Housing boom ends with first price fall, PropTrack finds

The housing boom ended in May as the market recorded its first fall since the pandemic set in on the back of mortgage-holders experiencing the first interest rate rise in more than a decade.

The housing boom ended in May as the market recorded its first fall since the pandemic set in on the back of mortgage-holders experiencing the first interest rate rise in more than a decade.

Last month, property prices fell 0.11 per cent nationally, according to PropTrack’s latest Home Price Index, in what proved to be the first decline since April 2020.

The result followed a continued slowing in price growth through the first few months of 2022 as affordability pressures were heightened by the threat of an interest rate rise that became a reality in May when the Reserve Bank raised the cash rate to 0.35 per cent.

PropTrack senior economist Paul Ryan said the slowdown meant home prices would have likely moved into negative territory regardless of a rate rise.

He said further increases to interest repayments might impact buyer sentiment and willingness to place large bids for homes that could flow through to more falls through 2022.

“The RBA definitely has more rate increases in mind,” Mr Ryan said. “They don’t operate by just tinkering at the margins – the board will discuss a path.

“The uncertainty is kind of holding people back from bidding up as much as they potentially could. Obviously, sentiment can change quite quickly but the market seems like it's in a pretty good place now for buyers and sellers to come together.”

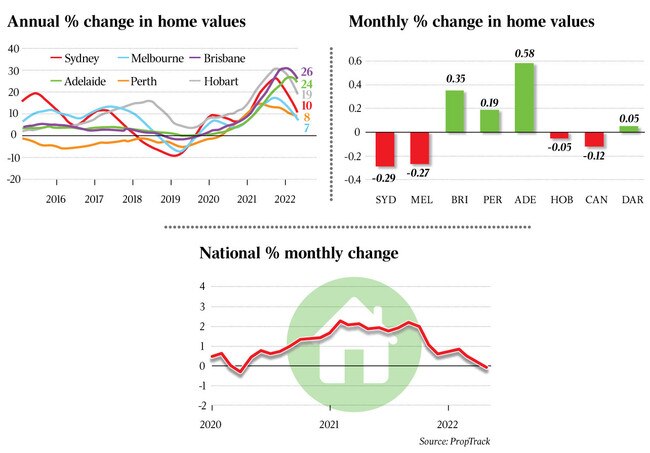

On an annualised scale, property prices are up 14 per cent compared to the same time last year, almost half the growth being reported six months ago (up 24 per cent), which indicates a significant slowdown through the start of the year. However, Mr Ryan said it was important to remember any declines ware against the back of the country’s fastest housing boom in decades, which saw prices climb 35 per cent over the past 26 months.

Banking regulator APRA on Tuesday warned homeowners that the country was moving into a “very different” housing environment compared to the past decade, given we were moving out of a period of ultra-low rates and a soaring property market. Negative equity could soon become a reality for some borrowers.

APRA chairman Wayne Byers noted in an address to the The Australian Financial Review Banking Summit that the body had targeted some banks for lending to home loan customers who carry too much debt.

Half of all capital cities recorded price falls through May, with a clear two-speed market playing out across the country.

Sydney and Melbourne each reported another consecutive month of falls, down 0.29 per cent and 0.27 per cent respectively through May. Prices fell for the first time in three years in the ACT (down 0.12 per cent), and Hobart slipped 0.05 per cent.

In the smaller cities, prices are still increasing moderately. Brisbane (up 0.35 per cent) and Adelaide (up 0.58 per cent) each rose in May and have shown no signs of falling into negative territory.

Perth prices increased 0.19 per cent, while Darwin was also up 0.05 per cent.

“I can’t see those markets going down even after all this growth,” Mr Ryan said.

Regional Australia broadly held steady (down 0.01 per cent).

The reality of the changing market has hit home for borrowers, with new research from Commonwealth Bank having found more than 90 per cent of Australian homeowners have taken steps to mitigate the impact of rising mortgage rates.