Brookfield chair Mark Carney outlines vision to power Australian green manufacturing

A massive investment slate for Origin from its incoming owner will provide “critical mass” needed to kickstart a local renewables industry.

The incoming-owner of Origin Energy is exploring bringing billions of dollars worth of wind and battery storage manufacturing into Australia, to help underpin the electricity giant’s efforts to accelerate its exit from coal.

Mark Carney, the global chair of Canada’s Brookfield Asset Management, said a $20bn investment slate for Origin will provide the “critical mass” needed to kickstart a local green energy manufacturing business.

Mr Carney, the former Bank of England governor, said the infrastructure major is already exploring strategic partnerships with players that can establish onshore production hubs.

“The solution here is a combination of wind and storage … and so we’re working through what would make sense to onshore components of both of those technologies,” Mr Carney told The Australian.

“One of the attractions of what’s interesting with the transaction is that it creates the possibility for that (onshoring) and we want to, we will fully, fully explore that,” he said.

Such a move would also give a much-needed boost to Australia’s efforts to develop manufacturing capability for the critical minerals that are mined here including copper to lithium. Australia’s efforts in this area are seen as quickly lagging behind the US and Europe with governments there offering significant incentives to build up a higher value production base.

Speaking to The Australia as part of a wide-ranging interview, Mr Carney said the $800bn Brookfield had the global expertise and access to capital to pivot Origin – one of the nation’s biggest power generators – away from coal into a renewables heavyweight.

And while nuclear energy is not on the table in Australia, Mr Carney said on a global level “there’s no transition to net zero without nuclear”.

Currently nuclear provides about 8 to 9 per cent of the global generation mix, mostly for baseload power and this is expected to increase sharply in coming decades. Brookfield, already one of the world’s biggest independent renewable energy operators, is exploring further investments around nuclear services or small scale nuclear plants.

“It’s hard to find a reliable, always on zero emission, baseload source,” Mr Carney said. More broadly, Australia “still needs to decide” over the coming decades which path it goes down for longer-term base load energy supply at scale, he said. This could be either hydro, nuclear or some other technology.

Mr Carney is a former Governor of the Bank of Canada and the first non-British citizen to head up the Bank of England. He was overseeing the UK central bank in the lead up and following its Brexit vote and at the time had warned that an exit from the European market was likely to result in supply shocks.

After stepping down from the Bank of England Mr Carney joined Brookfield in late 2020, where he led the infrastructure major’s global $US15bn ($22.4bn) transition fund that makes investments in green energy and associated opportunities. Late last year he was named chair of the Toronto-headquartered Brookfield Asset Management.

Mr Carney is in Sydney this week after Brookfield last month secured an agreement with Origin’s board for a $18.7bn mega power buyout. The deal is yet to be voted on by Origin’s shareholders and still needs regulatory approval. The takeover deal includes a plan for Brookfield to invest an extra $20bn in Origin through to 2030 to build up to 14 gigawatts of new renewable generation and storage facilities in Australia.

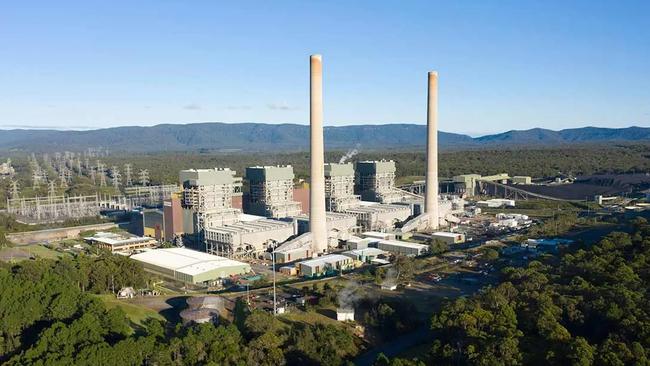

Central to this is shutting down the Eraring coal-fired power plant in the Hunter Valley, with Origin already committing to its closure by August 2025. This has stoked concerns about reliability, including from incoming NSW Premier Chris Minns.

Mr Carney said while Brookfield also intends to close the plant that supplies 25 per cent of NSW’s energy grid, this will only be done when there is about 4 gigawatts of wind and storage renewables ready to be deployed in its place.

“To be absolutely clear, there is no scenario in which we would shut down (Eraring) before it was ready,” he said.

In acquiring Origin, Brookfield takes “full responsibility” for the 4.5 million households and business customers that expect reliable, low cost power, he said. There is also an increasing number of customers that expect that power also to be sustainable.

“What we’re bringing in is the capital and the expertise in order to do that”.

Nor is he concerned about greater government intervention in Australia’s energy market, the most recent efforts include price caps on coal and gas pricing. Mr Carney believes rising intervention is a feature of most energy markets around the world while costs for households are soaring. But Mr Carney believes Brookfield “will adjust to the market as it evolves”.

The Origin deal is not only material to accelerating the energy transition in Australia, it is a globally significant transaction that will be a major test around the effectiveness of privately held transition style funds.

“This is a large-scale, true transition. It’s going where the emissions are and having a plan, putting capital work and bringing partners in to get those emissions down”.

The Brookfield-led transaction will result in Origin being split into two. Brookfield will control Origin’s energy markets business, comprising electricity and gas retailing, while EIG’s MidOcean unit will buy the integrated gas business, which includes the prized APLNG export plant. Brookfield and its partners are targeting completion of the deal by early next year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout