House prices lift in January but signs of slowdown coming, says Core Logic

Melbourne and Sydney house price growth slowed in January as affordability re-emerges as a concern.

Melbourne and Sydney house price growth slowed in January as market watchers warned affordability is re-emerging as a concern.

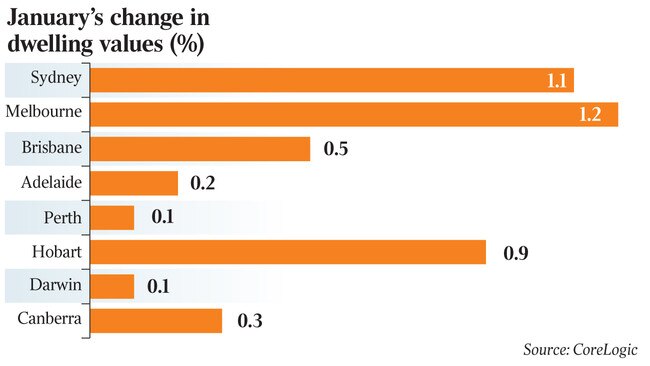

But that did not stop all capital cities from reporting gains for the first time since 2017 as the property market emerged from its holiday lull, the latest data from CoreLogic shows.

The property researcher’s monthly house price index showed the pace of growth slowed nationally to 0.9 per cent in January, but the annual rate of growth rate climbed to 4.1 per cent, the highest in three years.

Sydney kicked off the year with price growth of 1.1 per cent through January, down from 1.7 per cent the month prior. It was a similar story in Melbourne, which recorded New Year gains of 1.1 per cent, down from 1.4 per cent in December.

CoreLogic’s head of research, Tim Lawless, said the seasonal slowdown was due to the time of year. But economists expect the rate in price growth to slow more broadly though the first half of 2020 as the market moderates and more homes are listed.

“Seasonal effects are actually only a very small part of why the housing market is slowing,” Mr Lawless said.

“What’s really happening here is affordability constraints are starting to impact on the largest markets of Sydney and Melbourne. Also, we are starting to see some impact from listing numbers becoming higher. So, as prospective buyers get more choice in the marketplace, some of the urgency is coming out of their decision-making process.”

Most other capitals reported modest gains through the month, led by Hobart, with up 0.9 per cent growth. Brisbane prices were up 0.5 per cent, Canberra gained 0.3 per cent, Adelaide increased 0.2 per cent and Perth prices grew 0.1 per cent. Darwin surprised with a small 0.1 per cent jump in January but that is unlikely to be sustained as the market’s downturn continues though the year.

Longer term, Melbourne is leading the market recovery with prices up 8.2 per cent on an annualised basis. But Sydney is leading with quarterly gains, up 5.6 per cent in the three months to January.

A majority of capital city subregions were up the past 12 months, with top performers confined to Melbourne and Sydney.

Melbourne’s inner east continues to dominate annual price growth, up 16.2 per cent over the year to a median price of $1.179m. Now sitting just 2.9 per cent below its 2017 peak, the area is expected to set a new local record in the coming months. Sydney’s Baulkham Hills and Hawkesbury region and Inner West followed, up 13.5 per cent and 12.7 per cent respectively.

Realestate.com.au chief economist Nerida Conisbee said these high growth areas were proving popular with a large segment of buyers looking to upgrade from their current home to places close to transport hubs and amenity.

New data from the classifieds site shows Baulkham Hills in Sydney tops the list as most in demand by views per listing for upgrades, followed by the inner Melbourne suburbs of Hawthorn East, Blackburn and Malvern.

“They are family-friendly suburbs and the second is that they contain high proportions of big homes on big blocks. They all offer a high degree of amenity – decent public transport, good schools and solid retail precincts,” Ms Conisbee said.

“While Melbourne’s east dominates the list, the emergence of Northcote as one of the top family suburbs reflects the change in desirability of this suburb with families.”

Ms Conisbee said the Sydney Metro train line connecting the northwest corridor to the CBD is only going to push prices higher, labelling Baulkham Hills the “St Ives of the west”.

While regional markets were broadly up 0.4 per cent over the past 12 months to January, little over half of the 42 non-capital city subregions reported gains.

Tasmanian regional centres performed best, with the affordability appeal to interstate buyers driving prices between 6.5 per cent and 7.9 per cent higher. Lifestyle centres like Gold Coast and Sunshine Coast each grew around 3 per cent. Outback Queensland and regions across southern Western Australia continue to struggle through drought and weak economic conditions.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout