Record wholesale power prices for NSW and Victoria

Wholesale power prices are at their highest since the national electricity market was created two decades ago.

Wholesale power prices in Australia’s two biggest states have hit their highest levels since the national electricity market was created two decades ago, driven by the abrupt closure of the Hazelwood power station and a surge in the costs of gas and coal supplies.

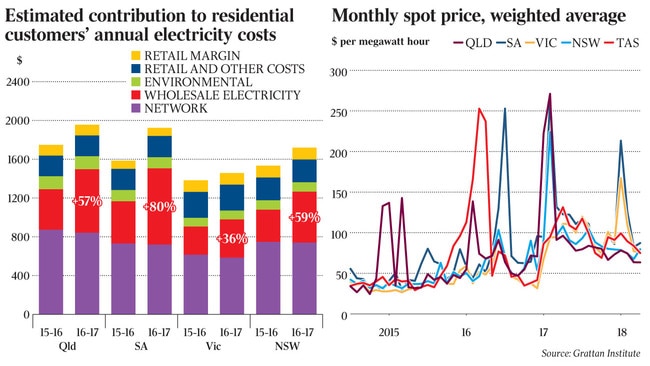

Prices for wholesale electricity on the spot market in NSW rose to a record of $82 per megawatt hour for the 2017-18 financial year to June 30, compared with $35 per megawatt hour just three years ago, according to new data from energy advisory firm Energy Edge. Victoria has seen prices triple to $92 per megawatt hour in 2018 from $30 per megawatt hour for the same period three years ago, also marking its highest annual electricity price on record.

While prices eased in Queensland and South Australia, they were the second-highest annual figures since 1998.

Queensland slipped to $72 per megawatt hour from $93 a year earlier, while South Australia saw levels ease to $98 per megawatt hour from $108 12 months earlier.

“The financial year average prices for all mainland regions were either the highest or second-highest electricity prices ever recorded,” Energy Edge managing director Josh Stabler said. The power spike underlines the huge challenge faced by the federal government as it looks to create more reliable supply and lower prices via its National Energy Guarantee policy.

The price hit is also a further blow for industrial users as they grapple with coal plant closures, high gas costs and generators gaming the system.

A landmark review of electricity supply and pricing by the Australian Competition & Consumer Commission, to be released today, will urge more competition among wholesalers and retailers to help boost long-term contracts for large users.

The alarming data on the two state’s power prices is the latest note of gloom for the sector. Australia’s biggest users of energy already faced a $10 billion bill over the next decade to cut emissions under the Paris climate agreement, with heavy industry set to shoulder the bulk of the country’s reduction effort, consultancy RepuTex said last week.

Recent electricity and gas price increases will cost energy users up to $11.7bn a year, with more energy-intensive manufacturers to be hit particularly hard, paying up to $3.9bn a year, a separate Ai Group report found.

And power costs, most of which went to generators as profit, rose by $10bn, or 125 per cent, between 2015 and 2017, a report by the Grattan Institute said.

The Grattan report recommends the National Energy Guarantee be legislated to provide policy certainty and more supply to ensure prices don’t blow out. But after that, the focus should turn to reducing network and retail costs, because new wholesale generation needs prices of $80 per megawatt hour or more to make a return.

A Melbourne-based metals business said while it remained frustrated about paying over the odds for wholesale gas supplies, it viewed the government’s National Energy Guarantee and its commitment to cutting emissions as the way forward for Australia.

“The energy supply industry requires certainty to implement large scale capital projects for the baseload supply we need,” Ace Metal Treatment Services general manager David Karney said.