CBA chief Matt Comyn confident about house prices

Commonwealth Bank boss Matt Comyn doesn’t expect house prices to fall dramatically and confident about the economy.

Commonwealth Bank boss Matt Comyn doesn’t expect house prices to fall dramatically this year and has expressed confidence in the health of the economy and the availability of credit.

After handing down an interim profit of $4.77 billion for the nation’s biggest home lender, Mr Comyn tipped housing credit would probably slow as demand remained weak but house prices would not rapidly fall. “I certainly do not subscribe to the theory that there is going to be a rapid acceleration in downward pressure on house prices,” he said, noting that even with a decline in Sydney, house prices remained 60 per cent than higher five years ago.

“Going forward [housing credit] is very difficult to estimate of course. Our economist would say between 3.5 and 4.5 per cent credit growth — I would be at the lower end of that range.”

The latest Reserve Bank data showed tempering housing credit growth of 4.7 per cent through 2018.

The latest CoreLogic numbers highlighted an almost 7 per cent drop in house prices nationally across capital cities in the 12 months to January 31, with the biggest decline in Sydney at almost 10 per cent.

Still, Mr Comyn’s comments align with those of Reserve Bank governor Philip Lowe on an orderly correction in the housing market. Dr Lowe yesterday made his first speech of the year.

“Importantly, unlike most other housing price corrections, this one has not been associated with rising unemployment or higher interest rates,” Dr Lowe said.

“Instead, mainly structural factors, relating to the underlying balance of supply and demand, in our largest cities have been at work.”

Dr Lowe said the housing market was experiencing a “manageable adjustment” that was not expected to derail economic growth.

Mr Comyn said while borrowers were getting frustrated with the banking sector’s greater focus on expenses to approve loans and their “much more rigorous assessment”, credit availability remained steady.

“I don’t think that actually bears out in the context of less available credit,” he added, saying loan approval rates and average loan sizes at CBA were consistent with his view.

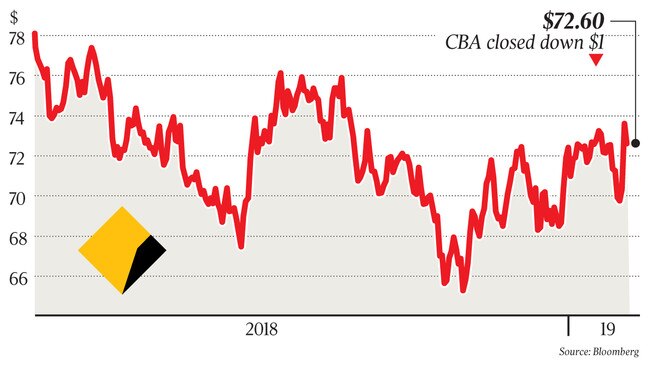

CBA yesterday reported a 2.1 per cent decline in cash profit for the six months ended December 31 to $4.77bn, as lending margins were hit by higher funding costs, fiercer competition for borrowers and customer switching from variable to fixed rate loans.

UBS analyst Jonathan Mott, who has reiterated warnings about a local credit squeeze, yesterday cautioned clients that CBA’s earnings momentum was slowing.

“The result was disappointing given the solid first quarter,” Mr Mott said. “Momentum appears to be slowing as the housing market rolls over.”

Home lending growth printed at 4 per cent and business lending at 5 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout