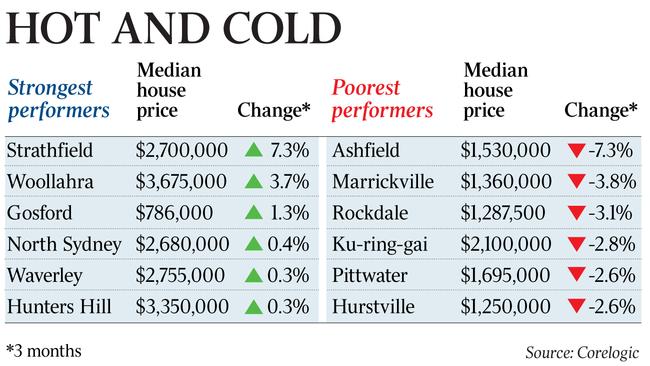

Local government price moves show which buyers are being hit

Sydney’s premium suburbs continue to fire while housing in the cheapest areas are okay. Not so for the middle market.

As an economist, I’m used to looking backwards to explain current events. But there are always unique characteristics that make our history different to our present. The current housing downturn is no exception, and the Sydney market is particularly interesting to watch.

The last time Sydney had large price drops was during the global financial crisis. White-collar workers employed in finance jobs were hit the hardest, and with people in high-paying jobs no longer employed, the premium property market saw sharp drops.

This time around, we’re not seeing any similar correlation to the 2008 downturn. In fact, many of Sydney’s premium suburbs continue to fire, and the cheaper Local Government Areas are performing well. This time, it’s the middle markets being hardest hit.

Sydney’s most expensive suburbs — areas such as Double Bay and Northbridge — continue to see steady price growth, and demand remains strong.

Housing in Sydney’s cheapest Local Government Areas are also going OK. Sydney’s cheapest LGA, Campbelltown, has seen stable prices over the past three months, while Gosford is still seeing increases.

It is pretty clear that the suburbs where there have been a lot of apartment developments are seeing declines for this dwelling type. Rouse Hill and Bella Vista have seen apartment prices fall more than 10 per cent over the past three months.

The other suburbs that have seen declines are those that saw incredibly strong increases in 2018. Bringelly saw the most growth in Sydney in 2017, but over the past three months it has seen one of the biggest declines. Houses in St Leonards have more than doubled over the past three years but have dropped by more than 8 per cent in three months.

While at a suburb level results can be driven by over supply or overpricing, at a local government level we get a clearer idea as to the buyer types being hit the most.

The middle market — particularly the $1.2 million-$1.7m price bracket — is a concern. Several factors could be driving this decline. First, mid-range owners could be selling as a result of being nervous about overextending themselves now that mortgage rates have started to rise. Alternatively, there could just be fewer mid-range buyers as finance restrictions continue to be an issue.

Cheaper locations seem to be propped up by renewed first-homebuyer incentives that have led to a 70 per cent increase in finance approvals to this buyer group. A study by RFI Group estimate that the number of people who say they intend to buy their first home in the next 12 months is 57 per cent larger than its estimate of the number of people who actually bought their first home in the last 12 months. This shows the confidence of first-home buyers has started to increase.

Expensive locations reflect that economic conditions are pretty good if you are a highly paid professional or a business owner. The NSW economy is growing and it seems to be benefiting this group first. It is yet to benefit middle income Australians.

There are some factors that will cushion the fall for Sydney. The financial services royal commission will finish up at the end of this year, providing greater certainty for lenders. And the economy is slowly gathering strength with unemployment at its lowest rate in six years and GDP growth at its highest rate in six years.

With such a strong run-up in prices in Sydney over the past five years, it is likely we are in for a few years of flat conditions, rather than a price free fall.

Nerida Conisbee is chief economist at REA Group.