Stamford hotel portfolio to split as developers chase Circular Quay prize

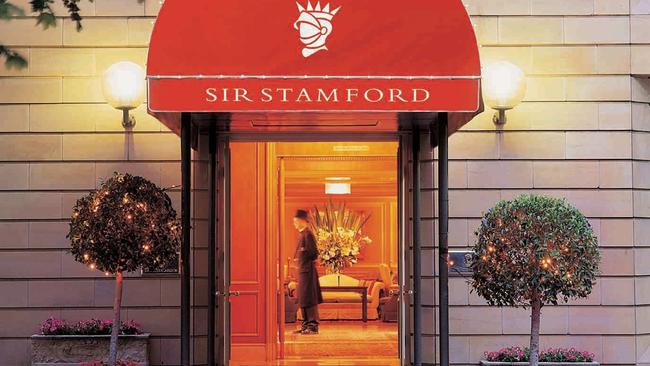

Developers have their eyes on the Sir Stamford near Sydney’s Opera House as the hotel empire sells.

Singaporean tycoon CK Ow’s Australian and New Zealand hospitality portfolio could be split up with developers chasing the prized Sir Stamford Circular Quay near the Sydney Opera House.

The hotel occupies a dress circle position and bidders are keen to capitalise on the luxury apartment boom by converting the landmark hotel on Macquarie St into a top end apartment block with part of the hotel’s sandstone facades retained.

Mr Ow’s original plans were stymied by Malaysian conglomerate Mulpha, owner of the nearby InterContinental Sydney, but he won a long-running legal stoush over the project, and the apartment price records in the area have been smashed by sales at the Sirius Building.

A five-strong field of developers that includes both Mirvac and JDH Capital, which is overhauling the Sirius, could split that hotel off from the remainder of the portfolio being offered by his Singapore-listed Stamford Land Corporation.

Spread from Sydney Airport to the Auckland CBD, Mr Ow’s Stamford portfolio encompasses 1569 rooms and, while he is intent on selling the entire portfolio, some hotels could be sold separately.

The other five Stamford hotels are being chased by international heavyweights with Gaw Capital and Brookfield believed to be among the contenders.

But local players could trump them with Salter Brothers’ new Australian hospitality sector joint venture with Singaporean sovereign wealth fund, GIC and private markets firm, Partners Group, showing interest.

Private finance house Ashe Morgan, which has been stepping up its property operation, is also circling.

Stamford is offering all six hotels with vacant possession after a quarter of a century of local investment.

Mr Ow expects more than $1bn, and he could get it on the back of Salter Brothers buying the Travelodge hotel portfolio from Mirvac and the NRMA for $620m.

The portfolio is largely CBD-based and has copped the full brunt of the Covid-19 pandemic, where city hotel occupancies in Sydney alone have plunged from more than 90 per cent to about 30 per cent.

But buyers believe they will be able to capture the upside in the portfolio as domestic travel starts up again and international borders re-open next year.

Stamford was quizzed about the prospect of paying a special dividend arising from the sale of its assets in Australia at its annual meeting.

The company said it would consider all options in connection with the use of the sale proceeds, including but not limited to any reinvestments.

It also flagged that it was considering options for the Stamford Plaza Brisbane, which could be turned over to a residential or commercial project. Stamford said its strategy was to continuously seek out the best use of its assets to optimise profits.

Stamford said the Covid-19 situation continued to “evolve daily” and it was subject to lockdown restrictions imposed in Sydney and other cities. “Operational costs continue to remain a concern and are being monitored closely,” Stamford said.

Some of its hotels are also being used as isolation facilities and it said it did not appear that the situation would return to normalcy anytime soon. “However, the strategy adopted by Stamford is working well to meet those challenging market conditions,” the company said.

JLL’s Peter Harper and Adam Bury and CBRE’s Michael Simpson and Tom Gibson are understood to be involved in the marketing campaign. JLL and CBRE declined to comment.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout