Home owners cop another hip-pocket hit

Mortgage holders have been dealt another blow to the hip pocket with an interest rate rise of 0.5 per cent on Tuesday, but two-thirds say they will be able to withstand the higher costs.

Mortgage holders have been dealt another blow to the hip pocket with an interest rate rise of 0.5 per cent on Tuesday, but two-thirds say they will be able to withstand the higher costs.

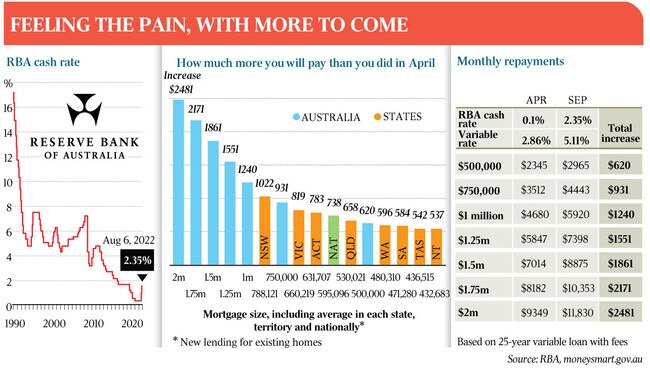

The Reserve Bank on Tuesday pulled the trigger on the fifth consecutive rise to the cash rate, bringing it to 2.35 per cent, adding $120 a month to the average mortgage.

A survey of homeowners by financial comparison site Canstar found 44 per cent did not expect the change to impact their financial position, while 13 per cent were borrowers who had enough savings in advance to cover increased loan repayments and could afford the higher repayments or are on fixed rates.

Around a quarter (24 per cent) said they would be doing it tough, with half of the group saying they would have to cut back on essentials to cover repayments.

Canstar finance expert Steve Mickenbecker said: “The blunt instrument of monetary policy has been even more dulled this tightening cycle and is spreading the burden unevenly, with already stressed borrowers again up for more pain while the majority are fearing nothing.”

Since May, monthly repayment costs on a $500,000 loan have risen $652 on average, by almost $1000 for a $750,000 mortgage and about $1305 for a $1,000,000 loan.

The fastest rise to the cash rate since 1994 has caused home prices to fall across the country, down 2.7 per cent nationally from the March peak.

PropTrack senior economist Eleanor Creagh said as borrowing capacities were constrained and buyers’ budgets shrank, the most expensive markets of Sydney and Melbourne would lead the price declines. “The good news for buyers is this spring is set to be much less competitive than last,” Ms Creagh said.

“There’s a lot more choice and less urgency, which could create opportunity for some.

“For sellers, though prices are dropping and properties are taking longer to sell, prices are still up on pre-pandemic levels and selling quicker than before the pandemic onset.”

In Brisbane – which has only recently passed the peak of the market – Kate Brady and Alex De la Flor are looking to upgrade from their worker’s cottage in the southside suburb of Bulimba despite the current rises. The young couple, both 30, feel comfortable with their current mortgage and look to their parents’ generation for guidance.

“My mum and dad were paying 17 per cent interest 40 years ago,” Ms Brady. “You just have to make it work. For us, we put our trust in our bank, mortgage broker and accountant.”

The couple’s agent, Courtney Caulfield of Place Kangaroo Point, said many buyers were making offers and transacting to upsize because they were having a baby or needed a bigger home, or downsize for a smaller mortgage or less space.

CoreLogic head of research Tim Lawless said it was reasonable to expect higher interest rates would flow through to less housing activity as borrowing capacity diminished and sentiment remained low, placing further downwards pressure on housing prices.

AMP chief economist Shane Oliver said he believed there was a strong case for the RBA to slow the pace of rises to assess the impact of credit-tightening measures. He stands by his prediction average home values will fall 15 to 20 per cent as a result of lower borrowing capacity and said it might happen earlier than previously expected.

The RBA believed inflation would find a peak towards the end of the year, which would in effect stabilise the cash rate, Mr Lawless said. This could potentially cause the central bank to retrace some of the hikes through the second half of next year or 2024. “As the cash rate finds a ceiling, that will probably be the cue for housing values to find a floor,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout