Buyer’s agents report a surge in clients looking for investment properties

With the recent stockmarket volatility, interest in property has spiked – with Melbourne back in focus.

Buyer’s agents are reporting a surge in clients looking for investment properties, with Melbourne real estate once again on the shopping list.

Real Estate Buyers Agents Association of Australia president Melinda Jennison says investor interest in property has notably heightened in response to recent sharemarket volatility and global economic uncertainty, as well as expectations that the Reserve Bank will cut interest rates further this year.

“Investors are clearly looking for secure asset classes, and property is something that a lot of people turn to at these times,” Jennison says.

While Perth, Adelaide and Brisbane properties have remained in strong demand with investors over the past 12 months, Jennison says buyer’s agents are seeing renewed interest in what Melbourne has to offer.

“Investors are moving back into the Melbourne market for the counter-cyclical opportunity because Melbourne has underperformed compared to many other capital city markets over recent years,” she says.

Specialising in helping buyers to find, evaluate and purchase property, buyer’s agents have become bigger players on the property stage in recent years as more people seek assistance with their property search.

Simon Cohen, founder of Australia’s largest buyer’s agent group, Cohen Handler, says his firm has seen “a big rise” in investment business this year as concern rises over sharemarket instability, with the strongest increase occurring in the $400,000-$1m property bracket.

“I think people have seen the capital growth in property over such a long time and they want to get into the market,” Cohen says.

Cohen, who oversees close to 70 buyer’s agents operating in eight offices across Australia, says investor interest is strongest in Perth, Canberra and Adelaide, although he’s also seeing more confidence in the Melbourne market. “There are some big results coming into Melbourne, and when that happens the market starts to increase so people want to get in,” he says.

While Victorian government changes to land tax thresholds put a dampener on Melbourne property investment over recent years, Matt Scafidi, the founder of Melbourne-based Abode Advocacy Group and REBAA’s Victorian representative, says the negative sentiment is now easing.

Scafidi says that his firm has seen “a massive spike” in the number of investor inquiries from Perth, Adelaide and Sydney in the first quarter of the year.

“Obviously, with Brisbane, Perth and Adelaide property doing so well some investors are thinking it’s too late to buy into those markets, so they’re now looking for the next growth area,” Scafidi says. “They think that’s Melbourne, and I would agree.”

With Melbourne median dwelling prices down 2.8 per cent in March 2025 compared to March 2024, Scafidi says the next quarter is the time to be buying.

“The sellers’ market will probably bounce back towards the back end of 2025,” he says.

In contrast to Melbourne, REBAA’s Jennison says Brisbane experienced an 8.6 per cent increase over the 12 months to the end of March 2025, while Adelaide was up 11 per cent and Perth rose 11.9 per cent. Sydney’s dwelling prices rose by just 0.9 per cent over the same period.

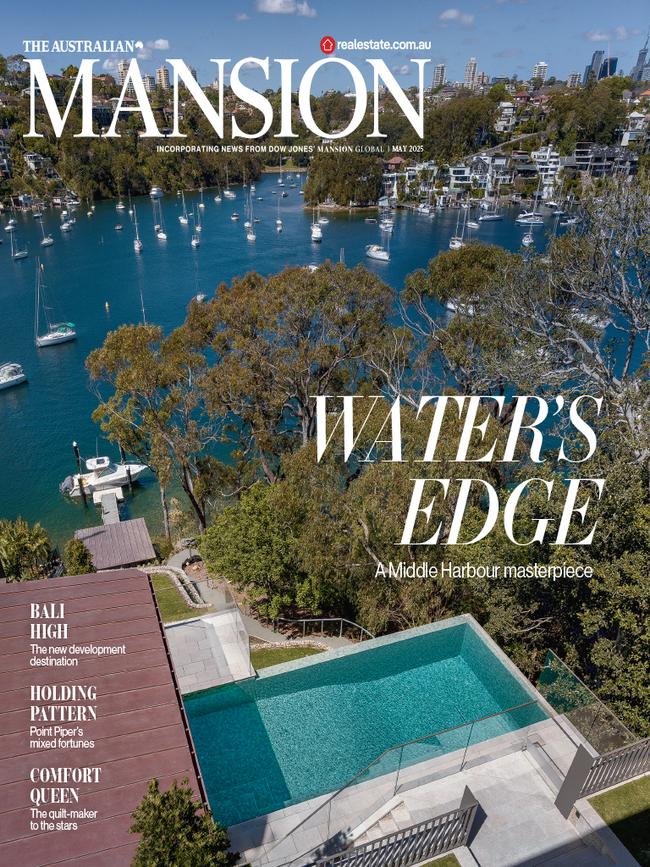

Don’t miss your copy of the May issue of Mansion magazine inside The Australian on Friday, May 30

The stellar results in Brisbane, Adelaide and Perth continue to reflect low stock levels as well as affordability, according to Jennison, who says the latest lending data also underlines the role investors play in the three high-growth markets.

In the December 2024 quarter, property investors accounted for 35.7 per cent of lending in Western Australia, 38.6 per cent in South Australia and 37.9 per cen t in Queensland – all tracking well above the 10-year average. In all other states except NSW, investor lending was on par or below the 10-year average.

Economic conditions aside, Jennison says investor interest in property is also being fuelled by an “influx” of new buyer’s agents drawing on artificial intelligence and property data to provide advice on investment properties across multiple geographical areas.

But she says that while this emerging tier of “borderless” data-driven agents can open new opportunities for investors, it is important for consumers to recognise that local market knowledge remains critical to making well-informed property decisions.

“Property investment success often relies on understanding nuanced factors that raw data alone cannot reveal,” she says.

Cohen agrees. “You can’t just buy off data,” he says. “You’ve got to understand what are the good streets, what are the good neighbourhoods, why one place gets more money than the next place. A lot of these [data-driven buyer’s agents] claim to give a value proposition but they don’t have the credibility or experience to do it.”

This story is from the May issue of Mansion magazine, out on Friday, May 30.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout