Mornington Peninsula’s Goslings estate on the block in mortgagee sale

The Goslings, a luxury 40ha Flinders estate on the Mornington Peninsula, has been relisted for sale – but this time it’s being marketed as mortgagee in possession.

The Goslings, a luxury 40ha Flinders estate on the Mornington Peninsula, has been relisted for sale – but this time its being marketed as mortgagee in possession.

The proprietor of the Boneo Rd trophy acreage, with views across the wilds of Bass Strait, is given as KD Misquitta Investments, which is directed by Darren Misquitta, the embattled childcare entrepreneur.

It has been scheduled for May 19 private auction through Danielle Vains and Rob Curtain of Peninsula Sotheby’s.

“As this is a mortgagee in possession sale, the vendor has not provided any price guidance,” the marketing advises.

“The statement of information is only available on request and at the open house.”

It is understood inspectees have been advised of a $12m to $13.2m price guide.

The Goslings was purchased for $9.32m in 2016 from the family of late businessman Chris Kayes.

It was listed for sale at $23m last September through Zed Nasheet of Zed Real Estate who advised there were concept plans for golf-course waterfront villas by ARM Architecture.

The residence was built in 2005 with the two turrets above multiple living areas and four bedrooms.

The property overlooking Stockyard Creek has commercial shedding and large dams.

The title indicates a registered 2021 mortgage to RMBL Investments.

There is also a caveat from Cameron Schwaiger’s Island Trader (Vic) Pty Ltd arising from a 2022 mortgage.

Misquitta co-owns Cloyne, one of the most glamorous 1920s Toorak residences, with a 99 per cent stake held by his wife Karina.

The Piper Alderman law firm placed a caveat pursuant to a mortgage on the Cloyne title last week to rank as the third lender behind RMBL Investments and Island Trader.

$6.5m mortgagee sale

Sydney’s top advised sale was a mortgagee sale of a five-bedroom, five-bathroom mansion in Strathfield for $6.45m, some $350,000 over reserve.

The mortgagee in possession had given a $6m pre auction guide.

It was auctioned through Belle Property’s Norman So and James Kaye.

Four of the eight registered bidders competed after the $5.5m opening bid.

It was knocked down to buyers from Burwood.

The Howard St home, designed by architects Bechara Chan & Associates, had been listed unsuccessfully earlier this year.

It was completed five years ago, with a curved glass lift between all three levels. There’s a man cave and 10-seat cinema in the basement with six-car garaging.

The 727sq m building block cost $1.7m in 2015.

Sydney’s preliminary clearance rate fell from 78.1 per cent last week to 75.9 per cent, according to CoreLogic research director Tim Lawless.

No sale in Brighton

Melbourne’s preliminary clearance rate fell from 71 per cent to 68 per cent. The city’s priciest listing failed to find a buyer at Brighton, with just one unsuccessful bidder for the Rothesay Ave offering.

The four-bedroom house with a sculptural staircase, home cinema, glass-enclosed wine cellar and four car garaging had been listed with $5.5m to $5.8m hopes.

It was listed by Russell Sim at Simcorporation, the transport logistics company. He wants a new abode with a larger garage, since he wants to start collecting cars.

Melbourne’s top advised weekend price was in Canterbury where a grand art deco mansion at 88 Mont Albert Road fetched $5.9m.

The five bidders took the price to well above its $5.12 on the market declaration.

There had been an undisclosed pre-auction sale at 59 Park Rd, Middle Park, which had been listed with $6m to $6.6m guidance.

Buyers agent Mal James calculated the Boroondara district enjoyed an 83 per cent success rate from the 12 prestige auctions he was monitoring.

Adelaide in the clear

The smaller capital city auction markets strengthened, with Adelaide’s preliminary clearance rate rising to 91.7 per cent, its second-highest result this year.

Its top sale was a $1,650,000 dead heat between a Torrens title townhouse in Nailsworth and a cream brick 1960s four-bedroom, one-bathroom house at Magill.

The 2018-built California St, Nailsworth offering had been marketed with $1.5m guidance through Toop+Toop agent Sharee Redic. Set on a 369sq m holding, the contemporary two-level, four-bedroom, two-bathroom abode had first sold in 2019 for $1.05m.

Brisbane’s early clearance rate rose to 76.7 per cent.

The top Brisbane result was 35 Duke St, Bulimba which sold under the hammer for $4.925m.

All five registered bidders were active for the restored two-level home listed through Ray White Bulimba agent Daniel Lazzaroni, who sold it to a local family.

The vendors are downsizing up to the Sunshine Coast.

Canberra broke the 70 per cent mark at 71.4 per cent for the first time since the week before Easter.

Canberra’s top sale was when a contemporary five-bedroom house at Kambah that fetched $2,268,000 through Hayman Partners.

Auction action

The volume of capital city auctions remained above the 2000 mark for the second week running, with 2168 properties going under the hammer last week.

The number of auctions was down 1.5 per cent on the prior week’s 2202, but 28 per cent higher than the 1692 at the same time last year.

The 72.6 per cent national preliminary clearance rate was the lowest since the Easter long weekend.

The first week of May saw a finalised clearance rate of 65.9 per cent after all the results were compiled.

“Finalised auction clearance rates have faded a little from earlier in the year, holding roughly around the decade average of 65.1 per cent,” said CoreLogic’sTim Lawless.

“With the average revision between the preliminary and finalised capital city clearance rate tracking at 7.5 percentage points, we are likely to see this week’s final clearance rate once again in line with the long run average,” he said.

Lawless noted the elevated late autumn exodus was evident in the freshly advertised capital city stock tracking almost 17 per cent higher than last May.

But he added that sales turnover and withdrawals meant total advertised inventory sat 4 per cent lower than a year ago and 16 per cent below the previous five-year average.

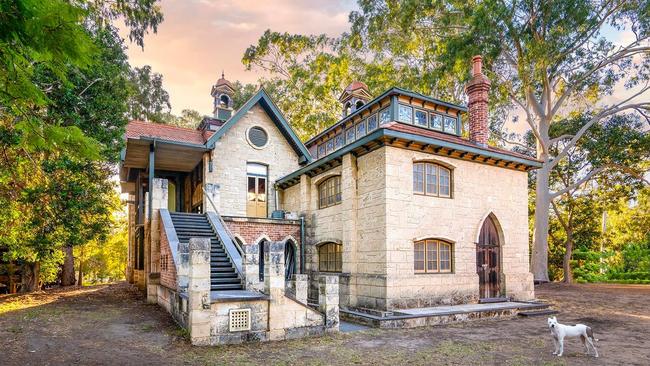

Gothic gem

PropTrack economist Anne Flaherty noted that the most viewed residential listing on realestate.com.au last week was an offering at Bassendean, located on the banks of the Swan River.

The 6181sq m property has a grand limestone Gothic residence adjacent to a classic 1910 Federation expanded by the late Lloyd Leist.

There have been more than 27,000 page views since its posting by Jayson Watson at Butler Property Group.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout