‘Extra fuel on fire’ set WA unit prices surging: Paul Blackburne

The Perth property developer says market conditions are booming, pushing up apartment prices and rents.

Paul Blackburne will commence building one of the biggest residential apartment blocks in Australia this year, with the booming Western Australian economy pushing up house prices and rents to make Perth the hottest market in the country.

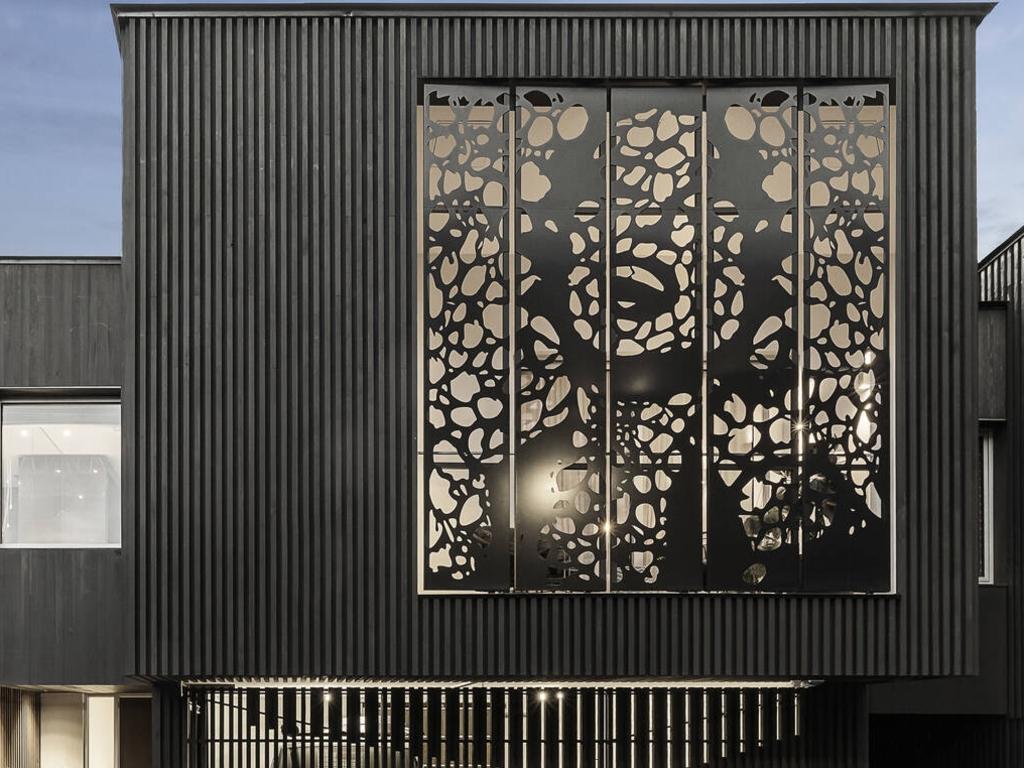

Mr Blackburne’s eponymous development company has clinched a deal for construction giant Multiplex to build its up-market $350m The Grove Residences in Perth’s Claremont, part of $1bn worth of projects it is undertaking in his hometown.

He says the buoyant local economy is pushing apartment prices and rents up, with Mr Blackburne forecasting prices to rise a whopping 20 per cent this year after rising 10 per cent since January 10.

“There is extra fuel on the fire in WA as the economy is booming, migration increasing and wealth expats returning home. There is a shortage of larger high-end apartments in the western suburbs. Locals want housing options and there are very few well priced high-end apartments options around. It’s an exciting time for WA and our company. ”

Blackburne Property Group has already sold $250m worth of apartments at The Grove, mostly in the $1.5m to $4m range and to wealthy local owner-occupiers for the site bordering up-market Peppermint Grove and Cottesloe in Perth’s western suburbs.

About 70 per cent of buyers are local owner occupier Baby Boomers, Mr Blackburne said, with about 10 per cent investors and the last 20 per cent a mix of young professionals and purchasers from the eastern states, continuing a trend of buyers flocking across the Nullabor that began with Covid-19.

The apartments are split across two residential towers, with tower one reaching 12 storeys and tower two having 16 levels. A separate podium apartment building will have four levels and contain commercial tenancies and common facilities.

The project also includes amenities such as a resort-style pool, sauna and spa, a golf simulator, residents lounge and co-working space, gym and yoga studio. The project’s penthouses include a bespoke $22.7m apartment with 1900sq m living space across two levels, a 600sq m balcony and 16-car private garage and private swimming pool.

Mr Blackburne told The Australian there are still far fewer apartment projects in Perth compared to other states, making the conditions ideal for developers now that the market has hotted up again.

“There has been and still is a significant undersupply of larger high end apartments in the western suburbs. We have now developed over $1bn worth of apartments there with The Grove being one of largest and fastest selling residential projects in the history of WA.

Meanwhile, the rental market is also booming. Blackburne Property Group manages about 1150 apartments on behalf of investors and rents have been pushed up 17 per cent already this year due to strong tenant demand.

“There are lines forming outside 15 minutes before the open times. Rental returns will be over 5 per cent, which means most are now positively geared.”

Mr Blackburne, a member of The List — Australia’s Richest 250, said the ideal trading conditions have attracted developers from the eastern states keen to gain a foothold in the strongest residential market in the country.

“As always happens, east coast developers are starting to look at sites here but it’s two years to get to market and they always miss the cycle. We always buy sites at a low when the market is dead and get ready for the next boom which happens here in a big way every five years or so.

“We purchased $85m worth of new development sites the past few years so we were ready with $1b in new stock for when the market heated up again.”

Given what is happening in Perth, Mr Blackburne said he keen to not fall in the same trap and head over east himself.

“We only want to start one to two projects a year and … have another $300m project launching next year. We want to keep small and targeted in what we do. We are very focused on sticking to our core business of large scale high end apartment projects in WA.

“We often get asked when we are expanding to the east coast however for now we plan to stick to what we are best at. Our competitive advantage is local knowledge, which we lose if we expand over east.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout