition there’s another 1600MW in uncommitted solar under the target.

Smaller AGL has detailed at least 12GW to come, and now Chris Bowen has pledged to throw taxpayer dollars underwriting 32GW of energy under the Capacity Investment Scheme.

The program has sharply improved the economics of batteries that can be installed at a quicker pace. Bigger green generation assets such as wind and solar are longer term propositions.

Origin is sitting on the best green real estate alongside much-needed transmission lines in the country, and along with investor funds, it has the cashflow from gas sales and legacy coal-fired generators to pay for the investment needed.

The defeat of Brookfield’s $20bn buyout is a mess for everyone involved to be sure. All told the price of Project Webb was $70m spent by Origin so far on bankers, lawyers and others. Stunningly work had even begun on the technical and legal separation of the company between its gas exports and electricity business even before the vote was in.

But it can’t be business as usual. Origin needs to take this moment and build a longer term win for all shareholders.

johnstone@theaustralian.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout