Empty towers: Nation’s office vacancy rate returns to 1990s levels

Office vacancy rates have hit levels not seen in almost 30 years as landlords deal with sluggish demand for space.

Office vacancy rates have soared to levels not seen since the mid-1990s as landlords confront a slow economy, sluggish demand for space and new towers hitting the market.

The nation’s office vacancy rate increased over the past six months from 14.1 per cent to 14.8 per cent. Most of the pain has been felt in suburban and fringe markets as overall vacancies hit the highest level since January 1995.

The pandemic’s legacy is having a greater effect on office markets than expected leaving demand for space soft and many large companies still allowing staff to work from home. As a result, few large leasing deals are being struck.

This has made getting the next wave of towers built tougher and some lower-grade offices face becoming obsolete as tenants exit.

The repeated rises in interest rates have also hit investment demand for large towers. Global institutions are cautious about the sector and a number of deals stalled last year as offshore investors pulled back.

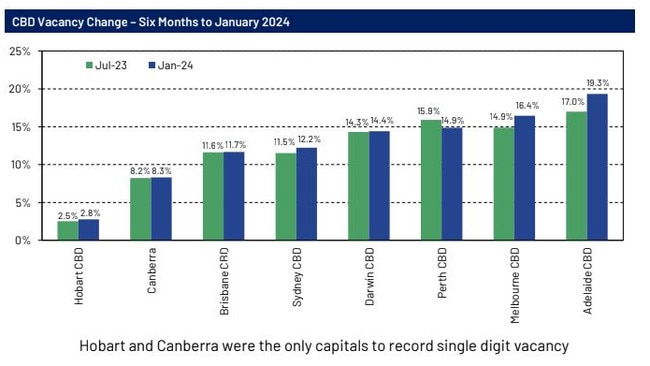

The January 2024 edition of the Property Council’s office market report showed overall CBD vacancies increased from 12.8 to 13.5 per cent nationally over the past six months, putting them at their highest level since mid-1996.

Non-CBD areas continued to rise – from 17.3 per cent to 17.9 per cent – making it the worst outcome since 1993 for those markets, effectively putting new projects on ice.

But there is some hope for landlords at the top end of the market as tenants make a “flight to quality”; the new data shows vacancy rates for prime office space is lower than those of older office stock in cities.

Sydney’s CBD office vacancy rate increased from 11.5 to 12.2 per cent, Adelaide from 17 to 19.3 per cent and Melbourne from 14.9 to 16.4 per cent.

Brisbane and Canberra’s vacancy rate was stable, rising slightly from 11.6 to 11.7 per cent and from 8.2 to 8.3 per cent, respectively. Hobart’s vacancy rate bumped up from 2.5 to 2.8 per cent and Darwin’s from 14.3 to 14.4 per cent. Perth’s vacancy rate dipped from 15.9 to 14.9 per cent.

Big listed landlords and the wholesale funds are taking some respite from the fact that the CBD prime vacancy rate across the country was 12.9 per cent compared with a vacancy rate of 14.5 per cent in the secondary market.

Property Council chief executive Mike Zorbas said despite a rise in vacancy rates after a period of strong supply, the outcomes vary across markets and office grades, with a continued preference for high-quality spaces.

“The increase in office supply during 2021 and 2022, far surpassing the historical norm, and continued business moves towards high-grade offices explains the results we are seeing,” Mr Zorbas said. “There is a clear divergence between older, low-quality stock and the new premium office buildings rejuvenating our cities.”

He noted that Perth, Brisbane and Canberra were around their historical average office supply levels over the past few years. But the two large capitals were dealing with more towers that started before the pandemic.

“Sydney and Melbourne continue to reflect differences in quality levels – following robust supply additions in recent years,” he said.

“Flight to quality aside, it is crucial for governments to champion the significance of our CBDs and the ecosystems of small businesses they support.”

The supply of new buildings continued to be a driving force behind the CBD vacancy level, with five of the past 10 reporting periods at higher than historic levels of supply, and the trend was expected to continue for now.

Landlords believe that top quality buildings will win out by getting the best tenants.

CBRE Advisory & Transaction Services senior managing director, Pacific, Tim Courtnall said that offices were showing resilience, with occupier confidence continuing to grow, a war for talent and the flight to quality trends driving demand for prime offices.

“We expect with financial market stability over the last six months and lower inflation forecasts, 2024 should be reasonably strong from a transactions point of view; however, we could see some unexpected headwinds in the second half of the year,” he said.

While Melbourne vacancy levels are high, JLL’s joint head of office leasing Victoria, James Palmer, said tenants were moving towards quality stock in prime locations.

“The narrative around the return to office remains at the forefront of occupier decision making, however, we are continuing to see a gradual yet steady increase in the number of employees making the return,” he said.

Colliers’ managing director office leasing Australia, Cameron Williams, said “green shoots” were emerging from large-sized occupiers and the number of inquiries received were increasing by 25 per cent.