Door left open for Ralan founder’s return

Creditors who put down deposits for collapsed developer Ralan’s Gold Coast towers have accepted a controversial plan.

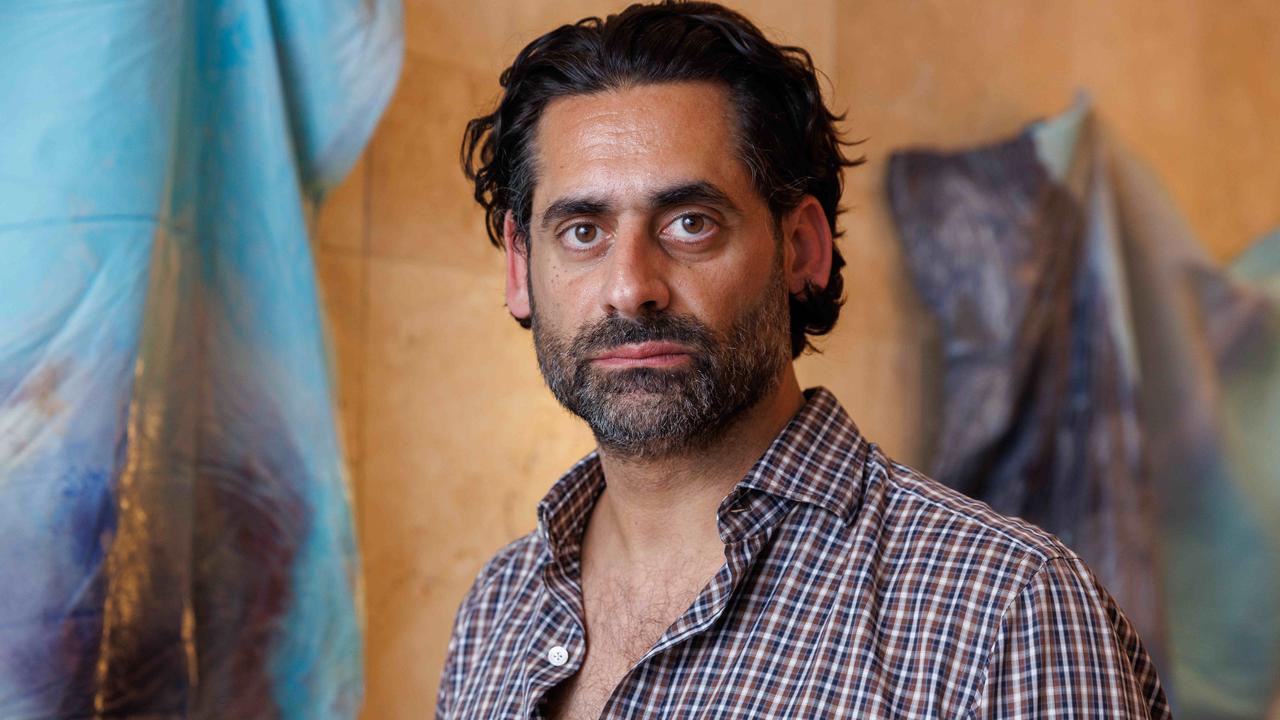

Creditors of collapsed apartment developer Ralan Group have voted to put a project in the Sydney suburb of Arncliffe into liquidation while those who put down deposits for its Gold Coast towers have accepted a controversial plan that will see company founder William O’Dwyer back in action.

The Arncliffe project is under the control of receivers Deloitte, who are completing the project, with only the company structure to be wound up, and most creditors were exposed to the unbuilt Gold Coast towers

After a fiery meeting last week at which Mr O’Dwyer came under verbal attack from some investors, creditors have voted to accept his ambitious deed of company arrangement.

Under the plan, Mr O’Dwyer and a yet-to-be-named developer will take control of seven separate Ralan companies involved with various Gold Coast apartment projects. The end game for them is to set up a new operation in Sydney that will market apartments to Ralan buyers at a discount from the unnamed developer — a stunning comeback from the development operation that collapsed in July owing about $550m.

Ralan’s voluntary administrator, Grant Thornton’s Said Jahani, who advised against adopting the DOCAs, said it had become abundantly clear during his investigation of the collapsed group that Ralan had been unable to pay its creditors for some time and most companies that are part of Ralan would be wound up.

“By liquidating the majority of companies in the group, we can attempt to recoup as much as possible for creditors — based on the potential actions available to a liquidator pursuant to the Corporations Act,” Mr Jahani said.

He said the onus would now be on Mr O’Dwyer to identify the mystery developer, the future development sites and details of the discount mechanics for creditors to consider in deciding whether to enter into new sales contracts for apartments.

The arrangement provides for a creditor who is owed $50,000 to purchase an apartment valued at $500,000 for $450,000.

Mr Jahani said the Australian Securities & Investments Commission had been presented with Grant Thornton’s full report and would assess the next steps “in terms of disciplinary action or charges related to the sole director, William O’Dwyer”.

Creditors at the meeting were incredulous that the deed for the Gold Coast entities had been accepted and called on the corporate regulator to intervene.

Suichun Lin of the Ralan Purchasers Alliance said she was looking at ways to overturn the deeds. Ms Lin had called on ASIC to attend the second creditors meeting held last week at which Mr O’Dwyer was heckled as he presented his plan. She said it had not responded.

“I’m very disappointed in ASIC,” Ms Lin said “We thought where is ASIC? Where is the law?”

Class action lawyer Matthew Bransgrove said Mr O’Dwyer had been allowed to put forward a DOCA that was “vague in the extreme” and required the creditors to trust him yet again.

“This was in circumstances where Grant Thornton reported that he was keeping falsified trust account records, an unlicensed debenture scheme and unlicensed managed investment scheme,” Mr Bransgrove said.

Mr O’Dwyer has denied any breaches and said the company’s report was only preliminary in nature. Those close to him said he had taken months to prepare the DOCA and was committed to its success.