Pub, property barons shrug off fall in profits

Profits for pub and property groups fell, though there were some bright spots for the billionaires on The List – Australia’s Richest 250.

A weakening economy and sharemarket, along with a subdued housing sector, have cut into the profits of the private companies headed by many of Australia’s richest people.

Profits for big pub and property groups fell in 2019, the latest financial accounts reveal, though there were some bright spots for the billionaires on The List – Australia’s Richest 250.

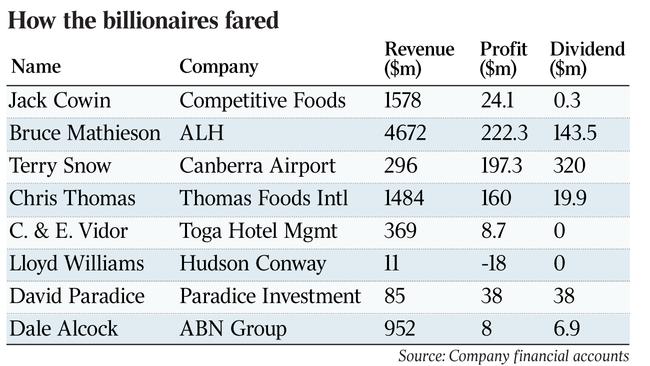

Jack Cowin’s Competitive Foods, which owns the Hungry Jack’s fast food business in Australia and some KFC outlets, trebled its net profit and doubled its pre-tax profits in 2019. Cowin is celebrating his 50th year in business in Australia after starting with a KFC outlet in the Perth suburb of Rockingham in 1969.

Competitive Foods made a net profit of $24.1m from revenue of $1.58bn, up from $7.5m and $1.39bn respectively in 2018, when it was hit by one-off expenses.

Billionaires Charlotte and Erin Vidor’s Toga Management hotel business almost quadrupled its net profit to $8.7m, as hotel revenue and management free revenue rose about $16m to $394m. Toga runs hotel brands such as Adina, Vibe, Medina and Travelodge.

Fellow billionaire Terry Snow had an improved year in revenue terms at least at his Canberra Airport, which paid him and his family a $320m dividend after a year when revenue rose almost $40m to $296m. Canberra Airport is as much a property concern as an aviation business, with a huge business park comprising the bulk of the $3.3bn in investment property assets on Snow’s balance sheet. But a $38m fall in valuation of some financial assets saw operating profit down to $197m, from $244m.

It was a similar story for Bruce Mathieson’s ALH Group, the pub and poker machines giant he runs in partnership with Woolworths. While ALH is about to merge with Woolies’ Endeavour Drinks business as part of a move by the supermarkets group to exit pokies, it is still making strong profits for its owners.

ALH’s revenue rose by 5.2 per cent to $4.7bn, but net profit fell by a slight $20.6m to $222.3m. Mathieson will have received 25 per cent of the $143.5m dividend ALH paid its owners.

Fund manager David Paradice will have shared in the $38m dividend his Paradice Investment Management firm paid him and his employee shareholders, but the group — which manages more than $16bn in assets — saw its revenue and profit fall.

The firm, which receives management and performance fees based on its stock-picking acumen, saw its revenue decline from $139m in 2018 to $86m, and its operating profit before tax drop from $78m to $54m.

Operating in a tough Perth housing market, Dale Alcock’s ABN Group saw its net profits almost halve to about $8m, despite revenue rising more than $40m to hit $952m.

Thomas Foods International, owned by South Australian billionaire Chris Thomas, recorded a $160m net profit but only after receiving $191m in insurance payments related to a fire at its Murray Bridge abattoir in 2018.