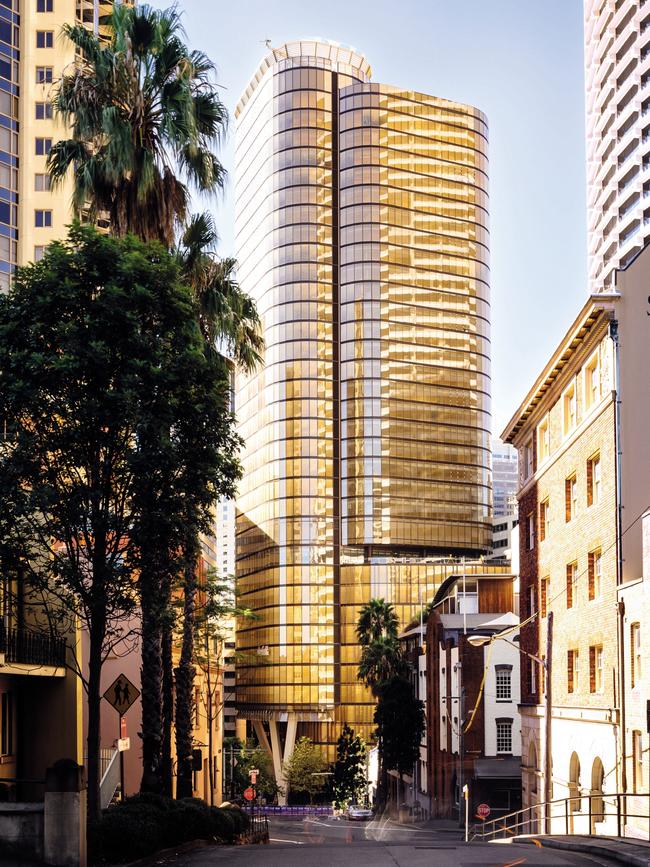

Mirvac takes control of $1.15bn EY Centre tower in Sydney

The deal for the EY Centre at Circular Quay shows Mirvac and its backers have faith in the recovery of the Sydney CBD.

Property developer Mirvac has stamped its authority on Sydney’s office market and taken full control of the EY Centre at Sydney’s Circular Quay in a deal valuing the building at $1.15bn.

The purchase, backed by British funds manger M&G Real Estate, is a repudiation of sceptics who believe the office market will struggle both during the city’s lockdown and for an extended period afterwards.

The move comes just after Dexus secured the $1.4bn Atlassian tower at a technology precinct next to Central Station, and shows that top landlords are bullish about a recovery from the present crisis.

The $7bn office property fund managed by AMP Capital which owned the EY tower had been poised to sell a half stake to a Lendlease-run office fund.

But that sale of the interest in the 200 George Street building was derailed when Mirvac exercised its rights as co-owner.

The deal shows the hunger of investors for top-class offices and that prices are jumping back towards pre-crisis levels.

The AMP Capital Wholesale Office Fund ran a competitive sales process via Cushman & Wakefield and Savills, which drew bidders from around the world.

However the domestic bidder prevailed, with Lendlease’s funds unit going into due diligence at about $575m before Mirvac found a backer to take the tower at this level.

The shimmering tower spans 38,650sq m of office space and is occupied by Mirvac, EY and AGL. Buying the tower stake would have been a coup for Lendlease as it is also developing the neighbouring Salesforce Tower, allowing it to create a new precinct at the gateway to Sydney.

But Mirvac may have similar ambitions, as it is developing another 60,000sq m tower at 55 Pitt Street, although it is yet to secure a tenant. Mirvac is also, on behalf Chinese fund CIC, boosting its interest in nearby Grosvenor Place from a one quarter stake to a three quarter stake.

AMP Capital fund manager Kit Georgeos hailed the deal. “At a significant premium to book value, the sale of 200 George Street is a fabulous result for the fund and its investors and demonstrates the continued strong appetite for prime CBD office assets,” she said.

But much of the focus is on whether the fund will remain in AMP Capital’s orbit. An independent committee made up of experienced director Paul Say, former Future Fund property head Barry Brakey and Wesfarmers director Sharon Warburton is running a process to determine the trust’s future, amid uncertainty about the overall platform’s direction.

The trio, aided by investment bank Jarden, is assessing submissions from rival managers to run the prize vehicle in a move that could potentially spark a larger merger transaction. The process has drawn bids from Charter Hall, Dexus, Mirvac, Investa and GPT.

The AMP Capital-run trust is a prize as it owns some of the country’s best towers, and the top performer according to Mercer data over the last three years.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout