First-time buyer race to secure deposits

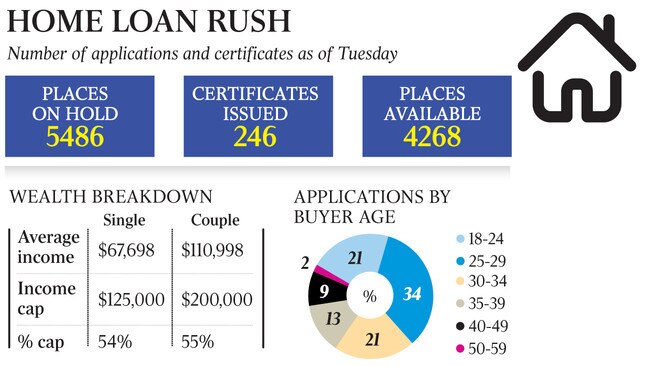

More than half of the government’s 10,000 first-home loan deposit spots have been taken up within a month of the scheme’s launch.

More than 5500 Australians have signed up to Scott Morrison’s First Home Loan Deposit Scheme in one month, exceeding half of the government’s 10,000 annual cap to support home buyers.

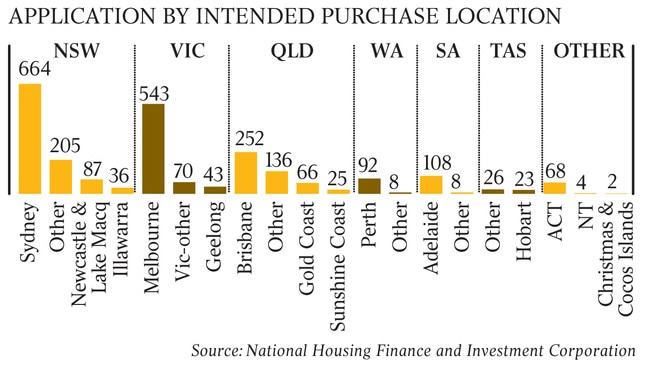

The first major update on the first-home buyers scheme, a key Coalition election pledge, reveals the greatest uptake has been in Sydney, Melbourne and Brisbane, with singles claiming up to 62 per cent of allocated places.

One-third of applicants were buyers aged 25 to 29, with the average income of prospective home buyers $67,698 for singles and $110,998 for couples.

Two major banks — Commonwealth Bank and National Australia Bank — have dominated the scheme’s lender market after kickstarting the scheme on January 1.

National Housing Finance and Investment Corporation data shows 5146 applications have been lodged through the major banks. Twenty-five non-major lenders, who entered the scheme on February 1, have already reported hundreds of applications.

More than half of applications were processed through bank branches, 20 per cent via brokers, 16 per cent by mobile lenders and 6 per cent over the phone.

Average purchase prices in Sydney and Brisbane came in at 82 per cent of the government’s price cap (the cap varies nationwide, from $300,000-$700,000, depending on region), with Melbourne at 79 per cent and Perth at 83 per cent.

Housing Minister Michael Sukkar said the scheme was making a “big impact” in the first- home buyers market, describing it as “another bright spot in a recovering property market”.

NHFIC data shows 70 per cent of successful applicants had bought houses, with 26 per cent buying apartments.

Mr Sukkar said he was pleased the average income of first-home buyers seeking the loans was “well below eligibility thresholds”.

“Buyers are also finding plenty of property options within the property price caps the government set in each region, and the scheme’s take-up is broadly consistent with population levels throughout the country,” he said.

Despite the high take-up, loan guarantees were still available and an additional 10,000 spots would be unlocked on July 1, he said.

“Buyers have 90 days from the securing of a guarantee reservation to settle on their property, so we will expect to see a further number of guarantees become available should buyers not move through to settlement,” he said.

Under the scheme, applicants are subject to eligibility criteria, including having taxable incomes up to $125,000 a year for singles and up to $200,000 for couples.

Caps are limited to under $700,000 and $600,000 in Sydney and Melbourne.

Mr Sukkar said adding 25 smaller lenders to the scheme, in addition to CBA and NAB, had been a “deliberate strategy to promote competition”. He said it was important the scheme had “broad geographic reach, including in regional and remote communities”, with applications received for properties in Geelong, Newcastle, Illawarra and the Gold Coast.

Under the scheme, first-home buyers apply for a guarantee and are provided with a reservation ahead of a 10-day period by banks to confirm eligibility.

Mr Sukkar said dwelling approvals data released this week showed positive growth through 2019 but more needed to be done to “get more supply in the market”.

Commonwealth Bank home buying executive general manager Jason Chan said the lender had been “overwhelmed by the response from first-home buyers”.

Reserve Bank governor Philip Lowe said this week there were “continuing signs of a pick-up in established housing markets”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout