Property market ‘running scared’ of Labor’s negative gearing tax plan

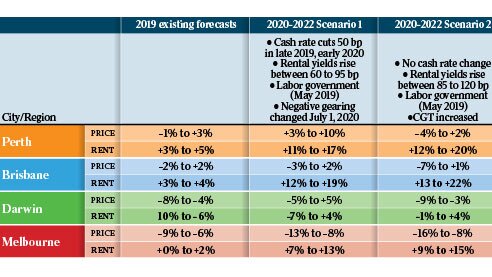

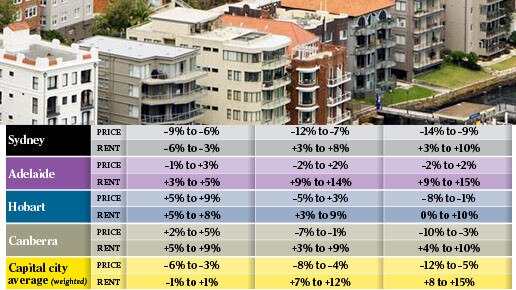

New modelling shows what impact Labor’s windback of negative gearing would have on prices and rents city by city.

Federal Labor’s proposed windback of negative gearing tax breaks would cause already nervous investors to desert the property market, sending prices falling further in most cities between next year and 2022, new economic modelling shows.

In a best-case scenario from SQM Research, housing prices will drop a further 4-8 per cent over a three-year period from 2020 to 2022, assuming an interest-rate cut of 50 basis points by early January next year.

Property sales turnover is predicted to fall another 8 per cent to 15 per cent by 2022 from 2019 levels with most of the declines in sales to occur in the 2020 calendar year, causing a flow-on effect to state and territory governments with an aggregate fall in state stamp duty revenue of $2.3 billion.

SQM has also modelled a harsher scenario in which price falls could reach 15 per cent without an interest rate drop, and one where the current tax break remains untouched.

If there were no change to negative gearing, average capital city prices could rise 8-14 per cent over the three years.

Managing director of SQM Research, Louis Christopher, said the windback of negative gearing was needed in the long term, but should be implemented slowly as part of wider property tax reform.

“Such a tax change during a housing downturn is, in our opinion, a risky move for the economy and so we encourage discussion of perhaps a phase-in period for such legislation that would reduce the economic shock that this tax change could create,” Mr Christopher said.

“Once again, (we) strongly encourage Labor to consider some of the investor issues, particularly surrounding the distortion their policy may create on pricing of off-the-plan developments and the likely losses investors in those properties would face come resale time to those who won’t have the tax concession.”

Labor said modelling that suggests the reforms will see the market drop were unfounded, with shadow treasurer Chris Bowen calling it one in a “parade of shonky property reports”.

Labor first announced its changes to negative gearing at the peak of the market to improve housing affordability. Only newly built properties would be allowed to be negatively geared under the changes, with the tax break to be grandfathered for existing properties. Capital gains tax concessions would also be halved.

Treasurer Josh Frydenberg said the policy would be a lose-lose situation, particularly when the market is falling, with the policy most likely to affect mum-and-dad investors. “Labor’s idea of fairness is not only to discourage hardworking Australians to save, but to punish those that do.”

He also criticised Labor for not naming a start date for their policy, fuelling more market uncertainty.

The government said investors could see average net rental losses across several electorates, ranging from $8500 in a key Labor seat to $13,300 in the Treasurer’s seat of Kooyong, based on tax office figures from 2016-17.

Under its first scenario, SQM found that Sydney’s housing prices could drop 7-12 per cent over the three years, Melbourne’s prices fall 8-13 per cent, Brisbane’s prices could rise 2 per cent with the possibility of a 3 per cent drop over the period, Adelaide could be up 2 per cent to a fall of 2 per cent, while Hobart could see a rise of 3 per cent to a drop of 5 per cent. Perth faced a brighter future with prices rising 3-10 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout