Covid squeezes apartment pipeline as foreign investors stay home

Overseas residential property investment shrunk to the lowest levels in seven years through the pandemic.

Overseas residential property investment shrunk to the lowest levels in seven years through the pandemic, causing the supply pipeline of apartments to dwindle over the coming years.

Developers spent $4bn on residential sites across the country in 2020, according to international real estate firm Knight Frank Research’s latest Australian Residential Development Review. The change in spending represents a 19.6 per cent fall from the $5.03bn spend recorded in 2019 and a significant drop from the 2014 peak of $11.3bn.

The decline was severely impacted by low levels of offshore investment, which fell to less than $0.5bn.

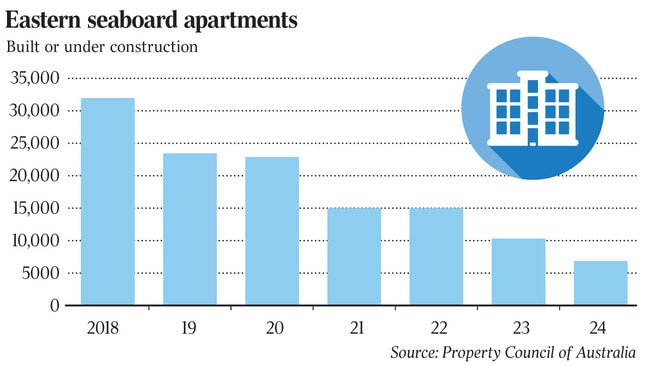

Concern is now mounting over forward work schedules. Just 86,400 new apartments are planned across Sydney, Melbourne, Brisbane, Gold Coast and Perth until 2024, a stark contrast to the 135,300 new apartments built in the three years prior.

Over the past 12 months, local developers have filled a majority of forward work schedules. Knight Frank’s head of residential Shayne Harris said the shift has seen a greater focus being placed on low-density sites, with the share of total sales for the product more than doubling to 23.1 per cent in the past five years and accounting for a fifth of all land sales last year.

“Developers across the country are continuing to shift their focus and risk towards boutique apartment developments and diversifying their portfolios with low-density sites,” Mr Harris said.

“Although we’re in uncertain times, we can’t underestimate the impact investors will have on the apartment market as they start to return across the country. It’s only time before they’re lured back to the new apartment market given the cheap finance, a thinning new supply pipeline and lowered residential vacancy rates.”

Almost half of all residential development sales in Australia last year were in NSW, followed by Victoria.

The Gold Coast and Perth bucked the trend of decline for high density development, with site sales in each city up 238 per cent and 10.7 per cent respectively. Brisbane high-density sites fell 86 per cent in 2020, causing the capital city’s pipeline to shrink to just 6,075 new apartments by 2024, down from 13,850 in 2018-2020.

In response to the looming apartment supply crunch, the Property Council of Australia has called for a co-ordinated state government approach to stimulate the sector, including a reduction in international investor surcharges and improvement in planning processes. Chief executive Ken Morrison said 30,000 jobs could be at risk across the country.

“Apartment construction is a critical component of Australia’s future housing supply and a vital job-creator for our economy,” Mr Morrison said.

“Without changes in policy, our apartment building industry will shed 30,000 direct jobs and produce $5.9bn less in housing assets over the next four years.”

“This is a wake-up call for governments as our biggest apartment markets will welcome growing numbers of people once Covid-19 safe immigration inevitably returns. International buyers and build to rent investors will be key to the next generation of projects and further opportunities exist to encourage these investors through planning system improvements and stamp duty relief.”

Knight Frank’s head of residential research Michelle Ciesielski said that while the pandemic has caused a widespread rise in prices, it has also solidified a new wave of buyer preferences.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout