Start-ups to scale-ups: Australia’s not-so-small-business challenge

Record numbers of new businesses have emerged, but can they scale up?

On the one hand this is proof of the raw entrepreneurial energy and forthright can-do-ism of the Australian people, to build so many businesses throughout a pandemic year.

On the other hand, this activity could be viewed as largely the result of the debt-funded support strewn liberally across the economy during tough times.

As usual the truth probably lies somewhere in between.

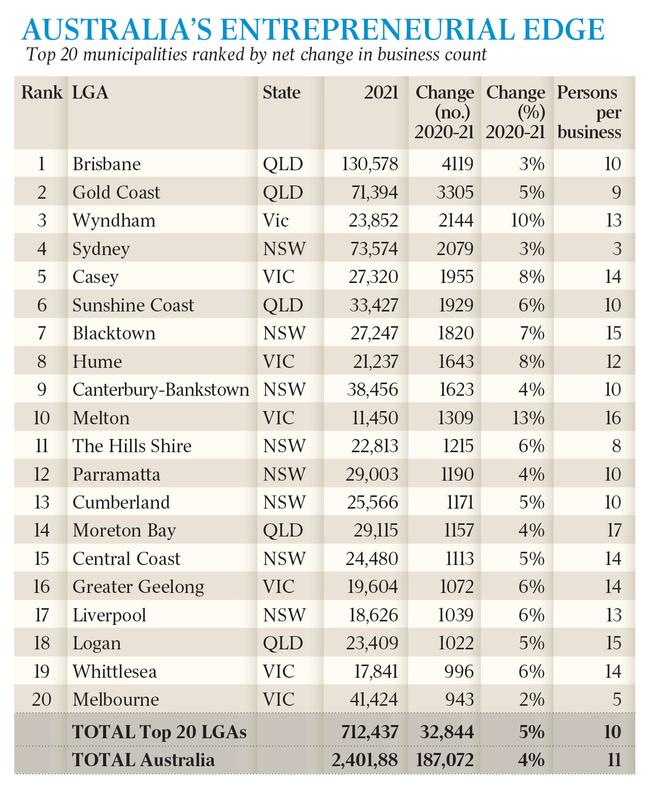

The top 20 places for net new businesses

Last month’s release (by the ABS) of Business Count data delivers insight into Australia’s small business world.

Just under half of the net extra businesses created last financial year were added in 20 (admittedly large) municipalities (see Graphic 1).

Most net new businesses (4,119 or 3 per cent) were added to the municipal behemoth City of Brisbane. This figure alone more than justifies a small-business focus (and funding) within that City’s administration.

Generally, there is one ABN per 11 Australians (of all ages). This ratio drops to three in the City of Sydney which of course has a disproportionate number of locally registered businesses relative to local residents.

This ratio can blow out to one business per 17 residents in places like the expansive Moreton Bay Region encompassing Brisbane’s outermost nappy-valley suburbs.

The net growth in business numbers over the 12 months to June 2021 was 4 per cent across Australia. In Australia’s Top 20 municipalities the average growth was 5 per cent.

Mr/Ms Mayor, you are on the right track by strongly supporting small business creation. And so, every February when this particular dataset is released, you can point to an above-average growth rate for your municipality and say: “my policies are working”.

Let me write a headline statement for the leadership of Melbourne’s fast-growing outer-suburban City of Melton.

“During the 2021 pandemic year, despite lockdowns in one of the world’s most locked down cities, business formation surged 13 per cent or three times the national average.”

The only “big” municipality to come close to this cultivation of business was Melton’s neighbour, the City of Wyndham, up 10 per cent.

In fact, this is a familiar theme: there’s strong business growth on the urban edge in Australia. And which is most likely being driven by the building, construction and property industries whose pipeline orders in this year encouraged tradies, incentivised by government stimulus, to create net new businesses right through the worst year of the pandemic.

City fringe leads the way

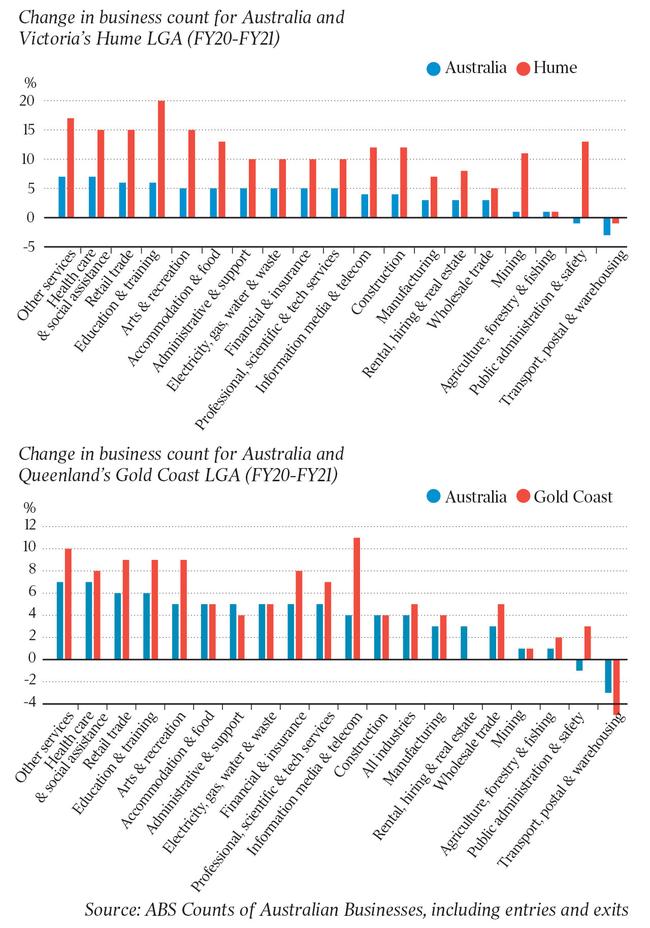

So, let’s look at the kinds of businesses that went gangbusters on the city’s edge in this year. Take for example the City of Hume on Melbourne’s northern fringe. (Hume includes Darryl Kerrigan’s fictional castle in Coolaroo.)

Here is one of the Top 20 municipalities in Australia by population and by business count. Indeed, Hume’s ABN count jumped 8 per cent across the 2021 financial year, double the national average.

But when the percentage shift in Hume’s Business Count is compared with the national average something quite extraordinary is revealed. There’s business growth across 18 of the 19 industries comprising the local economy in the City of Hume.

In construction, the business count jumped 12 per cent as compared with growth of just 4 per cent for Australia as a whole

.

In education and training the differential between the Hume and the Australian experience is stark: growth of 20 per cent as compared with growth of 6 per cent.

And in public admin and safety (likely Covid related) Hume businesses jumped 14 per cent whereas across Australia the number of businesses in this sector, by June 2021, had declined only marginally from the situation 12 months earlier.

The point here is that the Australian model of population and urban growth drives demand for business formation. And not just at some ethereal metropolitan or state level but in situ at a grassroots level and to a predictable formula: around one ABN per 10 residents. Add 100 residents and the ABN count should increase by 10, or thereabouts.

When viewed through this lens fast-growing municipalities on the city’s fringes, or indeed in lifestyle locations, aren’t simply in the business of delivering community services. These municipalities are also at the leading edge of small business creation and management in Australia.

Mr/Ms Mayor your municipal management apparatus should indeed include small business support and training facilities. The aim here is to deliver more small business, more opportunities for local apprentices, and more locally based entrepreneurs connected into (and supporting) the local community.

The Gold Coast’s business focus

The same pattern of business formation also applies in lifestyle destinations such as, for example, the Gold Coast. The City of the Gold Coast is Australia’s second largest municipality after Brisbane.

During the 2021 financial year this municipality created nine net new businesses per day. The Coast’s overall business count grew by 5 per cent (which is double the rate of population growth).

And so, as with Hume, the question is: where has all this surging net new business energy been focused?

Interestingly the number of ABNs operating in the Transport, Postal and Warehousing sector dropped by 3 per cent across Australia during this financial year. The contraction on the Gold Coast was 5 per cent.

These figures may reflect a shift by, say, Uber (and similar) drivers out of the gig economy and into other sectors offering more secure work.

But the overall theme remains the same: the Gold Coast and Hume are in the growth business whether that be facilitating new subdivisions, approving new apartment towers, chasing new infrastructure or indeed creating new businesses.

And I say that there is a very real opportunity in these and other places to improve not just small business operation but also the chances of long-term business success.

The evidence is that around 5000 net new businesses are created on the Gold Coast and Hume every year. What would be the social, economic and prosperity dividend to these communities, and to Australia, of improving the efficiency of these businesses by just a few percentage points?

Would the provision of support and education programs, perhaps a streamlining of municipal processes, encourage local businesses to take on another apprentice?

And can the rate of business growth continue to outstrip the rate of population growth? The short answer is yes; many Australians own and operate multiple business enterprises (and which includes self-managed superannuation funds). But logically the rate of growth must, at some point, slow down.

From a start-up focus to a scale-up obsession

If you subscribe to the view that there is an ABN saturation point (say one ABN per six people) then these years, maybe the whole of the 2020s, present as a kind of gold-rush scramble to stake claims, to start businesses, to capture the entrepreneurial spirit of Australia within say the nation’s Top 20 municipalities.

And in which case the focus should be to create the ideal microclimate, indeed the ecosystem, to attract small business wannabes.

But there is something else that can be gleaned from the ABS’s Business Count dataset.

There is no shortage of entrepreneurial energy in Australia. This report tracks the net figures. Who knows how many businesses set sail every year only to founder long before they’re picked up as having survived a single financial year?

What we need isn’t so much support programs for business start-ups because, well, state governments and municipalities already allocate staffing and funding in this direction. Prior to the pandemic many of the larger municipalities were already operating start-up hubs where tech-inclined Millennials in particular could create new businesses.

The opportunity that I think is evident from this dataset is the scope to scale up local businesses, to deliver programs and funding to embolden entrepreneurs to take that next step.

We are a resource rich people, entrepreneurial by nature and outrageously aspirational. One in 10 Aussies has an ABN (includes Millennial’s famous side-hustles).

Make that perhaps one in 12 to allow for some Australians who have multiple businesses. Take out kids and the frail elderly and we’re down to perhaps one in six working-age/young-retired Australians who own a business.

Sure, let us create more net new businesses every year. But let us also recognise that there are dividends to be reaped by scaling-up existing businesses. That requires business skills and expertise, but also entrepreneurial confidence in the future.

And that’s where governments at all levels, including local councils, can help by creating the conditions conducive to building better stronger bigger businesses.

Bernard Salt is executive director of The Demographics Group; research and graphics by Hari Hara Priya Kannan

There are two ways of looking at the record number of net new businesses (ABNs) created over the 2021 financial year (87,000 up from 45,000 the previous year).