Private party: wealthy buyers shape up amid market reset

Cashed up private investors like Annie Cannon-Brookes and Zareh Nalbandian are the driving force behind a series of big property sales as nervous bigger institutions pull back.

Private property players have made the running in the first months of the year and are set to dominate this tough part of the commercial property cycle.

Wealthy investors unconstrained by nervous investment committees or difficult lenders have emerged as the driving force in a series of transactions this year.

Their active investing contrasts with the pullback by many large institutions and even the difficulties in finalising deals between large players.

Buyers in this bracket include Animal Logic co-founder Zareh Nalbandian, who picked up a building in Sydney’s inner city Redfern for $15m last September and then followed that purchase by acquiring an office block in nearby Surry Hills from Abacus for $32.25m.

The deal, brokered by agents JLL and Knight Frank, showed the depth of the private market and the deals on offer for those able to move quickly.

Nalbandian, who started Sydney-based Animal Logic in the 1990s and pioneered the use of visual effects and animation for movies like Happy Feet, is cashed up after the business sold to Netflix in 2022 for a reported $700m.

Others are also moving in on properties the big players overlook.

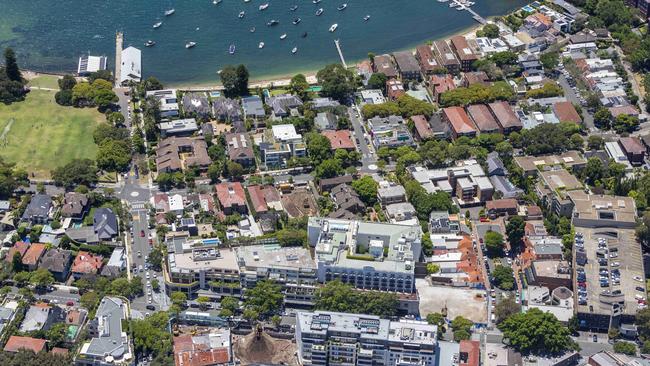

Bonython, the high-profile office compound of adman John “Singo” Singleton in inner Sydney’s Paddington, was quickly snapped up for about $30m this month by Annie Cannon-Brookes, the fashion designer and ex-wife of Atlassian’s Mike Cannon-Brookes.

During Mr Singleton’s five decade ownership of the former art gallery, the space has housed his SPASM ad agency, as well as other businesses such as Microsoft and Ninemsn.

Randall Kemp and Ben Vaughan of Ray White Paddington and Woollahra sealed the deal this month, and they did not disclose the buyer, saying only that three parties vied for the property.

Experienced developers are also buying hospitality assets while institutions are subdued.

Just this week, the InterContinental Sydney Double Bay hotel sold for more than $215m to a consortium of buyers led by low profile developer Mervyn Basserabie, alongside property figures Allen Linz and Eduard Litver.

The trio plans a dramatic revamp that would introduce luxury top floor apartments and seek to capitalise on the hot top end residential market, where wealthy downsizers are selling off mansions for premiums and buying up units, particularly those offering views of Sydney Harbour.

Other wealthy players are selling out – but the interest is again coming from the private sphere.

Birketu, media billionaire Bruce Gordon’s investment company, this week sold the WIN Grand development site in Wollongong, NSW, to developer Level 33 for an area record of $70m.

The site carries approval for a mixed used project designed to create a connected Wollongong city centre.

Mr Gordon’s Birketu put the proposed $500m on the block in July last year, seeking an industry specialist to deliver this landmark project.

“Consolidating the WIN Grand site was a good investment for us as we wanted to create something special for the city. We are happy to collaborate with Level 33 on our shared vision,” Birketu and WIN chief executive Andrew Lancaster said.

The deal was brokered by Simon Kersten and Taleah Thomas from Colliers Wollongong. WIN remains one of the Illawarra region’s largest property owners and the top regional broadcaster and largest private shareholder in Nine Entertainment Co.

The run of privates buying to fill out their portfolios or to spark developments is in stark contrast to the institutional market where property trading has slowed.

Some fund managers are hopeful of getting deals up in which they can buy shopping centres and offices, based on the appetite of wealthy investors.

Investment houses including Marquette Properties, Quintessential and Bayley Stuart are buying offices as the window opens for counter-cyclical deals.

However, institutional capital remains scarce for larger assets, with some transactions falling away. Canadian giant Brookfield has dropped plans to sell a 50 per cent interest in 388 George St in the heart of Sydney.

Even in Brisbane, the busiest market, ARA has ended plans to sell a building at 133 Mary St and a play for Cromwell’s Queen St building also did not go ahead.

The still uncertain lending environment and concerns about lower interest rates actually hitting this year means the property world is favouring the buyers that can move quickly.

There are hopes that investors will be able to join the private buyers that are making the running later this year once conditions settle down.

But, for now, it is an invitation only club of buyers who can pay cash or get in quick.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout