Oversupply to blunt housing spike

The extraordinary price growth being broadly recorded across the country could halve through 2022 as stagnant population and pandemic building stimulus cause an oversupply in housing.

The extraordinary price growth being broadly recorded across the country could halve through 2022 as stagnant population and pandemic building stimulus cause an oversupply in housing, according to global bank HSBC.

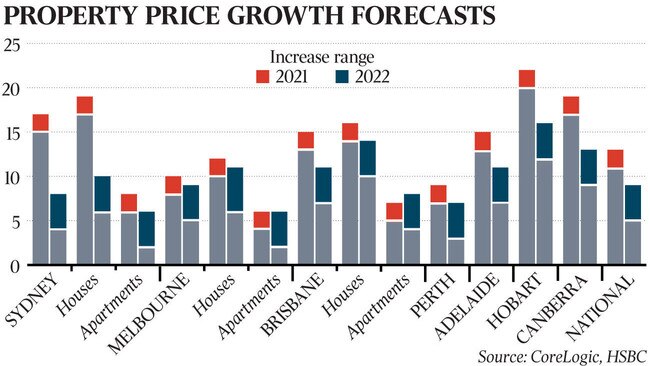

While low rates are partially to blame for an expected 11 to 13 per cent rise in property prices over the calendar year, signs have begun emerging that the market is starting to run out of steam.

The banking giant’s latest report compiled by chief economist for Australia and New Zealand Paul Bloxham suggests closed borders and the surge in housing approvals off the back of the federal government’s HomeBuilder stimulus package will cause the growth rate of prices to be reeled back to between 5 to 9 per cent next year.

“Based on our estimates, this combination is set to drive some housing oversupply until population growth is able to catch up,” the report said. “We see borders largely closed until mid-2022, and only gradually reopening after that. Net migration is not expected to return to its pre-pandemic rate until late 2023.”

Median property prices are at record highs in all capital cities, bar Perth.

HSBC expects Sydney growth will stall significantly from this year to 2022, dropping from a predicted 15 to 17 per cent growth to 4 to 8 per cent.

Melbourne is expected to rise between 5 and 10 per cent over the next two calendar years.

The country’s two largest capitals are expected to bear the brunt of the stalled overseas migration and lack of international students, which will take at least a year to recover, even if borders begin to reopen in mid-2022.

Meanwhile, Queensland is benefiting from a spike in interstate migration. Brisbane is expected to rise at least 13 per cent in 2021 and 7 per cent in 2022.

Hobart could have the highest growth in the coming 18 months, up more than 20 per cent this year and 12 per cent the next.

Prices are not expected to fall in any capital city.

Pandemic housing stimulus from the federal HomeBuilder scheme and state-based grants have created a building boom that is expected to amount to an oversupply in housing. The apartment construction frenzy through the mid-2010s caused a modest oversupply of about 30,000 properties nationally.

Building approvals figures released by the Australian Bureau of Statistics on Wednesday show that the number of new properties given the green light to go ahead fell only marginally (7.1 per cent) through May after hitting a near 40-year high in February.

HSBC predict this would lead to an oversupply of housing in NSW of 80,000 properties over 2021 and 2022, with a similar imbalance in Victoria (95,000 properties), Queensland (58,000 properties) and Western Australia (34,000 properties).

Housing Industry Association economist Angela Lillicrap said the number of new houses commencing construction was also expected to slow in 2022, but not without builders currently having to deal with a full set of challenges, including labour and material shortages.

After seeing their neighbour’s secure significant deals for their properties in the Sydney northern beaches suburb of Freshwater, Nilo and Candice Ibarburu, aged 41 and 37, decided to list their home on Tuesday.

It was a matter of striking while the iron was hot despite the circumstances, deciding alongside their agent, Tim Cullen of McGrath Manly, that waiting until after lockdown was a risk they weren’t willing to take.

“I don’t feel nervous selling in lockdown at all. I don’t think it will deter buyers or change the market,” Ms Ibarburu said.

“Prices are ridiculous.”

New CoreLogic data shows the low-rate loan environment has led to more than a third (36.3 per cent) of homes in Australia being cheaper to pay off via a mortgage than rent, a lift on pre-pandemic figures (33.9 per cent in February 2020).

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout