Sydney, Melbourne lead property price surge

Sydney and Melbourne lead as property prices post biggest growth rate since March 2017.

House prices continued a trend of significant growth in September as the market continues to turn around on the back of interest rate cuts, relative affordability and strong buyer demand.

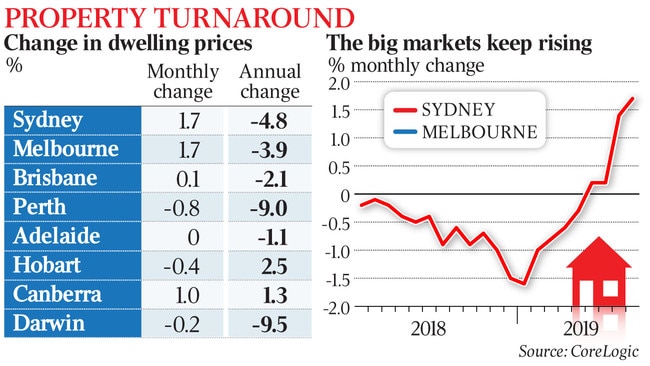

Property researcher CoreLogic’s monthly Hedonic Home Value Index found strong activity in Sydney and Melbourne markets pushed prices in each city up 1.7 per cent through September. The two eastern capitals led the national rise of 0.9 per cent last month, the largest rate of growth since March 2017.

The increase in house prices snaps a sharp retreat that had extended for close to two years and bottomed out in May.

The flow-on effect to mortgage rates on the back of RBA cuts, combined with the effects of big banks’ easing of access to credit, has helped boost buyer activity through winter and early spring.

Tim Lawless, CoreLogic’s head of Australian research, said relative affordability to the peak of the market has helped entice buyers. But the significant rate of price gains will likely remain unchanged despite Tuesday’s interest rate cut.

“Interest rates are definitely a component of what’s driven this turnaround,” Mr Lawless said.

“Of course, the lower cost of debt is a big part of buyers coming back into the market. But if it was just lower interest rates, then we’d be seeing stronger market conditions everywhere.

“Lower rates are going to be a net positive for market conditions. But I think the market is already priced in. Also, there’s an expectation that we won’t see all of the cash rate cut passed on to mortgage rates.”

Canberra (up 1 per cent) and Brisbane (up 0.1 per cent) were the only other capitals to report gains through September. Declines in Perth and Darwin slowed last month to 0.8 per cent and 0.2 per cent respectively. Hobart prices fell 0.4 per cent while Adelaide reported no change.

The improvements in the market are a complete turnaround from the first half of the year.

Sydney and Melbourne have each reported strong gains for the quarter, up 3.5 per cent and 3.4 per cent respectively.

But both capitals are still significantly below the peak of prices in 2017- down 11.9 per cent in Sydney and down 7.9 per cent in Melbourne - which Mr Lawless said is a good sign for affordability.

The two standout markets have benefited from high population growth, lower unemployment and stronger job growth, which have underpinned Victorian and NSW property.

Both Sydney and Melbourne also have the highest level of investor activity in the nation, which is driving prices.

The latest housing finance data from the Australian Bureau of Statistics for the quarter ending July showed investors made up 32 per cent of mortgage demand across NSW and 26 per cent in Victoria, the highest rates relative to the states or territories.

“In most other markets around the country, while they are benefiting from lower rates and easier credit, they aren’t seeing the same level of economic activity as Sydney and Melbourne,” Mr Lawless said.

For the first time since the peak of the market in 2017, Melbourne’s inner suburbs have reported an annual value gain of 0.1 per cent. While prices rise in Melbourne’s prestigious inner east and Sydney’s inner west continue - up 5.9 per cent 5.2 per cent respectively through the quarter - they are yet to reclaim the values seen before the downturn.

Outside the capital cities, popular coastal markets are also moving into growth territory, with values on the rise in the Gold Coast (up 1.0 per cent), Sunshine Coast (up 0.9 per cent) and Richmond Tweed (up 0.4 per cent) over the quarter. Satellite cities have also reported modest gains, with Geelong up 1.3 per cent, the Illawarra up 1.0 per cent and Newcastle / Lake Macquarie up 0.5 per cent through the quarter.

Rents have continued to fall for the fourth month continually, particularly in the softer Sydney market.

With Dow Jones

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout