Interest fall nullified in rising house market

Darren Kowacki and Helen McKinlay plan on having another chat to their mortgage broker following yesterday’s cut to official interest rates.

Hopeful homeowners Darren Kowacki and Helen McKinlay plan on having another chat to their mortgage broker following yesterday’s cut to official interest rates.

The first-home buyers are looking to enter the market in Melbourne’s eastern suburbs before their wedding in March. They already have pre-approval from one of the big banks and hope the historic low cash rate of 0.75 per cent will help them get the most out of their deposit.

“We are very interested to see what happened to the market. It is hard as first-home buyers to see prices continue to go up,” Mr Kowacki said.

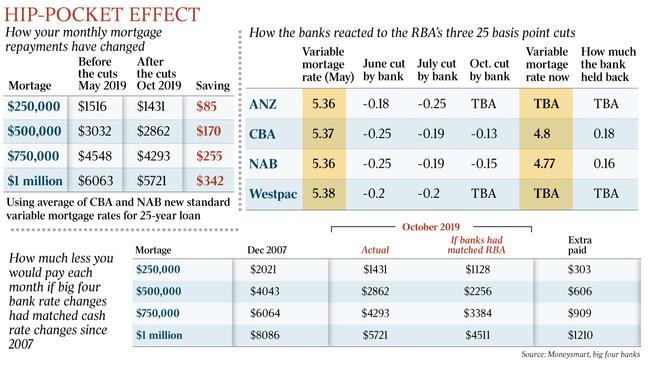

Yesterday’s decision by the Reserve Bank has put the housing market in an uncomfortable position. While buyers and sellers are reaping the rewards of lower mortgage rates and prices jumping higher month to month, the construction side of the industry is still feeling the constraints of bank lending.

This was acknowledged by governor Philip Lowe yesterday.

Property researcher CoreLogic recorded a significant 1.7 per cent price gain in Melbourne and Sydney and a national rise of 0.9 per cent in September, credited to loosening finance and pent up demand.

Mr Kowacki, 35, and Ms McKinlay, 30, said accessing credit was relatively easy for them.

The trajectories of increases in Sydney and Melbourne are unlikely to continue at their current pace, independent economist Andrew Wilson said, anticipating a slowdown as prices reached their 2017 peaks in 12 to 18 months.

AMP chief economist Shane Oliver said the rate cut would help the subdued, broader market, adding that the boom that followed rate cuts in 2011 was unlikely.

“The problem with Sydney and Melbourne is their economies are starting to slow. So while there has been a rush of buyers, it’s unlikely this is going to be a rerun of what happened after 2011,” Mr Oliver said.

In construction, Australian Bureau of Statistics data released yesterday found quarterly building approvals were down significantly year on year, with some moderation through August. The Housing Institute of Australia also released its new home sales report showing sales rebounded by 7.3 per cent in August but were still down on the quarter year on year.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout