The importance of being 50: When business owner-managers suddenly seek an exit strategy

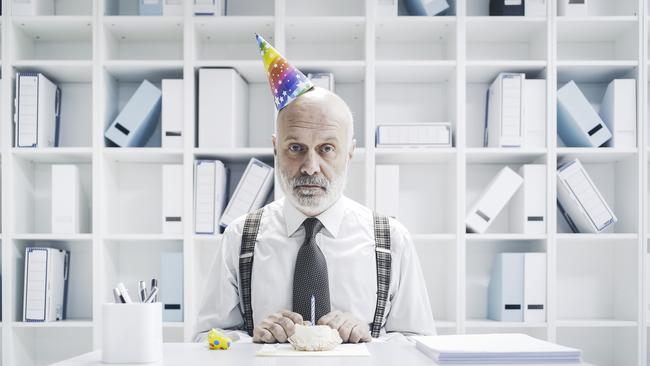

The late-40s/early-50s is a time to reassess where you’re at in relationships and in life. The milestone birthday is also key for business owners. How does turning 50 redefine Australian business and our property decisions?

There is a time in the life cycle when Australians are most likely to own and manage a business. That time is the age of 50. According to the 2021 census, 47,000 Australians aged 50 (and born in 1971) own and manage a business, which is more than at any other time in the life cycle.

What I like about this number is that it stands proud; the number of business owner-managers aged 49 is 46,000, the number aged 51 is 43,000. Something happens when a business owner-manager (someone actively involved in their own business) turns 50; evidently, they look for an exit strategy.

But there is more to this story than the “discovery” of a new milestone around which Australians organise their (business) lives. The age at which most Australian men describe their relationship status as divorced is 52; for women this “most common” age in the life cycle is 46. The late-40s/early-50s is a time of reckoning, a time to reassess where you’re at in relationships, in life.

Indeed, perhaps it’s time to finally sell the family business?

By the age of 55, adult children tend to leave the family home. The years leading up to 50 often coincide with the arrival of teenagers into the family home. It’s not that teenagers add a level of stress, it’s more that kids reaching puberty is a signal, a milestone, an inescapable reminder that time is marching on.

The bottom line is that business owners born in the early 1970s are in the process of either disposing of family businesses or considering their options. This is a cohort that went to primary school in the late 1970s, that attended secondary school across much of the 1980s, who went to trade school or university in the early 1990s.

Here is a generation of business owners primed and ready to sell their businesses and who most likely established these businesses, bravely, perhaps somewhat naively, in the post-recession 1990s as bright-eyed bushy-tailed 20-somethings (in the case of the trade-skilled), or perhaps in the post-GST-introduction years of the early 2000s for those delivering professional services.

Here is a generation proud of their achievements and who are unlikely to yield their business for what they perceive to be a less-than-fair offer.

The problem for business sellers, however, is that there’s a bucket load of 50-year-old business owners now looking to downshift, to downsize, to finally be rid of the grind, the marriage-straining stress, the endless navigating of even-more-pointless red tape, in the hope of finding a willing buyer.

The important demographic news for business buyers is that this surfeit of sellers, or of possible sellers, is fast fading as the deep pool of 50-year-old entrepreneurs born in the early-1970s becomes progressively shallower as the 2020s progress. This is due to a diminution in immigration following the chaos of the Whitlam years, combined with the popularisation of the contraceptive pill throughout the 1970s. The pill might have been available in the late 1960s, but it assumed universal usage in the 1970s.

Based on this demographic assessment of today’s late-40s/early-50s business owner-managers, now is the time to buy a (family) business given the demographic flooding that is attached to the early-1970s tail-end of the baby boom. The 50-year-old business owner-managers of 2030 (born in 1980) will be fewer, meaning there will be less (seller) competition to win the interest of willing buyers.

Cross-tabulation of the business owner-manager cohort at the 2021 census shows their largest workplace concentrations. Business owner-manager businesses cluster in and around the CBDs of our largest cities. They are also scattered across the regions (ie family farms). They range from mum and dad retail shops to the partnership cohort of the big accounting and legal practices for they too are ‘‘business owner-managers’’.

Business owner-managers comprise 14 per cent of the workforce working in the businesses that they own. However, this proportion ranges from 40 to 50 per cent across the regions where employees may include family members, to just 2 per cent in places like Melbourne’s Docklands.

Of the 170,000 businesses owned and managed by business owners aged 65+ (and truly in exit-strategy mode) just 12 per cent of the workforce are owner-managers. This suggests that the business-owning cohort that is most likely to part with their business in their 50s are the smaller businesses (by employee number).

For those looking to play the ‘‘long game’’ in scooping up proven businesses operated by an owner-manager aged 50 or thereabouts, a golden age of exit-strategy-seeking owners will emerge in the mid-2030s as the millennial generation (born 1983-2001), the children of the baby boomers, push into their 50s from 2033 onwards.

This imminent avalanche of exiting entrepreneurs is illustrated in the attached chart, which tracks net change in the Australian population over the decade to 2033.

The peak of the millennial generation is shifting from age 35 last year to age 45 in 2033 but with the leading edge of the generation (born 1983) at that time pushing into their 50s. Throughout the balance of the 2020s and into the 2030s the millennials will be driving new business formation.

Interestingly, the age at which a family member is made an owner-manager in a family business is 30. Many millennials in 2024 are already dealing with and/or managing family businesses.

What emerges from this consideration of the age of entrepreneurship, the timing of exit strategies, the determination of some to retain ownership of a business established 20 or 30 years ago, is how these businesses conform to, are shaped by everyday considerations of the Australian way of life.

Businesses tend to be formed in the late 20s and early 30s after training and the establishment of skills, a client base, and a capital reserve. A business is worked on, built up, carried by sheer will and determination at any cost throughout the family-developing late-30s and 40s.

But there is a turning point, perhaps triggered by a health incident and/or by a marriage breakdown, where a different ‘‘future life’’ is imagined. That turning point is, based on my demographic logic, the age of 50.

Sure there are businesses that might be ‘‘gettable’’ when owners age into their later 50s and 60s but those most willing to sell, based on the fall-off in business ownership from age 50 to 51 and beyond, seem to want to make a clean break from the beginning of their 50s.

The idea of 50 being a breakpoint in the life cycle of a business creator is based on evidence collected at the 2021 Census. The really interesting question is whether the next generation of business creators, the millennials now spilling out of their 30s and into their 40s, might ‘‘change the rules’’ when it comes to cashing in and moving on.

Maybe this generation will be more predisposed to selling in their late 40s and reinvesting, and to creating yet another business later in life? However almost every other social metric shows trends pushing later into the life cycle, not earlier. This is true of peak (full-time) income, which was reached at age 42 in 2016 but which pushed out to age 43 in 2021. If anything, my assessment is that exiting business owner-managers are more likely to peak later in life.

What does this mean for property? Perhaps try to lock in leases with business owners from their late 40s. There is a natural period of business and home-front (eg divorce) churn when owner-managers progress through their 50s and into their 60s. The largest collection of businesses started, and scaled to quite impressive levels, are invariably located in CBD and near-CBD locations. Perhaps target these businesses for accommodation as well as large publicly listed corporates.

And finally I don’t think anyone anywhere has come up with a solution that enables older farmers to exit the farm later in life. This is an emotional issue that is unlikely to be resolved in the coming decade.

Maybe sometimes we just have to accept that there isn’t an exit strategy available other than letting things play out as they have always played out.

Bernard Salt AM is founder and executive director of The Demographics Group; data by data scientist Hari Hara Priya Kannan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout