Record surge: housing market hits $9.4 trillion

Australia’s fastest housing boom in more than 30 years pushed prices in almost all suburbs around the country higher, some as much as 50 per cent.

Australia’s residential housing market has claimed a long list of records in the past 12 months as the fastest housing boom in more than 30 years pushed prices in almost all suburbs around the country higher.

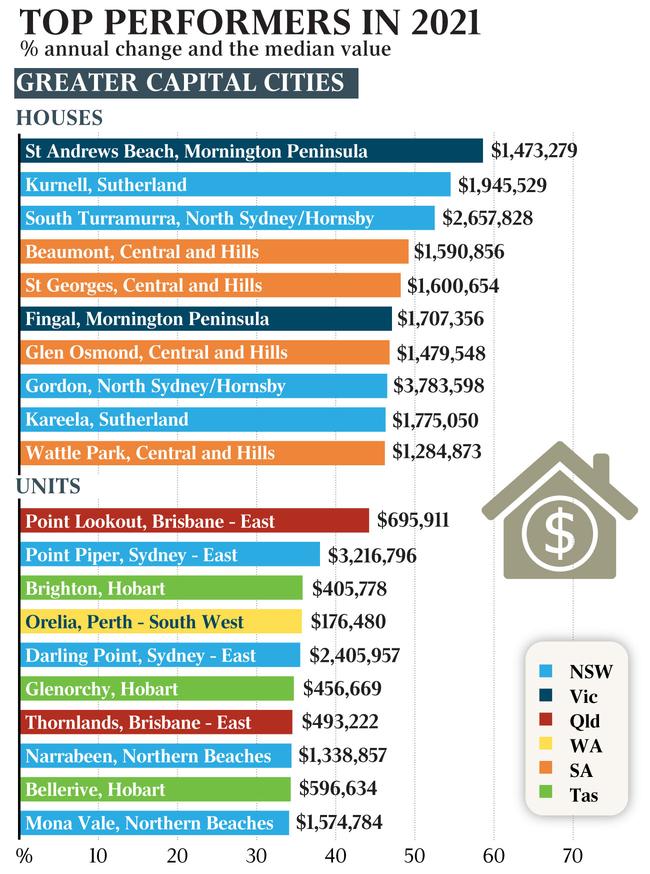

Houses in St Andrews Beach on the Mornington Peninsula have recorded staggering price gains of 58.6 per cent in a single year, with neighbouring Fingal also up 47.1 per cent.

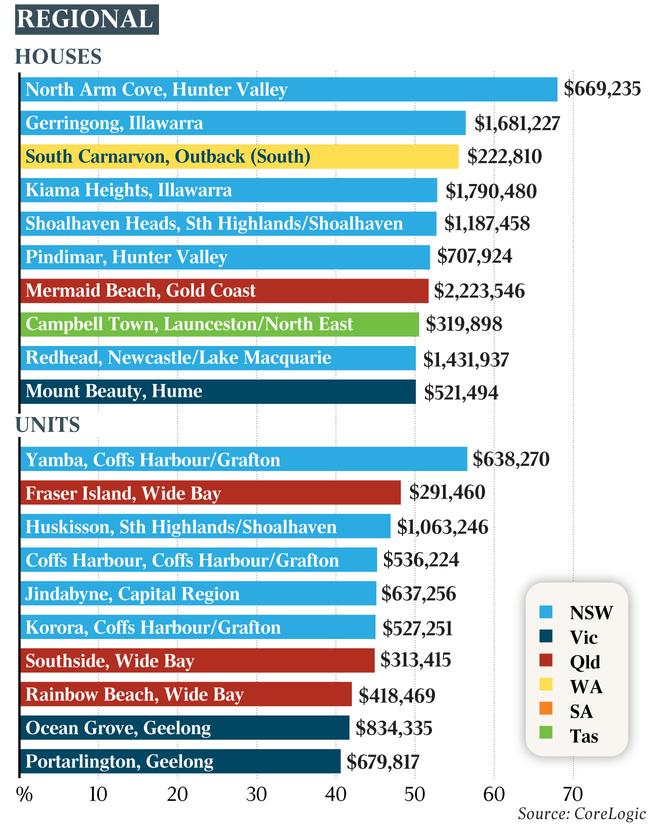

In the NSW equivalent of the Illawarra, Gerringong increased 56.4 per cent and Kiama Heights rose by 52.8 per cent.

The increases reflect a year of city dwellers moving to the regions and fierce buyer competition for limited stock, both of which have helped push up prices by 22.2 per cent nationally, according to CoreLogic’s annual Best of the Best report. About 614,600 homes were sold in the past 12 months, the highest number in almost 18 years.

As a result, the value of the Australia’s property pool has blown out from $7.2 trillion to a record high of $9.4 trillion in 12 months.

CoreLogic’s executive of research Tim Lawless said the fact some suburbs had risen in value by more than 40 per cent in a single year was “mind-blowing”.

“It’s been an absolutely crazy year for property,” Mr Lawless said. “For those people who own a property in those areas, well that’s fantastic news. But I think the other theme of 2021 is the worsening of affordability, which has been quite mind-boggling as well.

“For those people looking to buy into the marketplace, it’s been a year where homes have been selling very quickly and listing numbers have generally been extremely low. The urgency among buyers has been quite palpable.”

All bar one of the county’s most expensive suburbs for houses were in NSW, topped by Bellevue Hill at $8.7m and followed by Vaucluse ($8m) and Double Bay ($6.43m). The trend was similar for units, topped by Point Piper ($3.2m) and Barangaroo ($2.75m).

Adelaide homeowner Emma Patten, 50, hopes the market momentum will carry through into the new year after listing her home in Hyde Park, the capital’s third most expensive suburb.

Like many others, Ms Patten is swapping her corporate job and fast-paced life in the city to move to the country and open a small business – a luxury resort and spa for dogs called “Pats at Golden Paws”.

“After 20 years in corporate life, I wanted to find happiness,” Ms Patten said. “We lived in Byron for six months over winter and started looking at my life and what is important to me.

“People are looking to smaller towns for lifestyle after realising you don’t have to be in the office every day anymore.”

The agent selling the Hyde Park property, Ray White Norwood’s Sarah Bower, said strong buyer interest had already come from New Zealand, Queensland and the Central Coast of NSW.

Interstate interest in the smaller capital cities became another big theme of the year, with many choosing to move closer to their family or make a real lifestyle change, and it is changing the local markets.

“It is certainly helping sustain the buoyancy of the market, that’s for sure, and potentially inflating prices,” Ms Bower said.

Conditions have already started to ease in some parts of the country. The harmonious increases in most capitals over the year have now broken into several different speeds: growth in Melbourne, Sydney, Hobart and Canberra is slowing; Perth and Darwin are plateauing; and Brisbane and Adelaide are still growing above 2 per cent per month.

Outgoing president of the Real Estate Institute of Australia Adrian Kelly hopes market conditions will stabilise in 2022.

“I’m hopeful that 2022 will see a more normal supply of properties … which will start to ease the affordability issues experienced by first-home buyers,” he said.

“The indicators we are looking at will be listings, home loan and rent to income ratios, interest rates, jobs and unemployment, inflation, and immigration.”

CoreLogic’s Mr Lawless said southeast Queensland – inclusive of Brisbane, the Sunshine and Gold Coasts and Toowoomba – was the region to watch next year as interstate migration continues from southern neighbours.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout