Stockland, Frasers say housing inquiry levels have recovered

Two big residential developers say inquiry in their housing estates has recovered but buyers are reluctant to commit to big buys.

Two of the country’s largest residential developers, listed giant Stockland and Singapore-backed Frasers, have revealed that inquiry in their housing estates has recovered but buyers remain reluctant to commit to big purchases.

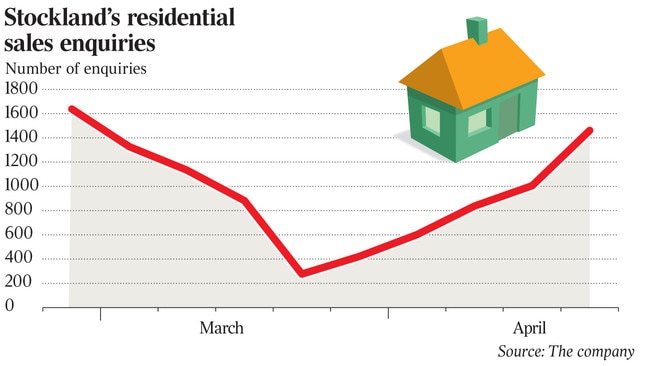

Stockland was slugged by the coronavirus, selling just 137 land lots in April, but says it is now in recovery mode with new inquiry levels recovering to be in line with pre-COVID-19 levels.

The company on Wednesday gave a bullish take on the prospects of recovery in the housing sector, saying an under-supply was already emerging, as activity levels among private developers have fallen.

Chief executive Mark Steinert dismissed concerns about a “W-shaped” recovery, as he believes the government and community can deal with the coronavirus, even if there are limited outbreaks. He pointed to plans to reopen the economy by July and Reserve Bank forecasts of growth resuming next year.

While stepping back from previous hopes of a V-shaped recovery that he expressed as the crisis emerged, Mr Steinert believes that low interest rates and fiscal stimulus, as well as containment of the virus, leave Australia well placed.

“We don’t believe there will be a W-shaped recovery,” Mr Steinert said, citing the government’s success in suppressing the virus. “We saw a trough in residential inquiry in late March and since then we have seen a very substantial increase back to pre-crisis levels.”

Although immigration is expected to fall, Mr Steinert said there was an under-supply in the housing market even now. He argued the strength of residential and retail sales in Western Australia was a pointer to how other states would fare as they reopened their economies. Settlements were completing in a similar time as they did pre-crisis, with default rates bumping up to about 4 per cent, just above long-term averages, although they spiked to 10 per cent in March when uncertainty peaked.

The company is bullish due to its focus on affordable housing estates, where it sells almost 80 per cent of its land packages to owner-occupiers. First-home buyers, who are highly active, represent about 80 per cent of sales and are most likely to benefit from state and federal government stimulus.

Stockland also cited low interest rates, positive credit conditions and government stimulus, particularly the JobKeeper subsidy, and reduced supply as supporting a market recovery. But it said it was cautious about the shape and speed of the recovery.

Frasers Property Australia has about 1600 residential units due for settlement in the second half of the 2020 fiscal year and chief executive Rod Fehring said inquiry levels had been lifting before the crisis struck.

Frasers last year switched its mix away from high-density apartments and increased the proportion of land lots it was undertaking along the eastern seaboard.

Mr Fehring said the key issue was the company’s ability to convert contracts worth about $900m into settlements this financial year. Frasers is also working with up to 30 per cent of buyers who are not able to immediately settle due to temporary job losses, but Mr Fehring argued that the situation was clearer than during the global financial crisis.

The current slowdown had been orchestrated in order to control the virus and the economy could be reopened in a more controlled fashion, but he warned the recovery would not be V-shaped.

“People will need to get their confidence back and that will take time,” he said.

Stockland also gave one of the first insights into the performance of shopping centres in April, saying they had gone into sharp reverse on their recovery earlier this year, although the fall-off in March was not as severe as that recorded by rival landlords Scentre and Vicinity Centres.

Stockland said the pandemic had reduced foot traffic and it was also hit by non-essential services store closures. It has been partly protected as its retail portfolio is skewed towards low discretionary and non-discretionary tenants and with exposure to neighbourhood and subregional malls of about 41 per cent of the portfolio.

Foot traffic was down 40 per cent on pre-virus levels in mid-April but more than 60 per cent of stores by rental income remained trading in March and April.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout