Home loan borrowers scrambling for better deals, ABS refinancing figures show

Australians refinanced a record $17.2bn in home loans in July, up 60pc, as borrowers sought lower rates in a hot property market.

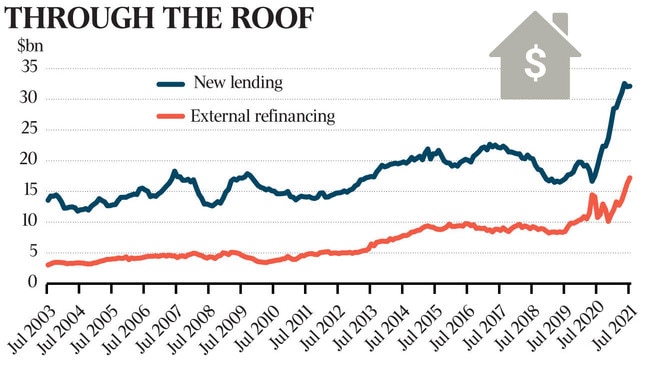

Australians refinanced a record $17.2bn in home loans in July, 60 per cent more than a year earlier, as borrowers shopped en masse for better deals and lower rates amid a hot property market.

Refinancing activity jumped 6 per cent in the month alone, the seasonally adjusted figures from the Australian Bureau of Statistics data show.

ABS head of finance and wealth Katherine Keenan said the spike in refinancing activity “reflected borrowers seeking out lower interest rates, particularly for fixed-rate loans, and cashback deals across a large number of major and non-major lenders”.

Close to half of all new home finance commitments were on a fixed rate – versus just 16 per cent two years earlier.

Total new lending commitments, excluding refinancing, peaked at $32.6bn in May, and have since stalled, totalling $32.1bn in July. That was still 68 per cent higher than a year earlier and than the levels immediately preceding the pandemic.

The current pace of new home borrowing far eclipses the previous peak of $22.7bn in March 2017 – according to ABS data going back 19 years – as property price growth and building approvals have also hit record levels over recent months.

Economists had expected the Greater Sydney lockdown would help drive a 3 per cent drop in new lending. Instead, excluding refinancing, total new mortgage commitments slipped only 0.2 per cent in July.

The value of new commitments to owner-occupiers was down 0.4 per cent to $22.8bn, while new lending to landlords climbed 1.8 per cent to $9.4bn, the latest ABS data shows.

New borrowing by investors continues to climb and has now doubled from a year earlier to approach the previous high of more than $10bn in April 2015.

As a share of total loan approvals, however, investor loans remained well below their long-run average at 29 per cent.

CBA senior economist Belinda Allen said “regulators will no doubt continue to watch these figures very closely, as well as the metrics around these loans”.

As investors chase a hot property market, high house prices – which jumped by 22 per cent over the year to August – are weighing on affordability, particularly for first-home buyers.

The ABS data shows that new lending to this group dropped 6.8 per cent to be down by a fifth since January – although commitments remained 20 per cent higher than a year earlier.

The average new home loan for an owner-occupier hit a new high of $593,600.

Ms Allen said: “Lending is a good leading indicator of dwelling prices about six months ahead.

“Recent trends in lending suggest dwelling prices will continue to rise this year, although we are expecting the monthly gains to slow.”

As mortgage holders refinance at a record level, Ernst & Young senior economist Johnathan McMenamin said lower mortgage costs would “support household disposable incomes and the future economic recovery post-lockdowns”.

“It remains important that the housing market remains strong while the rest of the economy hibernates in lockdown,” he said.

The average owner-occupier on a variable rate loan is paying 3.07 per cent, according to the Reserve Bank of Australia, but analysis by RateCity shows there are more than 180 home loan products on offer at rates of under 2 per cent.

RateCity research director Sally Tindall said: “If your mortgage rate starts with a ‘3’, it could be time to jump on the refinancing bandwagon or at least pick up the phone and haggle with your current lender.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout