Property prices, lending gain as regulators watch on

Australians are borrowing more to cash in on the runway property price rises, but regulators are watching with warnings of a likely crackdown.

Surging property prices across the country has caused homeowners to become more indebted to own their own castle.

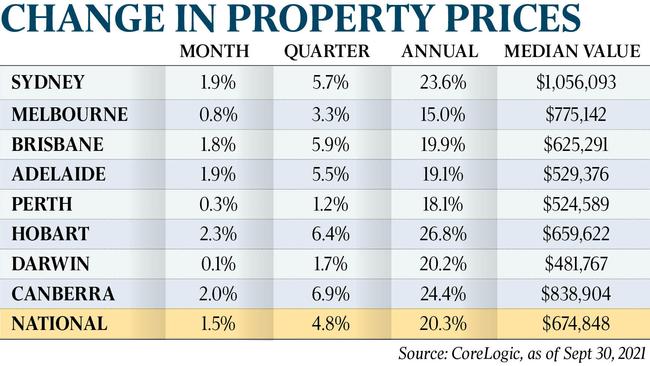

The current housing boom cleared a new milestone through September as national property prices rose at the fastest rate since 1989 to mark 20 per cent annual growth, according to the latest monthly figures from property researcher CoreLogic.

In real terms, the national median property costs $674,848, up from $554,372 in September last year.

Homeowners are now playing catch-up and are being forced to borrow more in order to buy. The average new mortgage nationally approved to owner-occupiers last month was $565,000 – a rise of 16 per cent from a year earlier – and as high as $732,000 in NSW and $598,000 in Victoria, analysis of Australian Bureau of Statistics data by The Weekend Australian reveals.

As a result, affordability is starting to bite, with first-home buyers bowing out of the market and investors starting to return. The pool of hopeful market entrants is still a third higher than before the pandemic but lending to the group is more than 20 per cent below the record peak of more than $7bn in January.

After prices rose a further 1.5 per cent last month, CoreLogic research director Tim Lawless said the costs associated with buying, such as stamp duty, was pricing many out and causing the monthly rate of price growth to slow. In Sydney for example, the typical house buyer would need to raise $262,300 in order to have a 20 per cent to purchase a house with a median value of just over $1.3m

“Even though we are seeing the annual numbers at about 20 per cent, which is clearly extremely strong, we are still seeing the monthly numbers easing off a little,” Mr Lawless said.

“Although the September numbers were originally flat against the August numbers, if you take it out to another decimal place, you can see there was a very subtle, slipping in the rate of growth.

“When you look at the longer term trend of those annual figures, it’s really clear that the housing market is still moving through what is an exceptional growth phase.”

The rising indebtedness of Australian households was highlighted by Treasurer Josh Frydenberg earlier this week when he endorsed tighter credit policies for home lending. Banking regulator the Australian Prudential Regulation Authority recently reported that new home lending with a debt-to-income ratio of at least six made up 22 per cent of home lending in the June quarter.

Regulators have flagged it will be at least two months before any changes are made to lending standards. SQM Research managing director Louis Christopher said it was likely any leading tightening would be across the board, rather than focus on one group of borrowers as policy did in 2017.

“It is true that lending has been accelerating on a high debt-by-income threshold,” Mr Christopher said

“What has been concerning to regulators on the credit side is just how in sync global prices have become. That would suggest the rise in more credit fuelled than anything else.”

Despite being locked down through September, Sydney (up 1.9 per cent), Melbourne (up 0.8 per cent) and Canberra (up 2 per cent) each recorded price gains. Smaller capital city markets continued to remain strong, with gains in Brisbane (up 1.8 per cent), Adelaide (up 1.9 per cent) and Hobart (up 2.3 per cent). After coming out of the gates strong at the start of the boom, Perth and Darwin have begun to stabilise with growth of 0.3 per cent and 0.1 per cent respectively.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout