Ralan says offer to all creditors to exchange their loss for a discount on future Sydney apartment remains

Founder of the collapsed property development business to offer discount apartments even as his empire faces liquidation.

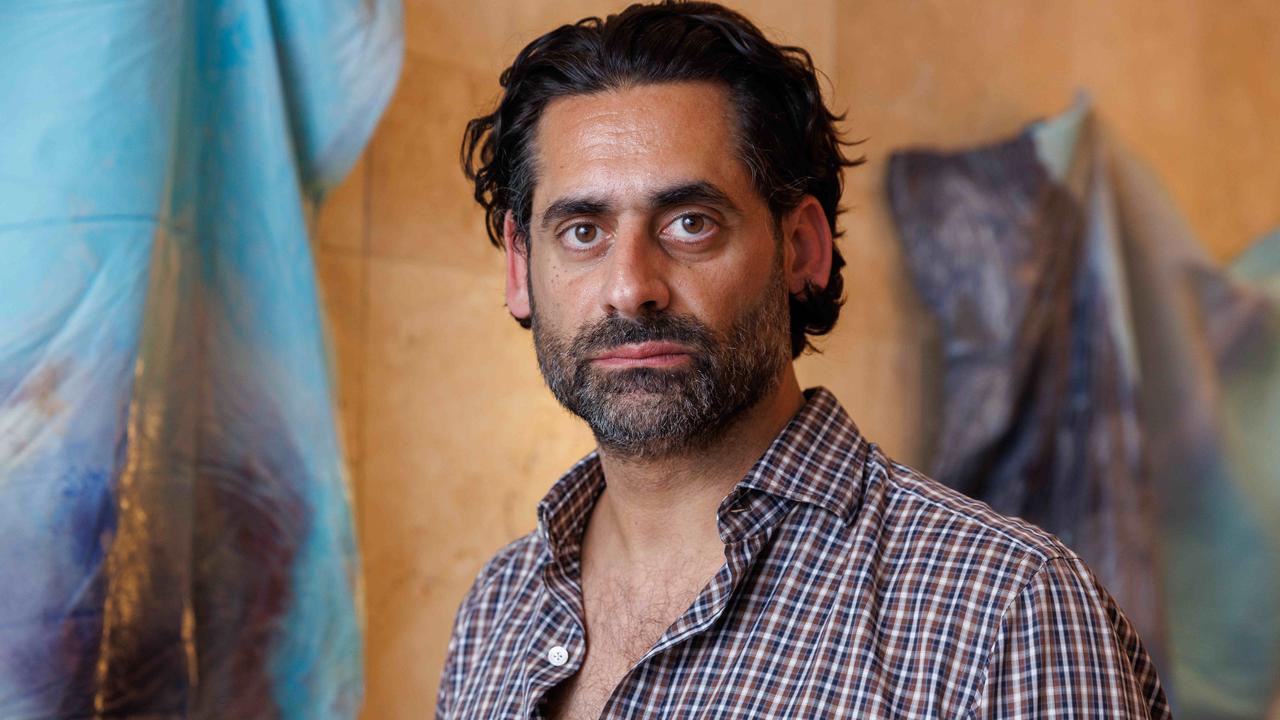

The founder of the collapsed Ralan property development business, William O’Dwyer, will keep pursuing his plan to offer discount apartments to about 1600 creditors even as his empire faces liquidation.

The Ralan founder staved off the threat of liquidation last December but has been pushed to the brink by a small creditor taking legal action to recover losses on an unbuilt apartment project.

But the Sydney entrepreneur insisted on Friday that his agreement to market apartments for Sydney developer Jean Nassif of Toplace Group was on foot and a number of sales had already been inked, sources said.

Ralan dramatically collapsed last year, owing about $564m, and buyers of hundreds of Gold Coast and Sydney units were reduced to unsecured creditors as the company was shuttered before completing towers that had been sold off-the-plan.

A project in Sydney’s Arncliffe went into liquidation but has continued. However, the bulk of creditors that paid deposits for the group’s Gold Coast projects and then released them back to Ralan had backed the deed.

The legal action would likely see Grant Thornton, which is overseeing a deed of company arrangement agreed to by Ralan creditors, step in as liquidator.

Grant Thornton was not available for comment on Friday but a spokesman for Mr O’Dwyer confirmed that one creditor had commenced legal action against the high-profile former apartment developer.

The legal action means the deed of company arrangement would terminate, putting a series of companies in the Ralan Group that were subject to the deed into liquidation.

“However, our client wishes to reinforce that the original offer to all creditors to exchange their loss in Ralan for a discount on future Sydney apartment remains,” the Ralan spokesman said.

Mr O’Dwyer would “work with all creditors of the Ralan Group to secure them a discount on a Sydney apartment regardless if the balance of the Ralan Group goes into liquidation,” the spokesman said.

As liquidator, Grant Thornton could again examine Ralan’s books and could seek to further investigate the company’s affairs, after preliminary findings that it had been operating insolvent since at least 2014.

“In our client’s view, a discount on a Sydney apartment is more valuable to creditors than a claim in a liquidation which is unlikely to bear any fruit,” Ralan’s spokesman said.