Reece bites bullet to tap US market

Reece’s expansion into the US was quite a wrench for the Australian plumbing giant.

It was a deal that was the absolute antithesis of everything Reece family patriarch Alan Wilson stood for: a multi-billion-dollar takeover in a foreign land funded by the biggest capital raising in the company’s history.

“I never thought we would do this. It was Peter’s dream,’’ Wilson, executive chairman of the nation’s largest bathroom products and plumbing group, tells The Weekend Australian of his 50-year-old son, who for the past 12 years has been the managing director of Reece.

“You come from a Victorian town and to grow to do what we have done in Australia was even beyond my dreams. Once we got going in Australia, I thought we could get to New Zealand. I thought that would be it in my lifetime. So we have done something I didn’t expect could happen.”

Wilson is making his first public comments on Reece’s $1.91bn acquisition last year of MORSCO, a key American distributor of plumbing, waterworks, heating and cooling products.

It was Reece’s first move into the highly competitive and disparate $US32bn ($46.4bn) US plumbing market.

So far, so good for MORSCO. The company, which operates 171 commercial and residential plumbing showrooms across 16 states in the southern parts of the US, grew revenue to a steady $US518m in the first quarter of fiscal 2020.

For the year to June 30, 2019, MORSCO’s sales revenue was $2.6bn. In Reece’s core Australia and New Zealand business, revenue was only slightly higher at $2.9bn.

Which is why Alan Wilson now believes the growth prospects for his iconic business, which started in 1919 when Harold Joseph Reece began selling hardware products from the back of his truck in Melbourne suburbia, will be in America.

“If we get it right, the earnings in America will be bigger than here. The growth there is substantial. The growth in Australia depends upon the economy,’’ he says.

While Wilson describes the US market as “very challenging”, he says it was pure pragmatism that drove his eventual support for the MORSCO deal.

“I understood that if we didn’t do something substantial, there would be a problem with maintaining and growing and keeping the enthusiasm within the staff and senior people. You need to keep having challenges for everyone. If we stopped in Australia, where would our people go? They would finish up in our competitors’ hands or something. I don’t know. Where else do you go?’’ he says.

“We did look at diversifying. But I would rather stick to my knitting. There are no real surprises in America. We do understand the business there. Every time I listen in to what they are doing, there are no real surprises.”

While Wilson didn’t visit MORSCO’s operations during the 12 months of due diligence ahead of the deal, and hasn’t since it was announced because of his wife’s ongoing health issues, he has been visiting America since the 1980s.

“And I did an extensive tour of both England and America back in the 1990s because a company tried to buy us, a firm called Fergusons. I think I have a fair handle on it,’’ he says.

His son admits it was difficult to convince his father, who he talks to every day, to do the deal. And the board.

“They were very sceptical. It was a big, big process,” Peter Wilson says.

“We have shown them warts and all, the risk versus reward. And that is what we are about. We are an entrepreneurial company, there is no guarantee here. I just tell them how it is. I probably share more warts than anything. And that is me, that is my style.”

Wilson Jr has previously acknowledged he had only one ambition in life as he studied accounting and marketing at university: to follow in the footsteps of his famous father.

Reece was listed on the Australian stock exchange in 1954 and a decade later was bought by the Wilson family. Alan Wilson’s father and grandfather had both been plumbers. The Wilsons still own 70 per cent of the company.

But the American deal has made Reece, for the first time in its history, a global enterprise. Which brings with it much greater complexity and many challenges.

In August Reece announced a 10 per cent fall in net profit after tax to $202m, as its core Australian and New Zealand business eked out sales growth in what Reece called a “moderating” economic environment.

Housing completions in Australia in the year ahead are expected to be down 12 per cent, putting a further cap on growth, although Alan Wilson told the company’s annual general meeting at the end of October that Reece had become more “recession proof”.

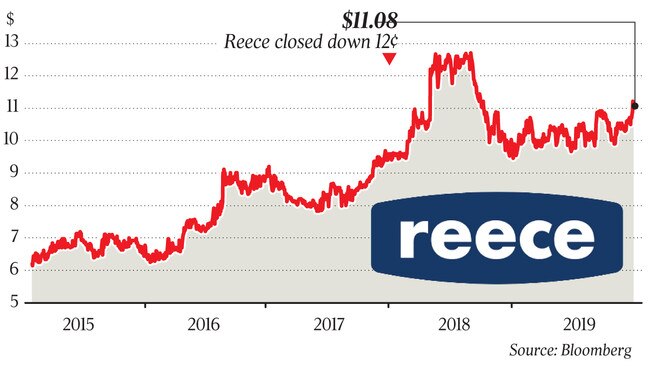

Since the AGM, ahead of which Reece shares had fallen below $10, they have climbed back towards $10.80. But they were worth over $12.50 in June last year.

Peter Wilson says the task for Reece in Australia is to defend its market-leading position by continuing to innovate.

For example, the company’s ventures arm, Superseed, has launched an app called “Goodwork”, that allows tradespeople to contact reliable contractors online. Over the past year the app has been used by 20,000 members.

By contrast, in the US, he says “we have a model to grow”.

“We have gone there with the objective that the US can eventually be bigger than Australia. That is our aim. Whether we can do it, time will tell,” Peter Wilson says.

“In some ways the core plumber over there is behind the Australian plumber, in terms of systems and technology. They don’t like change. When we went in and did our due diligence (for the MORSCO deal), it reminded me of Reece 20 or even 30 years ago. So that is the opportunity.”

He says a key attribute of the Reece US strategy so far has been humility.

“We have let the US team drive a lot of the issues they want to bring. In many ways we are slowing it down to get the building blocks in place. The guys we have sent across are really humble guys who have worked in the trenches so they have the respect of the people,” he says. “It has been carefully planned out and so far things are going OK.”

The success of the Reece approach has been in stark contrast to building products giant Boral, which has issued four profit downgrades in 18 months as its $3.5bn deal two years ago to acquire Utah-based construction materials group Headwaters has not delivered on expectations.

Now Boral is also battling a major accounting scandal in its North American window-making business.

Peter Wilson says the positive surprise of Reece’s US experience thus far has been how well its people have been accepted by the Americans.

“When we did our big town hall when I went over there, we basically said ‘we are like a little brother or a little sister. We are like another state of the US’. So we played a really humble view. We didn’t impose anything. We have brought the US team out here and we have been surprised how much they wanted to take of what we do here, back there. In terms of the foundation work, the culture, the communication rhythms, they feel the same. Then you adapt to the local trends and the local market,’’ he says.

Alan Wilson might never see MORSCO’s operations, but that hasn’t stopped him coming into the Reece head office in Burwood, in Melbourne’s east, every day since the deal was conceived.

Aurizon chairman Tim Poole, who joined the Reece board as its youngest independent director in July 2016, recently became the company’s deputy chairman.

Peter Wilson says the move is “a part of the succession planning down the track” but stresses his father isn’t going anywhere.

Alan Wilson concurs. Accounting industry legend Ron Pitcher was formerly his long-serving deputy chairman at Reece, so Poole’s title fits with tradition.

“When my father was there I was also the deputy chairman. Provided my health is OK and I am still enjoying what I do, I will keep doing it,’’ he says of his daily routine, before adding with a wry smile in trademark Wilson-speak: “My father kept doing it until he was 91. I won’t be doing it until I’m 91, I can tell you.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout