Rising stamp duty costs have sent property listings to record lows: report

The rising cost of ‘antiquated’ stamp duty is stifling property listings and contributing to the housing boom, says new analysis.

Removal of “antiquated” stamp duty taxes would improve affordability by addressing supply concerns and encouraging more homeowners to consider trading properties, according to a new report.

The continued low number of properties being listed on the market has proven one of the key components of the current housing boom, as buyers compete to take advantage of record low rates.

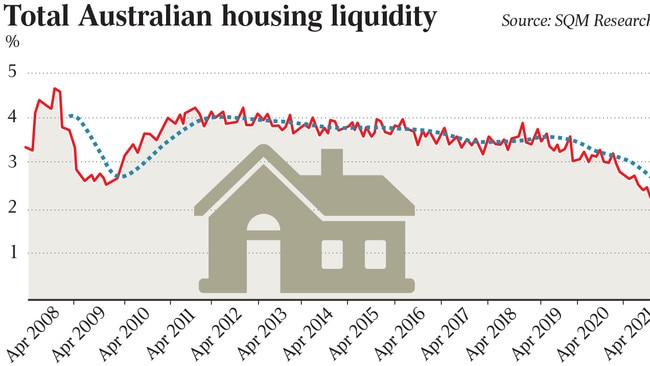

New analysis from the Real Estate Institute of Australia (REIA) in conjunction with SQM Research suggests the rising cost of housing and flow-on effect to stamp duty might be playing a larger part in the equation than first thought.

According to the “Stamp duty: The relationship to Australian housing affordability” report, the total number of national property listings has been steadily falling over the past year and now sits at just over 200,000 properties – a record low on SQM’s numbers.

In contrast, national listings between 2011 and 2019 – a period that recorded two upturns and one downturn – ranged between 380,000 to 300,000 dwellings.

This has coincided with a near 35 per cent rise in national median property prices between the March quarter of 2012 and the same quarter of 2021 from $553,955 to $746,389.

As such, stamp duty as a proportion of purchase price has also risen a full percentage point over the period to add an additional 4.2 per cent to the purchase cost. In real terms, median stamp duty has risen from $17,688 to $31,152 over the past nine years.

SQM managing director Louis Christopher said “bracket creep” and rising tax costs are deterring people from moving house.

“The long-term decline in listings fundamentally represents a shortage of real estate which is a contributing factor to the surge in prices,” Mr Christopher said.

“While there may be various reasons for this situation, we believe stamp duty bracket creep is a leading contributor. When transaction costs of transferring properties disproportionately rise compared to dwelling prices and incomes, (as what we have found) then that must be a massive disincentive for property owners to move house.”

People don't want to pay tens of thousands of additional costs on already expensive homes, said REIA president Adrian Kelly.

“Stamp duties as a percentage of average national earnings have jumped over the past decade to 34.3 per cent from 25.1 per cent recorded back in 2012, up almost one third. In Sydney and Melbourne, stamp duties alone can represent nearly half the average annual income,” Mr Kelly said.

Mr Kelly said transfer duties as a percentage of median property prices have jumped in most capital cities over the nine years between the March quarter of 2011 and March 2021 because of rising property prices.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout