Key evidence housing crash is ‘bottoming out’

Nine months of falling house prices have stalled in 2023, possibly spelling the end of the market downturn.

Nine months of falling house prices have stalled in 2023, possibly spelling the end of the market downturn.

As interest rates draw closer to their peak – with two more interest rate rises expected – and with constrained housing supply in most capital cities excluding Hobart, house values are stabilising, which some experts say could represent a “bottoming” of prices.

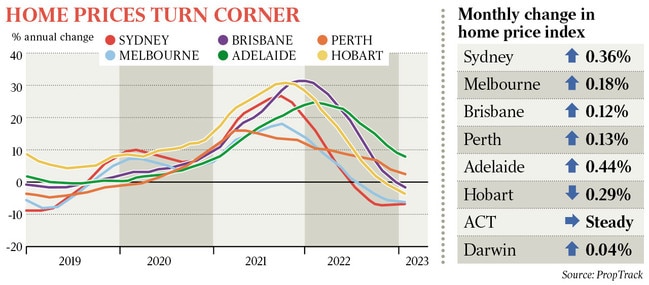

National home prices were up 0.18 per cent in February 2023, according to PropTrack’s Home Price Index. This follows a small 0.09 per cent national increase in January – the first jump following the March 2022 peak.

It’s mainly been driven by limited housing stock as seller confidence weakened and many held back on listing properties for sale, and despite substantial interest rate rises, up 325 basis points, and reductions in maximum borrowing capacity by around 30 per cent.

“We’re seeing that with the listings environment remaining constrained and fewer properties coming to market, that is concentrating buyer interest, and putting a floor under prices, countering the downward pressure from interest rate rises,” senior PropTrack economist Eleanor Creagh said.

Prices bounced in every capital city except Hobart in February, with Adelaide recording the largest jump at 0.44 per cent, followed by Sydney at 0.36 per cent, and Melbourne at 0.18 per cent.

These figures appear to coincide with housing supply in each capital city.

“Prices fell 0.29 per cent in Hobart this month and that really lines up with what we’re seeing on the supply side. Hobart is the only capital city where total property listings are more than 30 per cent above the prior five-year average, whereas all other capital cities are seeing total listings below the prior five-year average,” Ms Creagh said. The number of properties listed for sale in Sydney is down nearly 20 per cent on previous five-year averages.

In Adelaide, the comparative affordability of homes has seen prices hold up better than other states, and low stock levels are helping to insulate home values, according to the PropTrack Price Index report. Buyer demand per listing is also sitting at a record highs in January 2023.

While it’s too early to confidently call an end to the downturn, experts suggest this could be a “bottoming” process.

“While maybe it’s too early to call an end to the downturn, I think we also can’t rule out that the trough is unfolding and this is a bottoming process with value stabilising as interest rates draw closer to their peak … even if we do see two more rate rises,” Ms Creagh said.

There’s still some uncertainty, she said. If there is an increase in stock, house prices will decrease but if low supply persists, it will continue to counter the downward pressure from rate rises.

For sellers, that could mean less hesitancy to list properties, with the February figures showing there is a level of buyer demand keeping prices resilient.

For buyers, some of the shock and uncertainty they experienced last year in terms of borrowing capacities and mortgage servicing costs decreases as we approach peak interest rates.

Home prices nationally are still 29.4 per cent above their pre-pandemic levels. Prices are down 6.64 per cent in Sydney and 5.99 per cent in Melbourne over the past year.