McGrath predicts more housing pain before rebound

Housing markets are in for a tough 12 months, but some suburbs are still worth buying in, John McGrath says.

Australia’s housing markets — and particularly the once white hot Sydney and Melbourne — will be in for a tough 12 months not unlike the period after the global financial crisis as uncertainty from state and federal elections and the lending clampdown shackle the sector, veteran real estate agent John McGrath says.

“I think it will be double-digit (falls in Sydney and Melbourne peak to trough) and there is few per cent to go. It feels like we haven’t reached rock bottom,” he told The Weekend Australian ahead of releasing his annual market report.

However, he expects the downturn to ease in the latter months of next year, with even a small price rebound of 3 to 4 per cent as clarity emerges both on securing finance and on policies that affect housing such as negative gearing, which depend on the outcome of next year’s federal election.

Sydney’s housing prices had surged 75 per cent over the five years to 2017 and Melbourne was up 59 per cent, while peak-to-trough falls could reach 15 per cent, close to half of which had already happened, he noted.

“If it stabilises at those levels, then that’s not a bad outcome,” Mr McGrath said. “Sydney and Melbourne would always be the New Yorks of Australia.”

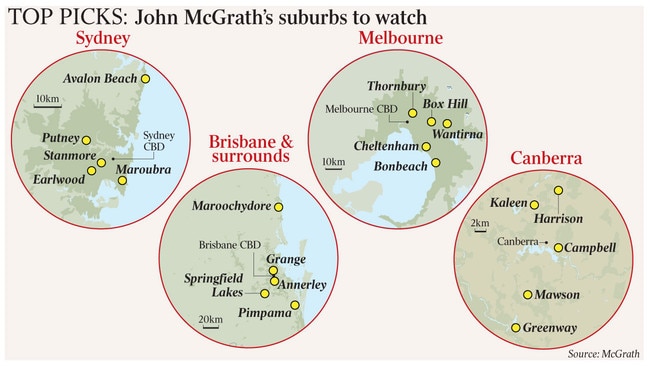

The annual report includes Mr McGrath’s top suburb picks, with three waterfront suburbs in his Sydney top five. Topping his Sydney list are Putney, once dominated by public housing but neighbour to upmarket Hunters Hill; Avalon Beach, with its boutique retail village and proximity to Palm Beach; and Maroubra, which he says offers value relative to other beach locations.

In Melbourne, he picks Bonbeach where the median house price is $900,500 and a ripple effect is likely from pricier neighbouring suburbs; Thornbury, where first-home buyers will be active due to its $500,000 median; and Box Hill, for its rail and hospital infrastructure.

People would increasingly be drawn to southeast Queensland for its far cheaper housing, Mr McGrath noted. “If you had a good house in Dulwich Hill in a reasonable street that’s worth $2.8 million, you could go to the Gold Coast and buy a house on a canal for $800,000. We expected Queensland to lift years ago but it’s been held back by the economy. Now there is a strong migration push,” he said.

In southeast Queensland, Mr McGrath’s suburb picks include the Sunshine Coast’s economic hub Maroochydore, the Gold Coast’s affordable Pimpama, which recorded the state’s fastest population growth in 2017, and Brisbane’s near-city Annerley.

Dante Lucarto purchased his Annerley home 15 minutes from the CBD in April after a two-year search. “I created a map of a number of different areas with buffers around train stations, busways and proximity to the city, to calculate a reasonable distance to get to work. I had identified a number of suburbs and Annerley was one of them,” Mr Lucarto said.