ARA launches new Weiss bid for Cromwell board amid takeover

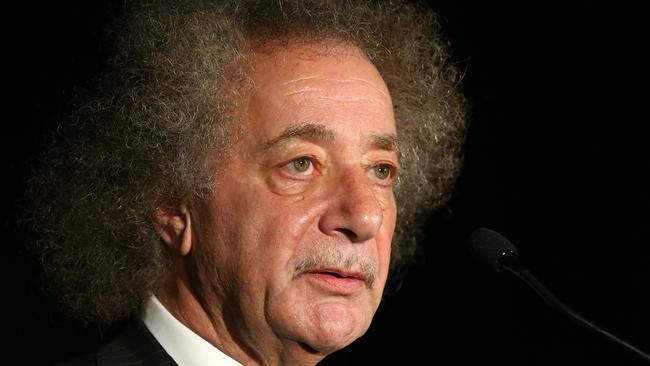

Cromwell Property Group is again under assault from major shareholder ARA Asset Management which is still pushing for corporate raider Dr Gary Weiss to be elected to the target’s board.

The battle for Cromwell Property Group is again heating up, with Singapore’s ARA Asset Management lodging its $518m proportional takeover offer for Cromwell and saying it will call a meeting to appoint corporate raider Dr Gary Weiss and Melbourne funds manager Joe Gersh to the target’s board.

The fight for control of the $2.8bn company, which has property across Australia and Europe, has rolled on for more than a year since relations between Cromwell and major shareholder ARA soured.

In the latest salvo by ARA, it attacked Cromwell’s planned foray into the new field of data centres, where it struck up a partnership with Stratus Data Centres to set up a new data centre fund holding up to $US1bn ($1.42bn) in assets.

Cromwell sees its core business in setting up new funds but ARA criticised its investment record as it continues to advance its takeover bid.

ARA said last month it would make a proportional off market takeover bid that could see it end up with a stake of about 49 per cent. But the offer price is just 88.125c, below analyst estimates, and has been rejected by Cromwell, which told investors to take no action.

On Tuesday evening Cromwell reiterated that view, saying the draft bidders statement contains misleading statements and material omissions, particularly in relation to ARA’s intentions for the future of the business.

It was “cleverly timed to exploit current market dislocation,” Cromwell said.

ARA has twice lost votes to appoint Dr Weiss to the board but has bumped up its stake to 24.07 per cent and also has had the backing of the Tang family, another large investor, for board change.

ARA said Dr Weiss and Mr Gersh were highly regarded in the commercial world and had the necessary skills to help address the concerns ARA had with respect to the manner in which Cromwell is being managed.

ARA Group chief executive John Lim said “there is a groundswell of rising support among a broad range of Cromwell security holders for desperately-needed change to deliver improved governance and performance”.

“This is a company showing signs of becoming directionless under an erratic strategy that is creating unacceptable risks for all security holders,” he said.

In a nod to Dr Weiss’s approach, ARA said it was critical the Cromwell board was refreshed and a strategic review process was overseen by a board with a proprietorial focus.

ARA again attacked Cromwell’s $1bn investment in a portfolio of shopping centres in Poland, calling on it to release the key assumptions that underpinned its draft property revaluations, including changes in market rental assumptions as well as capitalisation rates.

Rent collections were sitting at a run rate of just 57 per cent of total billings according to Cromwell’s June business update.

Mr Lim said evaluations put forward by Cromwell bore little resemblance to its rivals, especially those with exposure to the European and Polish retail sectors.

“When considered against the backdrop of the appalling track record that Cromwell has had in Europe, there are genuine reasons for concern among all its security holders,” he said.

Analysts have suggested Cromwell may need to raise up to $600m and Mr Lim said the company‘s balance sheet was stressed and that a capital raising was “inevitable”.

Moelis Australia and Credit Suisse are acting as financial advisers to ARA.

Cromwell’s legal adviser is MinterEllison and its financial advisers are Goldman Sachs and UBS.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout