Get ready for Australia’s great home inheritance avalanche

It is only a matter of time before older Australians die off en masse and begin to bequeath their homes to their millennial children.

It is one of the most contentious demographic issues of our time. It is the seeming unfairness of the cost of housing today compared with a generation ago. “Home ownership back in the ’80s and ’90s was easy,” is the popular refrain.

Some say this is very much the case while others say that home ownership is a challenge for every generation.

Assuming that home ownership is indeed getting more difficult and especially in our biggest cities, then surely it is only a matter of time before older Australians die off en masse (to put it bluntly) and begin to bequeath their cheaply-bought but-now-expensive homes to their millennial children (born 1981-1999).

In which case, this prompts the question of precisely where are all these pre-eminently inheritable (and unencumbered) homes, and how long before these older homeowners, well, let’s just say, eternally vacate this space?

What we are dealing with here is nothing less than the great home inheritance avalanche which will surely gather momentum later this decade and peak in the early 2030s.

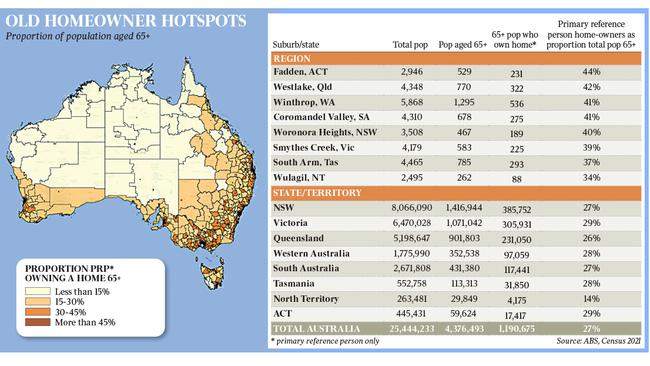

We can get some clues from 2021 Census as to where we might expect this “inheritance avalanche” to kick off. Together with data scientist Hari Hara Priya Kannan I have extracted home ownership data for all households headed (aka primary reference person or PRP) by persons aged 65+ and which includes many (but not all) baby boomers (born 1946-1963 inclusive) and older Australians (born up to 1945). There were 4.4 million people aged 65+ living in Australia according to the August 2021 Census, some 27 per cent (or 1.2 million) of whom headed a household where the home was owned either outright or with a mortgage. It is not unreasonable to assume that most of these properties would have been owned outright.

This is the pool of homes that, by dint of the owners’ advanced age, is imminently inheritable either in full or in part (via equity). So, where are the hot spots of these homes that will in due course either pass to the next generation or flood the market in such numbers in the 2030s that they may ”spot reduce” house prices?

This information might also be relevant to those selling reverse mortgages or indeed household maintenance services. Older homeowners comprise a cohort that will become increasingly engaged by the property market.

Interested (property) parties might also include developers looking to amalgamate suburban allotments for more intense (and efficient) housing developments.

We have calculated the proportion of households headed by a long-term resident (excludes visitors) aged 65+ in 2021 that is owned either outright or with a mortgage.

Across the entire 65+ cohort this proportion averages 27 per cent.

Home ownership rates typically peak in the 70s and then subsides.

This pattern is connected to concerns about diminished health and/or to the loss of a life partner, prompting alternative accommodation choices to be made. While this proportion averages 27 per cent for household-heads aged 65+ in Australia, in the Canberra suburb of Fadden (in Tuggeranong) it peaks at 44 per cent.

Fadden is ground zero for the older baby boomer homeowner genre in Australia.

By this measure – that is, continued home ownership later in life – Canberra does it better than other states. This is no doubt due to the high average income levels that prevail in this public-sector dominated city.

Other Australian suburbs comprising older homeowners effectively showcase a series of comfortable niches in out-of-the-way suburban places like Brisbane’s Westlake (near Jindalee) where 42 per cent of the population aged 65+ owns their own home.

Other states follow a similar theme with older-homeowner hot spots surfacing at Perth’s Winthrop, Adelaide’s Coromandel Valley, Sydney’s Woronora Heights, Ballarat’s Smythe’s Creek, Hobart’s South Arm and Darwin’s Wulagi. At the other end of the spectrum are communities (suburbs and towns) where the population aged 65+ is least likely to own a home that in due course might be transferred via inheritance to a younger generation or simply offered to the market.

The places least likely to support older homeowners comprise resources towns like Port Hedland where just 5 per cent of the household head population aged 65+ own a home. In the Pilbara’s Newman this proportion is 4 per cent. Across the whole of the Shire of East Pilbara this proportion is 2 per cent.

If there is to be an avalanche of baby-boomer-owned homes flooding the market later this decade or early next decade it will not have any alleviative impact on housing shortages in Australia’s resources towns.

Indeed, the great housing inheritance avalanche is more likely to emanate from and spill across middle suburbia, and especially in the “comfortable” suburbs of Canberra.

A generation of high average income levels for both males and females in Canberra delivers the security of home ownership later in life in the hotspot of Fadden but also in similar suburbs like Fraser (Belconnen), Macarthur (Fadden adjacent), Oxley (near Fadden) and O’Malley (Phillip).

The mapping of home ownership in the retirement years shows across Australia and throughout our largest cities that if there is to be an avalanche of inheritance, it is more likely to apply in middle- to outer-suburban areas.

Regional cities are also likely repositories of older homeowners who, later in life, will transfer wealth via equity to others. In places like Sydney’s well-to-do Bellevue Hill some 32 per cent of household heads (or PRPs) own their own home. But this proportion drops to just 31 per cent of households in Melbourne’s battler suburb of Melton West. Sydney’s Bellevue Hill (like Toorak in Melbourne) supports grand villas but also a large number of apartments that attract renters.

Remaining in, and retaining ownership of, the family home later in life isn’t solely determined by the need for (retirement) income. The decision to sell most likely results from consideration of the options.

Why sell and move from Bellevue Hill? Where could possibly be better? And what would be the purpose of selling and moving from Melton West? What are the options?

The great housing inheritance avalanche is thus quietly building in the suburbs and towns of Middle Australia, mostly. But also in places where the locals simply don’t see anywhere better. Today’s baby boomers are aged 60-77; mortality rates will quietly do their fatal work over the balance of this decade. The avalanche might well start later this decade as older boomers rethink their housing requirements once dad dies and mum can no longer maintain the family home. The biggest impact on supply and possibly house prices won’t be in places like Bellevue Hill and its counterparts in other cities. It’s more likely to be in the middle of middle suburbia in the suburbs preferred by the middle class in places like Canberra’s Fadden.

With older boomers now literally in their later good health years, it’s only a matter of time before families start having the kind of difficult conversations necessary to manage mum and dad, or maybe just mum, into more suitable accommodation.

This may well be a single difficult conversation to have but it will also trigger an unstoppable demographic avalanche that could well release much-needed family homes (inherited and otherwise) into the housing market over the coming decade.

Bernard Salt is founder of The Demographics Group; data by Hari Hara Priya Kannan