Grocon rescue deal approved by creditors

The rescue plan put forward by Grocon scion Daniel Grollo has been accepted by creditors.

As Victoria slips into lockdown Melbourne construction scion Daniel Grollo has gained his freedom from the saga of the administration of his family’s construction empire.

Creditors voted on Thursday to accept the rescue plan proposed by Mr Grollo for the Grocon group of companies, but many were unhappy with the deal which they say leaves major businesses short-changed for the millions owed.

The outcome of the vote of creditors of 88 Grocon entities only came after a last minute sweetener by Mr Grollo secured the critical vote of the Tax Office.

The deal proposed by Mr Grollo sees him pour $13.2m into the pool of funds of the Grocon group, on top of other funds and assets of the business.

As part of the deal Mr Grollo will sell his sub-penthouse apartment in Melbourne’s Eureka tower. But finding a buyer of the luxury apartment, encumbered by a Bank of Queensland mortgage, may prove difficult as sources note its state is complicated by an unfinished $15m renovation.

The vote in favour of the rescue plan does not mark the end of the ordeal for Grocon or its creditors, with any potential payout hanging on a win in the courts against the NSW government.

The deed of company arrangement will pool a bevy of intercompany loans and promises to pay, upon success of a court battle with the NSW government, the remaining creditors.

Grocon has been claiming it was short-changed almost $270 million after a shock decision by the Barangaroo Delivery Authority that blocked tower sightlines to Sydney Harbour.

The court case between Grocon and Infrastructure NSW is ramping up, with a direction hearing due on July 16.

Mr Grollo has alleged the Barangaroo authority struck a secret deal with Crown and Lendlease that devalued its own development on the Sydney harbour front. Grocon has secured $7m in backing from a litigation funder for the fight.

The approval of the DOCA marks the nadir of the Grocon companies, which once built some of Melbourne’s most identifiable landmarks, including the Eureka and Rialto towers.

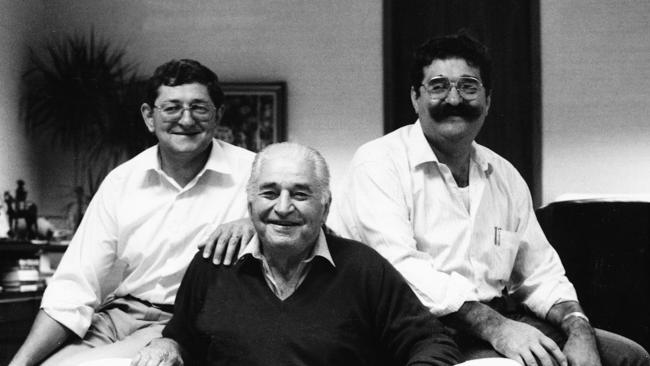

Thursday’s creditor call revealed the Grocon brand, started by Mr Grollo’s grandfather Luigi, was sold to entities controlled by the construction scion for the princely sum of $25,000.

The sale of the Grocon web domains and company intellectual property was brokered in a deal between KordaMentha administrators and Mr Grollo on Monday.

Not all Grocon group companies were placed into administration by Mr Grollo, but much of the business was caught up in the collapse. His new development business, Home BT also known as Grocon build-to-rent, has continued largely unfettered by the administration.

Work on six sites in Sydney and Melbourne controlled by the business, funded by Singapore sovereign wealth player GIC, has continued apace.

The administration process will see some funds reclaimed from the millions lent to the build-to-rent business, but others linked to the group were found to be unable to repay the millions lent to them.

Several creditors sounded off in the fiery meeting on Thursday, lobbing accusations at KordaMentha administrators that the process had been clouded by a lack of detail.

As part of the deal the ATO will walk away with at least $6m in an upfront payment on the $13.68m it is owed in unpaid GST.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout