Covid legacy breaks the mould as housing market shifts to urban fringe

A new dynamic could be in play as millennials scurry for the suburbs.

The ideal of buying a separate house on a separate block of land and commuting to the city centre underpinned the property market and operation of Australian cities.

However, coming out of the 1990s recession a new ideal, supported by a new generation of Xers (1965-1982) questioned, if not outright rejected, suburbia and instead embraced a new narrative based on living in a rented apartment in the inner city.

Members of this new generation increasingly spent a large part of their 20s studying or training, travelling, and trialling jobs as well as relationships, all of which required rented accommodation owned by investors.

These new behaviours impacted the property market: baby-boomer houses expanded a-la Packed to the Rafters (2008-2013), and Gen-Xers quickly snapped up (or more likely rented) apartments in Southbank, south Sydney and Fortitude Valley.

The McMansion, too, surfaced later in the long boom (1991-2020) and served the needs of those with few ties to the CBD.

Hype this up with seemingly endless studentification and skilled immigration programs, toss in a colonial penchant for incessant overseas travel, let all this simmer – unstirred – for a decade or two, and you have all the ingredients for a rising property market.

That is until the coming of the coronavirus.

The coronavirus has wrought the greatest social, cultural and lifestyle impact on the Australian people since World War II. It is global; it has critical mass; it will shape consumer behaviour directly for 2-3 years and then leave a legacy.

The pandemic poses strategic questions for boards and senior management teams (SMTs) in the property industry (and elsewhere) whose careers have been formed during a rising market. Indeed there are few people still in business today who were in a management position during the last recession.

The first question to be addressed involves response options to a serious further deterioration in relations with China. If your board and/or SMT hasn’t discussed this issue – and how various scenarios might affect the business – then raise it today.

The second question is also uncomfortable largely because it challenges an entrenched way of thinking. This is the idea that the housing market – and the shape of our cities – is shifting from medium- and high-density apartments in the inner city to low-density living on the edges of our capital cities.

There are other shifts such as the move to the regions but in this column the focus is the biggest residential markets impacting most Australians.

Property chief executives in their 40s and boards in their 50s and 60s have careers and reputations on the line when changing strategic direction.

Plus, the idea of adding yet more housing to the urban fringe will most likely raise the ire of the town-planning community.

The problem is that data confirming a directional shift is sketchy.

Net overseas migration to Australia stopped in March 2020, cutting off access to skilled and seasonal workers, backpackers, students and visitors. And it looks like it will be another year before these flows begin to recover.

This factor alone removes, say, 450,000 net additional homebuyers and/or apartment renters from the property market over the two years to June 2022.

And yet the property market is booming. Why?

Research group CoreLogic shows median house price growth of 19 per cent for Sydney and for Hobart for the year to June 2021. Median house prices in the public sector-dominated cities of Darwin and Canberra jumped 21 per cent over this period according to the same data source.

The median value of apartments jumped by 5 per cent for Sydney and 8 per cent for Canberra during this year.

Why are house prices going gangbusters and especially when access to skilled workers and foreign students has stopped?

The answer, my friends, isn’t so much blowing in the wind as it is Australia’s shifting demographic base.

A bucketload of baby-boomer children (aka the millennials 1983-2000) pushing from their mid- to-late-30s into their early-40s during the early 2020s lifts demand for a separate house on a separate block of land.

The millennial generation postponed commitment to home purchase throughout their 20s and 30s but now, in their late 30s, with a couple of kids in tow and the opportunity to work from home – plus access to crazy low interest rates – they have had a housing revelation.

The long boom underpinned by an expanding population base, making for comfortable decision-making by property’s senior management teams and boards, is over.

Market demand is now being driven by expat Aussies coming home, by baby boomers downshifting and/or buying lifestyle property in sea-change and tree-change locations, and by millennials changing their mind on the issue of home ownership.

The property market is a bit like a car switching to its reserve fuel tank of millennials. The best-case outlook is that today’s home-buying surge, soaking up pent-up demand by yesterday’s renting millennials, will bridge the closed-border gap until students and skilled immigrants return during FY2023. Consider the trajectory of housing preferences in Melbourne over 20 years. (This exercise can be repeated for any Australian city or region.)

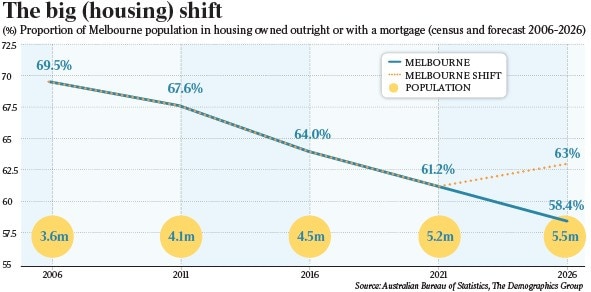

There is a question in the Census that tracks the number of Australians living in residential accommodation by property tenure. For example, in 2006 some 70 per cent of Melbourne’s 3.6 million residents (includes kids) were living in a property (house or apartment) that was either owned outright or with a mortgage (see graphic).

Five years later this proportion had fallen to 68 per cent but it applied to a bigger base of 4.1 million residents.

In 2016, this proportion had dropped further to 64 per cent but the city’s population had expanded to 4.5 million. The big shift away from home ownership and towards renting was disguised by Melbourne’s population growth.

We are now less than two weeks out from the 2021 Census where I think the on-trend proportion of Melburnians who live in an owned property would under normal circumstances fall to 61 per cent.

This is what I mean by a straight-line management regime: everything has been heading in the same direction for two or more decades.

The strategic question for the property industry right now is where these trends are headed in a post-Covid world.

Covid is a bit like a meteorite that has collided with Planet Melbourne’s housing preferences and is pushing it further towards suburbia. And if this theory is correct it will show up in the 2021 Census results.

Melbourne today has 5.2 million residents; by 2026 I think it will settle at 5.5 million.

If I am correct about this ‘big shift’ then by 2026 about 63 per cent of Melbourne’s population of 5.5 million (or 3.5 million) will live, or will want to live, in their own owned or mortgaged home.

If Covid is indeed just a blip and things return to normal, then perhaps just 58 per cent of the city’s population will be living in their own home. This would equate to 2.8 million residents.

The difference between these two trajectories is a population of 700,000 that shuffles from apartmentia to suburbia over the next five years.

And while the big shift towards suburbia is also expected in other capitals, it is Melbourne that is leading the trend.

The proportion living in an owned/mortgaged property in Melbourne dropped six percentage points between 2006 and 2016 which compares with lesser drops in other cities including Sydney down three percentage points, Brisbane down five, Adelaide down four and Perth down two. Melbourne was careening towards apartmentia faster than other capitals.

And then Covid hit.

It would be ideal to have data to confirm this theory now. But that’s kind of the job of chief executives and boards: to make strategic decisions with imperfect data.

This big-shift theory has town planning implications. More housing on the city edge is not the kind of thinking that would be well received by planners trying to contain urban growth, or with developers wedded to the idea of apartmentia forever.

So, the strategic question for boards and for senior management teams is twofold.

Do nothing and wait for confirmation about this big shift theory until Census results are published in November 2022.

Or buy into the argument that Covid combined with ageing millennials, low interest rates, and the option of working from home, have changed the market for housing which would require new business models and a change in city planning.

Either way I suspect this is going to be a hard call for many in the property industry to make, but ultimately the data will tell whether indeed Covid has caused a big shift in Australian housing preferences.

Bernard Salt is executive director of The Demographics Group; research and graphics by data scientist Hari Hara Priya Kannan

For the better part of 30 years the Australian housing market and the shape of Australian cities have been underpinned by drivers that are now being disrupted by the pandemic.