Southern Cross Towers battle to top $2bn as office recovery kicks in

The big players are readying to spend billions on office towers as the recovery of cities gets underway.

Office towers are back in vogue in the wake of the pandemic, with a leasing recovery and some of the world’s largest institutions chasing assets worth billions of dollars around the country.

In the defining contest, the landmark offer of the Southern Cross Towers has brought out the biggest players in the world to compete for the $2bn-plus landmark property in the heart of the Melbourne CBD.

The building was put on the block by private equity group Blackstone and co-owner Canadian group Brookfield, with the entire complex now potentially up for grabs after the pair initially offered a 75 per cent stake in the twin tower skyscraper.

The big contenders for the building include local property company Lendlease, which has garnered the backing of British funds house M&G and Singapore-listed fund Keppel REIT for its bid in keeping with its push into funds management.

The AMP Capital real estate unit is also a contender, with the backing of powerful superannuation fund UniSuper, in a demonstration of the platform’s ongoing strength as AMP negotiates to sell the funds management business to Dexus.

That company is not believed to be in the race but fellow local powerhouse Charter Hall is among those chasing the opportunity, aided by Singaporean sovereign wealth fund GIC, with which it has close ties.

The field also includes Hong Kong’s deep pocketed Link REIT, which has already made major forays into the Sydney market, buying up stakes in key retail centres and office buildings, with funds house EG advising.

Link REIT this year took a 49.9 per cent stake in a $2.3bn portfolio of buildings that was sold by Canadian group Oxford in a sign of the deep demand among Asian investors for top towers.

That group is also believed in this contest aside its local manager, Investa, as it looks to again expand its office holdings in Australia. Oxford swept into the market when it bought the listed Investa Office Fund in 2018 and it has since sold down much of this portfolio.

The building offer, via real estate agencies Cushman & Wakefield and CBRE, will see the bulk of the $2bn-plus complex change hands as the owners capitalise on strong demand for prime long-leased assets underpinned by government tenants.

The complex comprises Southern Cross East Tower and Southern Cross West Tower. Blackstone held the asset as part of its core-plus strategy and with Brookfield it repositioned the East Tower, winning a seven-year extension over 78,000sq m of space.

The 37-storey East Tower spans 79,731sq m and the 21-storey West Tower spans 46,369sq m. Both owners planned to exit the East Tower.

Blackstone will also exit the smaller West Tower, while Brookfield considers whether to retain a half stake in that building, or exit entirely.

A separate contest has also emerged for the West Tower. Bidders on this element include property house AsheMorgan and contenders would be banking on getting on a new tenant as Australia Post is set to depart in late 2024.

The building is expected to be a leader in the race for a new 20,000sq m- 45,000sq m leasing requirement from the Victorian government.

Brookfield initially planned to keep its interest in a smaller tower which is part of the complex but bids from local managers have indicated a desire to control the complex and willingness to stump up a premium.

The contest will now move into later rounds of bidding and pricing is expected to rise in line with expectations of a recovery in office values and continuing tightening of capitalisation rates with the deal likely to show a rate in the low 4 per cent range.

Melbourne is also not alone in large deals getting done. A series of office blocks are selling in Brisbane but the Melbourne building is likely to be the marker in the half.

While the parties and agents declined to comment, the latest figures released show that there is strong return to office and vacancy rates are now falling in key cities.

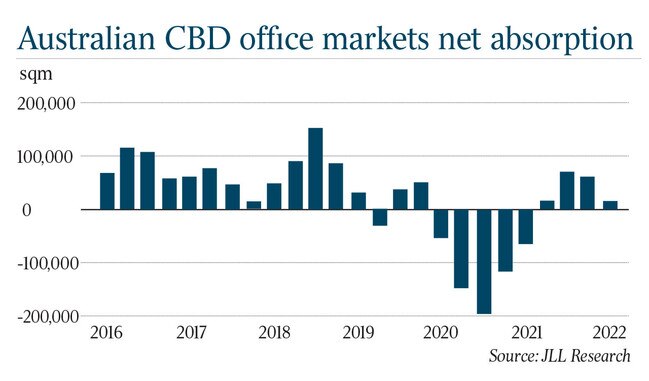

Real estate firm JLL’s first quarter figures for national office markets showed leasing markets were firmly recovering with positive net absorption of 14,200sq m recorded across CBD office markets in the March quarter, taking it to 163,300sq m over the 12 months to the end of March.

The national CBD office market vacancy rate contracted by 0.2 percentage points to 13.5 per cent in the quarter in a sign that demand is meeting the new wave of towers.

JLL head of research, Australia, Andrew Ballantyne, expects further demand for space.

“Corporate Australia remains in expansion mode with headcount growth recorded over the first quarter. Recent job advertisement surveys point towards strong hiring intentions over 2022,” he said.

“With the Australian economy close to full employment, one of the challenges organisations face is the availability of skilled labour, especially in technology and health related professions. The expected recovery in overseas migration will be an important ingredient in allowing organisations to fill open positions,” Mr Ballantyne said.

JLL head of office leasing, Australia, Tim O’Connor is tipping more activity. “The number of leasing transactions completed tends to be low over the first quarter, but we started to see a notable increase in inquiry over March and into April,” he said.

The Sydney CBD office market was relatively flat in the quarter but recorded positive net absorption of 27,800sq m over the 12 months to the end of March. As a result of stock withdrawals, Sydney’s CBD vacancy rate contracted by 0.2 percentage points to 12.3 per cent and this is expected to fall.

“The number of workers coming into the Sydney CBD has steadily improved over the first few months of 2022. However, workplace attendance was heavily influenced by weather patterns and we expect that the second quarter will provide greater insight into daily occupancy levels,” Mr O’Connor said.

The Melbourne CBD mirrored the Sydney result. Positive net absorption of 38,600sq m was recorded over the 12 months to the end of March and the headline vacancy rate compressed by 0.2 percentage points to 14.8 per cent.

Mr O’Connor said the Melbourne CBD recorded a number of large leasing transactions over the quarter, and TV operation Foxtel and the LeasePLUS Foundation centralised operations into the CBD. “We still see healthy levels of inquiry from small and mid-sized organisations and owners are willing to split floors and undertake speculative fit-outs to capture this inquiry,” he said.

The Brisbane CBD recorded 6,700sq m of net absorption over the 12 months to the end of March and vacancy tightened by 0.6 percentage points to 14.9 per cent.

Mr O’Connor said the recent increase in leasing inquiry points towards an acceleration in activity over 2022 and he warned that the office sector was starting to see the impact of higher inflation.

“Construction costs for office fit-outs are increasing, while higher labour, material and financing costs are exerting upward pressure on economic rents for new developments,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout