Qantas shares have fallen to $4.94 – almost 27 per cent down the Alan Joyce selling price of $6.75.

The Joyce shares were sold on the same day as the company was buying Qantas stock as part of a $1bn 2022-23 share buy back.

Remaining shareholders look to be down about $170m on the $1bn outlay. Qantas is still buying its shares.

For too long the regulators have turned a blind eye to the Qantas capital strategies.

Qantas is a huge airline with effectively no equity capital – just $10m.

The company’s “capital” comes from customers paying for tickets in advance and those who don’t receive money quickly when they cancel prepaid tickets.

In addition the frequent flyer program is a big additional source of “capital”.

And so as at June 30, airline customers had paid Qantas a staggering $5bn for tickets in advance of travel – up 13.7 per cent on the previous year.

But there was also $3.2bn in unredeemed frequent flyer revenue which, with other revenue received in advance, took the Qantas “magic pudding” to $8.7bn – greater than the market capitalisation of $8.5bn.

Meanwhile the share market appears to be aghast at the lack of equity capital and the company’s seemingly endless problems so is pricing the shares at only five times last year’s earnings per share.

That this should be happening in a supposedly well-regulated corporate sector like Australia will concern large areas the Australian director community.

One of the few members of the community prepared to speak on these issues is former ANZ director John Dahlsen so today I am going had over my commentary to him.

Dahlsen: “The Qantas balance sheet shows that the decision of the Qantas board to have a share buyout is extraordinarily risky and not in shareholders interest let alone the national interest. Surely Qantas bankers would have some concern.

“The Qantas ratio of current liabilities to current assets is a great test of liquidity being a negative of 42 per cent. When you add to that debt of $3.9bn it is a worry that equity is only $10m.

“The Qantas balance sheet is funded by the customers who have been severely damaged by Qantas behaviour.

“It is also curious that former CEO Alan Joyce’s performance payments were aided by the buyback, and he was able to sell a substantial number of shares into that buyback at a time when the shares were likely to be valued at their peak.

“Qantas has unused facilities of $10bn but if Qantas traded at a loss would they be able to draw those facilities down without a government guarantee?

“Alan Joyce has been brilliant at manipulating demand and capacity with the oligopoly working in his favour. By causing a shortage of aircraft and the rise in demand he has optimised loads and enhanced his profit margins.

“Unlike most companies that have hard assets Qantas in funding its business is incredibly reliant upon customers and their prepayments. It is the customers’ support that creates the brand value.

“The Board focus must be on brand which means a focus on staff in delivering value to customers. The current trashing of the brand and its people has a massive effect on equity.

“For a board member of Qantas not to be sensitive to the above issues, not understanding its model and not taking sudden action to control Joyce represents in my view is gross neglect of their duties as Directors and especially the Chairman.

“Qantas goes to great trouble to protect its 70 per cent market share otherwise than by good performance – for instance in resisting Qatar’s decision to be allowed extra slots at the airport.

“The ACCC powers to monitor Qantas are limited and the ACCC alone cannot insure a pro-competitive environment.

“There are a number of remedies:

• Passengers need to be compensated for the customer inconvenience factor (CIF).

“When CIF is caused by factors outside the control of Qantas like weather and safety that is part and parcel of the product and Qantas should not pay but where CIF is caused by engineering problems or the rescheduling of flights to optimise yield passengers should have the opportunity to be either paid forthwith or alternatively agreeing with the delayed flight or a new flight.

“At present, the delay in repayment for CIF in unacceptable.

• When you have a massive number of transactions involving a massive number of customers consuming different products daily you have a huge issue in monitoring performance. Further, the issue is made more complex by the many contact points with staff.

“In these circumstances you need very targeted and precise policies to assist staff but, at the end of the day, it is the people and systems involved that will deliver performance.

“Monitoring performance information is crucial and Qantas should be obliged to make public the very detailed information on its performance. You need this information to induce change.

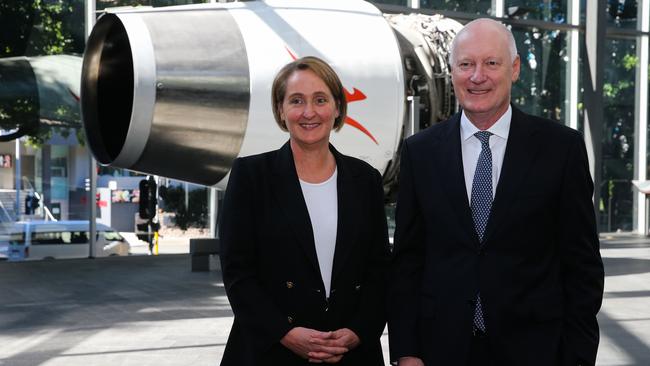

“Goyder as chairman is in a difficult position. How can someone who, as chairman of a board that has not dealt with systematic failures – but in fact has done the opposite through remuneration arrangements – continue on as chairman to rectify the situation?

“Whilst we have to be careful about the chorus of media and unions calling for his resignation, cannot he see the desirability of change and importance of giving others the opportunity to drive cultural change and improvement?

“In saying ‘I am the one to fix this” is he not putting himself above the market and insulting a number of talented people who could potentially become chairman?

“Is he not doing serious damage to his other chairman led companies Woodside and AFL?

As a flawed chairman is he acting in the interest of those companies?

“With the likely litigation that is about to flow, whether it be class actions or direct litigation, is it not in Qantas’ interest for this to be managed by independent directors?

“If he does not resign some might imply that he is staying there to protect his own legal position.

“There is a seismic shift taking place in community attitudes commencing with the royal commission on banks and now accelerated by behaviours like that of Goyder.

“There is growing disquiet with the role of capitalism, big business, and some of our corporate leaders.

“Goyder should understand that his unwillingness to accept any accountability is mind blowing. Goyder is doing huge damage to large corporates and our corporate leaders.

“It is extraordinarily selfishness and shows a lack of a concern about anyone other than himself. The difficulty is that cynicism in the community will affect our other business leaders and they will continue to fall in the reputation index”.

Thank you John Dahlsen.

First customers trashed the Qantas brand now it’s the share market’s turn to cast severe doubt on the viability of the “magic pudding” financial operating model used by former chief executive Alan Joyce backed by his chairman Richard Goyder and the board.