Loan curbs a risk for first-time buyers

Changes to lending regulations to halt rising property prices may block first-home buyers.

Economists are warning any changes to lending regulations to curb rising property prices will block first-home buyers from entering the market, as the Reserve Bank swears off raising interest rates.

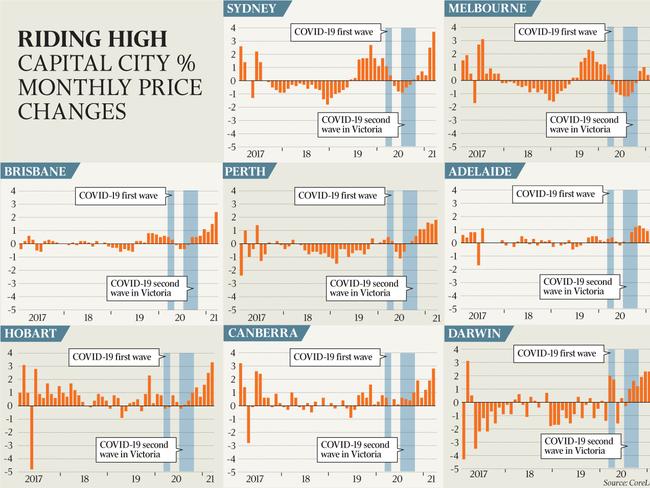

As the Australian property market booms — with prices rising 2.8 per cent nationally in March, the single largest monthly hike in 32 years — affordability is again at the centre of policy discussion. Six of Australia’s capital cities — Sydney, Brisbane, Melbourne, Adelaide, Hobart and Canberra — have hit record highs in median residential prices this year.

With no interest rate hike on the horizon, CoreLogic research executive Tim Lawless said it was now a matter of “when, not if” macroprudential measures were introduced by the banking regulator APRA to dampen prices.

But Housing Industry Association chief economist Tim Reardon said the market forces that were in play in 2015 — when lending changes were last used to control rising prices — were completely different.

With interest rates now at a record low, he said further measures would only force out the first-home buyers and owners-occupiers who have formed the basis of the post-COVID-19 recovery.

“We just need to wait, only time will solve this problem,” Mr Reardon said. “Price rises become an automatic stabiliser and force first-home buyers out of the market. That demographic shift will slow down current activity.”

Macroprudential measures were introduced ahead of the last residential price peak in the form of lending restrictions to slow down the rising levels of riskier home loans and limit the percentage of investors purchasing, which had hit record highs.

Economist Andrew Wilson said the market was now in a completely different position. Lending had remained stringent since the 2019 banking royal commission, which in turn caused investor levels to fall to record lows over the past 12 months.

“I think it’s a reasonably rational environment, to be quite honest,” Dr Wilson said. “It’s almost inevitable what is happening this year. We’ve had all these artificial outside constraints that have occurred and held back normal demand in the housing market and, right now, all those constraints have been released.

“Thankfully, the regulators and policymakers can’t interfere as they have, perhaps questionably, in recent years and create another impediment to orderly market outcomes.”

Prices in all capital cities rose last month in what is proving to be a broad-based boom. Sydney led the charge through March, gaining 3.7 per cent, while Melbourne jumped 2.4 per cent. Inner-city apartments, the dwelling type of choice of inventors, are continuing to lag in growth but there are signs of stabilisation in rent and selling prices.

Last week, Katherine Burchfield, 45, and Sean Girvin, 53, sold their California bungalow at Wahroonga, Sydney, in a matter of days after their agent, James Sutton of McGrath Lindfield, teed up a buyer ahead of the property’s planned auction in mid-April. “If we had gone to auction, we could have got more, but you never know,” Ms Burchfield said. “We are pleased but surprised at how fast the market is. It felt like we sold when it was hot, if not, at the peak moment.”

Real estate network Ray White, which holds a quarter of the property market share nationally, posted a record month of trade through March, achieving $8.53bn from more than 9100 sales. The result was almost double the same time last year and beat the previous record set in November by almost $2bn.

Managing director Dan White said any outside interference in the market would have far-reaching implications. “When you play with the market, it can have a broad impact,” he said. “I don’t think anyone wants to see more price growth, for families or the market generally. It’s very hard to find a level to do that (introduce policy to limit growth, without bringing the market to a stop.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout