Fletcher Building floored by weaker housing outlook

The challenging residential market has been blamed for the embattled building company’s profit downgrade.

Embattled building materials group Fletcher Building has blamed the challenging residential market for a profit downgrade in the wake of plunging revenues.

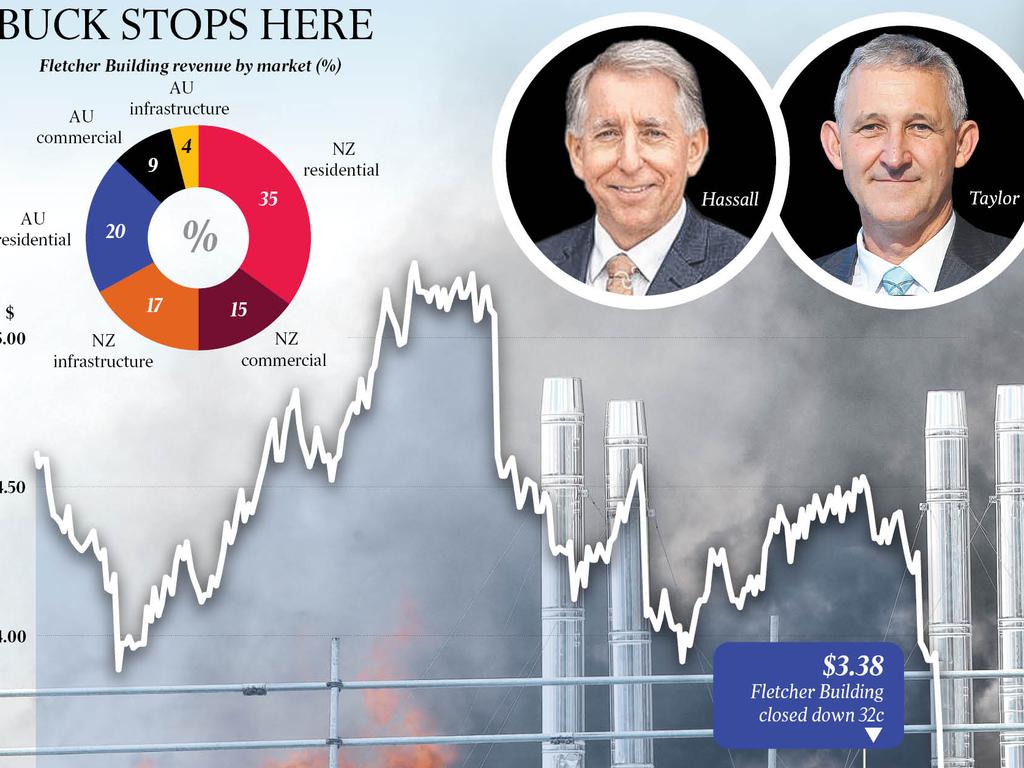

Shares in the troubled $2.5bn New Zealand-based diversified building company – which had a clean-out of top executives earlier this year – plunged after it revealed the slower housing market has affected its materials and distribution divisions, which had experienced “weaker revenues and gross margin pressure”.

On the ASX, dual-listed Fletcher shares plunged 10.9 per cent to close at $2.87. On the NZ bourse, the stock dropped 10 per cent to $NZ3.19.

A sharp correction in the Australian residential market led Fletcher to forecast a 10 per cent revenue decline in its Australian operations in the second half of the 2024 financial year compared to the three months to December 2023.

In New Zealand it has forecast a 5 per cent revenue decline over the same period.

The company said there had been a notable slowdown in house sales in the New Zealand market and an end to the house price momentum seen in the first half of FY24.

Fletcher’s guidance for full-year earnings before interest and tax was reduced from a range of $NZ540m ($492.3m) to $NZ640m to a range of $NZ500m to $NZ530m.

Fletcher said the variability within the range was driven by May and June being two of the biggest trading months of the year.

The company pointed to “a combination of weaker revenues and gross margin pressure in certain building products businesses, notably Iplex NZ and Steel, where end markets have been particularly soft”.

It told the ASX that conditions were expected to remain challenging in both New Zealand and Australia with the increase in price competition.

However, it said other divisions were performing solidly, with better margins in its concrete business and higher earnings in construction.

Acting Fletcher chief executive Nick Traber said given the current conditions, the company’s focus had been on managing operations within its control.

“In particular: customer service; costs and margins; cash flows; capital allocation; funding; and closing out the remaining legacy construction projects,” he said. “Fletcher Building has many strongly positioned core business assets that have demonstrated resilience in current market conditions.

“Our immediate priorities are to optimise the performance of each of our businesses, close out legacy issues and tightly manage risks to maximise our ability to deliver shareholder value.”

Fletcher’s new guidance includes $NZ10m to $NZ15m of restructuring costs. It also expects net debt of some $NZ1.9bn to $NZ2bn at the end of June.

The company has had a tough 12 months, posting a $NZ120m first-half loss and losing its chairman Bruce Hassall and chief executive Ross Taylor. Chief financial officer Bevan McKenzie also resigned in the aftermath of the shock result and will leave in October.

Backed by its largest shareholder, fund manager Allan Gray Australia, the company has plans to sell its underperforming Tradelink business.

It is also dealing with a shareholder class action as well as ongoing costs associated with the fire-affected New Zealand International Convention centre at Auckland.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout