Gas shortfall fears for next year: supply squeeze threatens to leave users out in the cold in 2023 winter

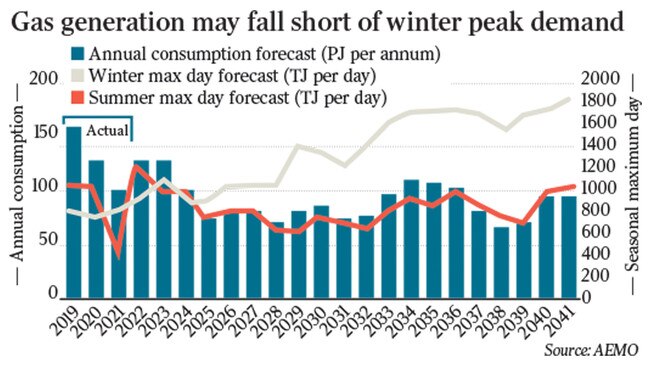

The Australian Energy Market Operator has forecast a risk of gas shortfalls under extreme weather from winter 2023 as production dries up from offshore fields.

Households in NSW, Victoria, the ACT and Tasmania could be forced to cut their gas use during next year’s winter due to an ongoing supply squeeze as production dries up from offshore fields and amid a year-long delay bringing on volumes from Australia’s first LNG import plant.

The shock warning, first revealed by The Australian on March 21, means consumers and businesses face a fresh energy security crisis at a time of record petrol prices and broader inflation across the economy and ahead of a May federal election.

The Australian Energy Market Operator, which runs the national electricity and gas system, has forecast a risk of gas shortfalls under extreme weather conditions from winter 2023 in NSW, Victoria, Tasmania and the ACT, when average consumer demand is three times more than summer.

“A shortfall risk in the southeastern states in winter 2023 is forecast under extreme conditions, given ongoing production decline from Bass Strait, and pipeline capacity limits from northern Australia, including the Moomba to Sydney Pipeline and the South West Pipeline,” said AEMO’s executive general manager for system design, Merryn York.

A one-year delay in delivering the nation’s first LNG import plant, owned by billionaire Andrew Forrest, at NSW’s Port Kembla will add to the supply squeeze. The project was identified a year ago by AEMO as averting a near-term deficit by adding an extra 500 terajoules a day of gas into the domestic market ahead of the 2023 winter.

However, AEMO now forecasts the iron ore magnate’s LNG plant will not be ready until the 2024 winter, a significant factor in the gas gap that could hit the market next year.

Port Kembla “developers now advise that they remain committed to the terminal and associated pipeline infrastructure, but insufficient customer contracts have delayed the relocation and operation of the floating storage and regasification unit, and project works will not be complete until late 2023. AEMO now classifies the project as anticipated supply for winter 2024,” the system planner said in its annual gas statement of opportunities report.

States could also ask household consumers through the media to voluntarily reduce their use of gas during forecast extreme peak day events, while broader “scarcity risks” for the entire electricity network could flow from any gas shortages if other types of generation are not available.

The gas crunch over recent years has in large part been sparked by the rapid depletion of supply sources in Victoria’s offshore Gippsland Basin by mid-2023, although Exxon last week committed to bringing more gas to the market.

The Morrison government is fast-tracking a series of gas infrastructure projects to bring more supply to the domestic market, including Snowy Hydro’s Hunter gas plant, and in Tuesday’s budget it will pour nearly $50m in grants to accelerate “priority gas infrastructure projects” to increase storage and deliver more supply to the southern states. Shortfall risks after the 2023 winter through to 2026 are expected to fall as Port Kembla and a host of other new supply sources come online, although later in the decade further gaps could again emerge with a decline in production outpacing an expected drop in consumption.

The fate of gas over the next few decades appears bleak under several of AEMO’s future scenarios as users switch to electrification while huge investment piling into hydrogen could also roil the fossil fuel.

“Under AEMO’s scenarios, there is uncertainty about future demand for and supply of natural gas as the market identifies pathways to decarbonise and users look to alternative fuels, like hydrogen or electricity, for industrial processes, manufacturing, heating and cooking,” Ms York said.

The system operator’s scenarios also now assume stronger electrification with consumers switching from gas to electricity to lower emissions as the market develops more renewable energy than last year.

The issue of dealing with such a tight demand-supply gas market has also prompted AEMO to consider whether it needs to consider introducing a new mechanism to keep the grid running uninterrupted.

It can currently call on emergency power reserves as a last-ditch method to keep the electricity grid running uninterrupted and may need a similar tool for gas markets.

“Increasing ‘peakiness’ of gas demand is likely to require flexible solutions that support high, but infrequent, gas demand,” Ms York said.

“This may include possible new instruments that emulate contingency gas in the Short Term Trading Markets or the National Electricity Market’s Reliability and Emergency Reserve Trader.”

Five LNG import plants are in the works in Australia with two in NSW – the Port Kembla facility and a South Korean-sponsored development in Newcastle.

Viva Energy’s Geelong hub is accelerating plans to sign off on its venture, Venice Energy also has plans for a South Australian project, while Dutch oil storage giant Vopak is considering developing a terminal near Geelong.

Victoria’s supply situation also hinges on supplies being sent south from Queensland’s big LNG export plants, which are major contributors to domestic markets in addition to their foundation buyers in Asia.

The competition regulator in February warned that in the southern states a shortfall of 10 petajoules was expected this year and gas would need to be directed from the north to meet demand.

However, analysts expect the supply crunch in Russia will lead to a new surge of demand for LNG volumes globally, potentially incentivising Australian producers to cash in abroad, while a price spike for LNG also raises questions over the economics of import schemes.

“The push in many countries to diversify away from Russian gas may affect Australian LNG exports as well as potential access to LNG imports, and the demand for floating storage and regasification units which are the infrastructure enabling these imports,” AEMO noted.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout