GIC's Park Hyatt lures Chinese

FU Wah has made a $130 million-plus play for the Melbourne hotel.

SINGAPORE'S largest sovereign wealth fund, the Government Investment Corporation, is likely to be the next beneficiary of the wave of Chinese investment in Melbourne real estate, with one of its premier local assets catching the eye of a buyer out of China.

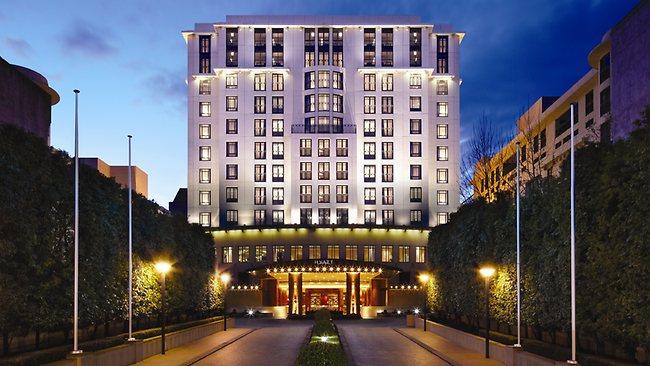

China's Fu Wah International Group has made a $130 million-plus play for the Park Hyatt Melbourne that GIC's real estate arm has been looking to offload, sources say.

GIC's real estate arm purchased the five-star hotel in 2003 for $125.7m from prolific Melbourne developer Lustig & Moar, which developed the hotel in 1999 at a cost of $150m.

GIC owns about $4 billion worth of real estate in Australia, including Chifley Tower and the Queen Victoria Building in Sydney. It also owns an 11.64 per cent stake in GPT Group valued at just under $750m. It did not respond to requests for comment.

The 240-room hotel is located between Parliament House and St Patricks Cathedral and consists of a 12-storey tower and two low-rise wings.

Established in 1988, Hong Kong-based Fuh Wah is focused on hotel investment and development. The company is controlled by Chinese self-made billionaire Chan Laiwa, one of China's richest women with a fortune estimated by Forbes at $US6bn ($6.4bn).

During the past 20 years, Fuh Wah has has developed more than 1.5 million square metres of commercial real estate in Beijing alone, including the domestically renowned private club Chang An Club and high-end commercial street Jinbao Street, which connects the core commercial area of Wangfujing and the CBD.

The Australian was unable to make contact with Fu Wah.

Fu Wah's interest follows hot on the heels of China's Greenland, which has already picked up two prime development sites surrounding Melbourne's Flemington Racecourse.

Another Chinese group, Far East Consortium, is building the 2500-apartment Upper West Side project in the CBD and has purchased the former Age site on Spencer Street for another six-tower residential project. China-backed Fifth Grange and AXF Group are also actively investing in Melbourne.

In Sydney, GIC has fielded approaches from Chinese developers on its 175 Liverpool Street tower. The tower includes 28 upper office levels with a net lettable area of about 46,320sq m.

It is also converting a mid-rise plant room into two more office floors.

While the building has some vacancy issues, GIC has said it does not see the tower as a development opportunity.

Instead, it is focused on leasing the asset and may entertain offers next year.