Boomers or Generation-Z: who paid top price for houses?

Who had it worse: millennials and Gen-Zs with the eye-watering cost of buying a first home, or Gen-X and baby boomers who had to pay mortgage rates of up to 17.5 per cent?

If you want to start a fight around a dinner table, just ask who had it worse: millennials and Gen-Zs confronting the eye-watering cost of buying a first home, or their Gen-X and baby boomer parents who had to pay mortgage rates of up to 17.5 per cent?

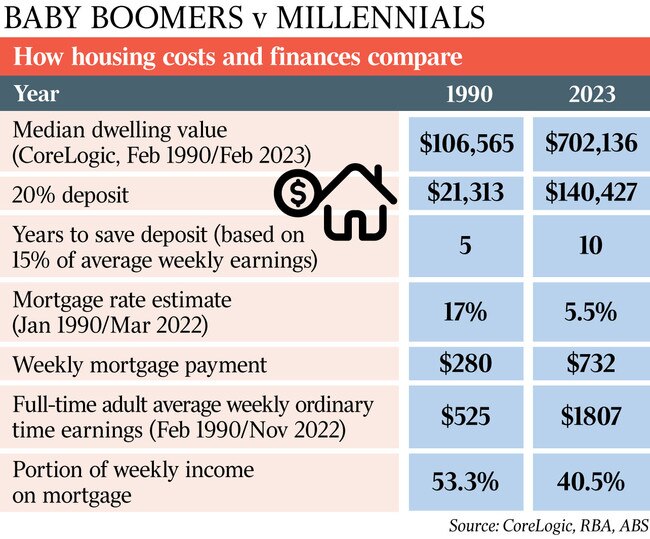

The bad news for Australians born after 1981 is they are paying 6½ times more for a house than their parents did at the height of the last recession three decades ago, and taking out a loan that’s 6½ times bigger for a median-priced property.

The good news is that average annual earnings for adults working full-time over the past three decades has more than tripled from $27,300 in 1990 to $93,964, meaning the average mortgage eats up less of the pay packet.

The younger generations can expect to devote 40.5 per cent of their income to paying off a house – assuming they can find one in their price range – against the 53.3 per cent share their parents absorbed, according to numbers crunched for The Weekend Australian by property data service CoreLogic.

AMP Capital chief economist Shane Oliver said servicing a mortgage at current retail interest rates of 5.5 to 6 per cent is every bit as painful as what it was to pay a sky-high 1990 interest rate because of the amounts people now borrow.

In the past 30 years, the median mortgage has increased from $85,252 to $561,709.

“It’s way too simplistic for baby boomers to say to their children or grandchildren, ‘well, you’ve got nothing to worry about; mortgage rates today are a fraction of what we paid,’ ” Dr Oliver said. “The reason that is incorrect is because anyone who is buying into the property market today has a much higher debt burden relative to their income.”

Just ask the Sitaramayya household in Kellyville in northwest Sydney. Alicia Sitaramayya and partner Latrell Harvey, aged 24 and 26 respectively, are resigned to paying up to $1m to buy their first home. They have trimmed spending and moved in with her parents, Arthur and Jane, to save for a deposit.

Alicia, an executive assistant, is in no doubt which of the two couples faced the biggest challenge to break into the property market.

“It’s different now because of the cost of living, interest rates and property prices in Sydney,” the young woman said.

Her father agreed. Mr Sitaramayya, a 53-year-old IT worker, bought his first home in 1990 for $130,000 – with a mortgage rate of 21 per cent with Westpac.

Despite this, he said the great Australian dream of home ownership was still achievable. “It’s almost becoming unreachable now,” he sighed.

Based on the market standard of 20 per cent down, CoreLogic estimated that a wage-earner putting away 15 per cent of their income would take 10 years to accumulate a home deposit, against five years in 1990.

That’s because house price growth has been much higher than income growth in recent times, said the company’s head of research, Eliza Owen.

“Debt-to-income levels are so much higher than they were back in the ’90s,” Ms Owen said.

“Now, on top of all of that, increasing interest rates are compounding the challenges for a younger generation. Other factors, such as the rising rent market which, on top of everything else, is making it harder for people to accumulate a deposit.”

Generational finger-pointing over housing prices became the new Australian obsession after millennials and Gen-Zs were left behind by a national 40 per cent surge in homes prices over the course of the pandemic. Being told to cut down on avocado consumption is no consolation.

But the baby boomers’ protestations about the burden they shouldered in the late ’80s and ’90s are overblown and “purely psychological”, said Simon Kuestenmacher, director of The Demographics Group.

“We have this generational clash that is the first in Australia,” he said. “The millennial generation now falls behind their parents in certain ways. This is where this intergenerational envy from the bottom towards the older generation starts.”

While Mr Kuestenmacher calls them the “experience generation”, Sydney-based broker Chantelle Rangel, of Mortgage Choice Marrickville, said young people were not bogging themselves down in non-essential debt.

“Their expenses are a little bit high because they’re eating out and doing all those sorts of things,” Ms Rangel said.

“But, in terms of actual debt – such as credit cards, shopping, car loans – I’m not seeing that much of it.”

According to banking regulator APRA, through the final days of the pandemic boom, almost a quarter of new loans written were at debt levels six times higher than income.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout