MRS looks to double funds under management under new boss

MRS Property is on the hunt for more acquisitions as part of an ambitious plan to double its funds under management to $1.5bn over the next five years.

Property investment and advisory firm MRS Property is on the hunt for more acquisitions as part of an ambitious plan to double its funds under management to $1.5bn over the next five years.

Under the leadership of new managing director Lloyd Ioannou, the Adelaide-based firm’s investment arm - Harmony Property Investments - is shrugging off the uncertainty surrounding property markets and eyeing opportunities to expand its portfolio on the eastern seaboard.

Since the merger of property management and advisory outfit MRS and syndicator and fund manager Harmony in 2013, the group has built up an investment portfolio worth close to $760m, with 35 assets in South Australia, Victoria, Queensland, NSW and Western Australia.

Around 60 per cent the portfolio is located in its home state.

Mr Ioannou, who took over from long-standing managing director Geoff Robertson earlier this year, said that while the challenges facing property markets were showing “no sign of abatement”, there were still attractive investment opportunities across a number of segments.

“We expect opportunities to emerge, and we’ll be diligently considering those opportunities for our investors,” he said.

“For office we see a counter-cyclical play for the right assets, industrial we’re bullish on as the fundamentals remain strong, and we’ll continue to consider good quality retail assets where we see value.

“We’re actively looking to grow our exposure to markets on the eastern seaboard in order to give our growing investor pool the exposure to good quality long-term investment opportunities across Sydney, Melbourne and Brisbane, whilst also retaining a focus on Perth and Adelaide.”

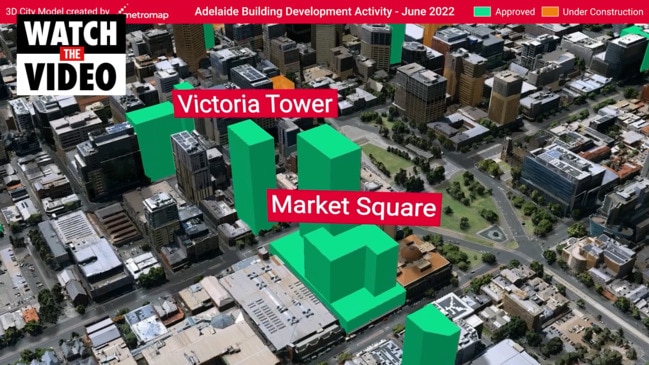

Earlier this year Harmony snapped up its largest single asset - paying $130.5m for a 17-level tower at 211 Victoria Square in Adelaide.

It remains the largest office deal in the City of Churches since Centuria and MA Financial paid $166.6m for Grenfell Centre, or the “black stump”, in 2021.

While office vacancy rates in Adelaide currently top the nation at 17 per cent, Mr Ioannou said he was confident office landlords would ride out the current uncertainty surrounding the future working arrangements of office occupiers.

“We see that businesses are still figuring out exactly what it means for their future space requirements in respect of flexibility and WFH (work from home), and we envisage that there’s still a bit to play out there,” he said.

“Whilst there are instances that dictate a need for flexibility, from a team collaboration and learning and development standpoint, it remains difficult to optimally replicate the benefits of being face-to-face with your team relative to sitting behind a screen.”

Mr Ioannou returned to Adelaide earlier this year after spearheading MRS’s push into Melbourne in 2020. As part of the recent leadership change, Mr Robertson transitioned to a new role as executive director.

MRS currently employs 61 staff across Adelaide, Melbourne and a third office in Brisbane.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout