Aussie home market worth more than $8 trillion: ABS

Australians’ homes are now collectively worth more than $8 trillion, a new milestone achieved amid a Covid property boom.

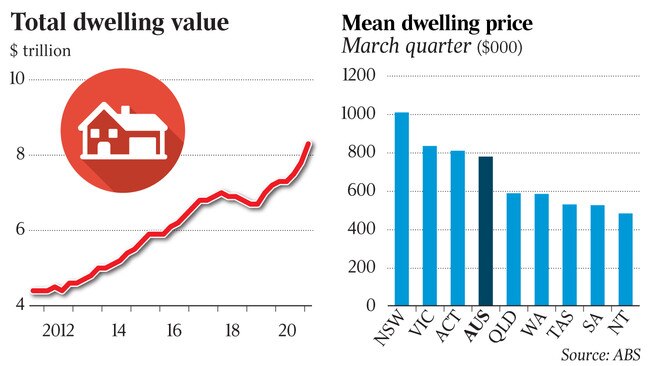

Australians’ homes are now collectively worth more than $8 trillion, a new milestone achieved amid a Covid-19 property boom that also pushed average dwelling prices in NSW above $1m for the first time.

Figures from the Australian Bureau of Statistics showed the value of the country’s 10.6 million dwellings increased by $450bn to $8.3 trillion in the March quarter – the largest jump in a series stretching back nearly a decade.

Residential property prices jumped 5.4 per cent in the quarter – the biggest rise since late 2009. The gains were concentrated in houses, which surged 6.4 per cent – the strongest quarterly gain in at least 19 years, the ABS said – while apartment prices lifted by a more sedate 2.7 per cent.

National home values on average climbed $39,100 to a new high of $779,000, and in NSW to $1.01m – the first time the average dwelling price has breached $1m in a state or territory.

Victoria recorded the next highest average property price at $834,600, followed by $809,600 in the ACT. The Northern Territory recorded the lowest average home price, recorded at $480,400.

Property prices were up 7.5 per cent over the year to March, led by gains of more than 10 per cent in Canberra and Hobart, followed by a 9 per cent lift in Perth.

AMP Capital chief economist Shane Oliver said for the two thirds of Australian adults who were homeowners, climbing property wealth was a good thing.

“From the point of view of economic recovery, rising wealth is better than falling wealth, and that is what the RBA and government has sought to engender – they didn’t want falling house prices that would weigh on consumer spending and jobs,” Dr Oliver said.

“In that sense they got what the wanted.”

ABS head of prices statistics Michelle Marquardt said the quarterly results “were consistent with housing market conditions”.

“Strong demand for housing was supported by record low interest rates, government initiatives, and rising consumer confidence,” Ms Marquardt said, with prices climbing “in all segments”.

Minutes from the most recent Reserve Bank board meeting show the central bank remains committed to keeping rates pinned to 0.1 per cent until 2024 “at the earliest”, despite members noting that the economy was “transitioning from recovery to expansion with more momentum than previously anticipated”.

RBA officials have made it clear they see no evidence of slipping lending standards, although the minutes showed board members were “carefully monitoring trends in borrowing”.

ABS data released last week revealed monthly new mortgage lending boomed to a record $31bn in April, or 55 per cent above pre-pandemic levels as homebuyers rushed to take advantage of cheap money and get in ahead of a runaway property market. Average new home loan sizes reached an historic $563,550.

Dr Oliver said the new high-water marks for the property market came with affordability issues for new buyers and presented issues of intergenerational fairness. He said climbing debt levels could pose financial stability risks should rates or unemployment climb unexpectedly.

The $8.3 trillion in housing assets compares to the $3.1 trillion in accrued retirement savings, and the $2.4 trillion market capitalisation of the Australian stock market, as measured by the broadest All Ordinaries index on March 31.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout