$200m restaurant development near Queenstown is raising residential prices

A luxury development in New Zealand’s south island is stimulating sluggish real estate prices as interest rates start to drop in the so-called land of the long white cloud.

A luxury restaurant and bar development costing around $200m to develop near Arrowtown and Queenstown on New Zealand’s south island is stimulating sluggish real estate prices as interest rates start to drop in the so-called land of the long white cloud.

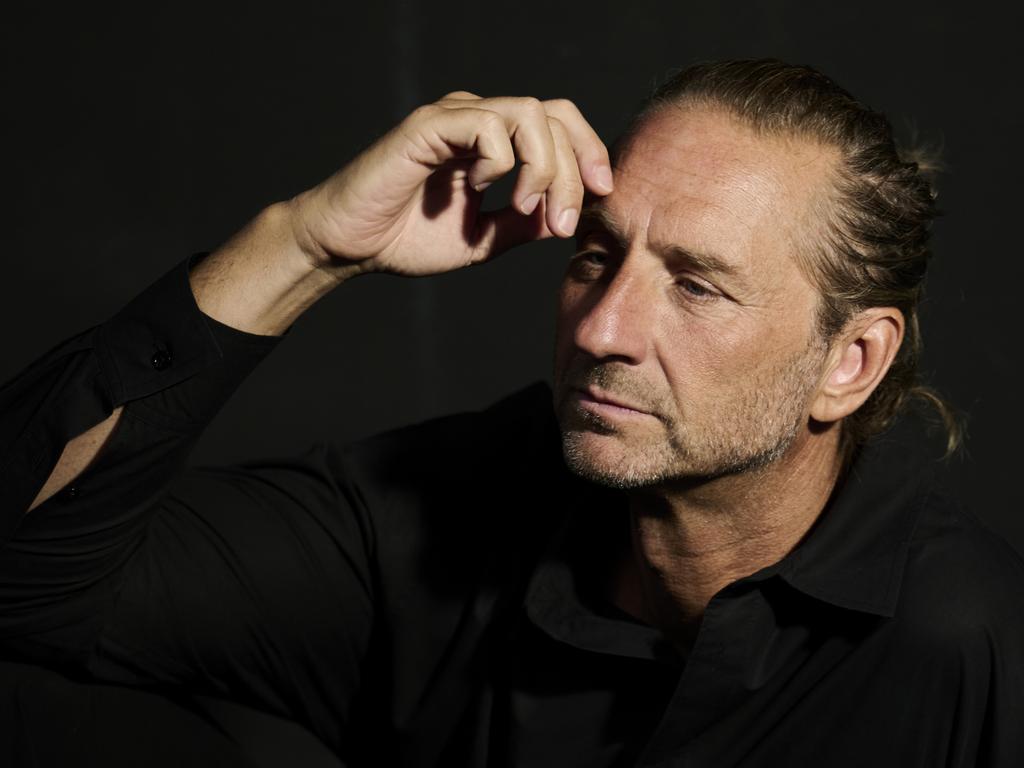

Local residents reckon the just opened Ayrburn, the hospitality brainchild of property multi-millionaire Chris Meehan, on the outskirts of New Zealand’s chocolate box township of Arrowtown, has boosted their house prices by hundreds of thousands of dollars.

Initially Mr Meehan, who founded Australia’s Belle Property Group, copped flak with his plan to convert a sprawling 160-year-old sheep farm into a bar, restaurant, upmarket boutique hotel and retirement living precinct, in the foothills of The Remarkables.

Now locals, no doubt cognisant of New Zealand’s slowing economy, thank him for building the development on one of the South Island’s oldest sheep farms into an extravaganza rivalling anything Australia’s hospitality tsar Justin Hemmes has ever dished up. They reckon Ayrburn will draw in local and international tourists, support local farmers and suppliers, and employ hundreds of locals.

“As a local living in Arrowtown, he (Mr Meehan) has probably lifted the value of our houses by $100k. What he has done is a gift to the community not only to enjoy but in economic terms. He’s been very mindful of having something to offer everyone,” said one local.

Luxury Real Estate New Zealand agent Nick Horton admits NZ’s real estate market was slower last year, but in the first quarter of this year it has picked up due to several banks dropping interest rates.

“The market was slower because we were in an election year in 2023 and because interest rates were rising, but they have just announced cash rates are staying the same,” Mr Horton says.

“Some banks are already dropping interest rates, and we have seen an increase in interest in the first quarter from purchasers,” he said.

He said locals had welcomed Ayrburn because it raised the bar of hospitality offerings in Queenstown.

“It will trigger existing hospitality to lift their game. It will raise the appeal of Queenstown to sophisticated travellers, particularly out of Australia, which in turn will create a strong market for luxury homes,” Mr Horton said.

Close to Ayrburn he is marketing the seven-bedroom 59 Mountain View Road, Queenstown which has a bank valuation of NZ$7.1m.

Like Ayrburn, the property has views of the Remarkables to the south and Coronet Peak to the north, with the main residence constructed of cedar and schist with large windows that frame the enticing panoramic outlooks. The property also features a two bedroom guest cottage with kitchen, bar and wood burner as well as a separate entrance. A terracotta brick courtyard to the north of the cottage looks out over the tennis court and a row of willow trees.

At Lake Hayes, Mr Horton is expecting more than NZ$6m for the three-bedroom Marshall Cottage, fronting 2 Marshall Ave. The 1.36 hectare lakefront landholding features a heritage property dating back to the 1860s.

An iconic property at the western end of Lake Hayes, the two-storey stone cottage was constructed circa 1865 during the gold rush era and has been updated since. Encircled by mature gardens, the cottage is five minutes’ drive to Arrowtown.

The location takes advantage of the lake and mountain panoramas and surrounding countryside, with the site adjacent to a 8km lakeside walking/cycling track which forms part of the Te Araroa trail.

According to Mr Horton, the opportunity exists to take the property to the next level through additional development, and potentially subdivision (subject to approval). Resource consent has been granted (and stage 1 enacted) for plans for an 660 sq m footprint (972 sq m building). The concept plans are designed to be sympathetic to the site’s heritage yet with modern comfort a priority.

At Ayrburn five venues opened last December and there’s another six to come plus the luxury retirement village called Northbrook. Even though the minimum age to buy into the 196 apartments being developed along a creek at Ayrburn is 70 years and the minimum entry cost is NZ$1.98m rising to NZ$7m to $8m, much younger buyers are expected to be clamouring to purchase once they see the display suite.

“I am pitching the BMW of retirement living,” Mr Meehan says, adding that the apartments will have full medical facilities. “The pitch is they are for people who like living in five-star hotels with their mates. We will run these retirement villages like a hotel.”

The apartments will overlook Mill Creek, a skilfully diverted trout-filled stream running from a waterfall at the very back of the property into the village-like Ayrburn with its bars, gelaterias and dining venues.

The sale of the retirement apartments by Meehan’s Winton group will help fund Ayrburn.

Winton was listed on the Australian and New Zealand stock exchanges in 2021 and has 26 projects on the go, mainly in New Zealand.

Meehan founded Australia’s Belle Property Group, a real estate franchise which he subsequently sold to private equity in 2009, most of the 26 projects are residential subdivisions in New Zealand, centred around Auckland. Just one of Mr Meehan’s projects is in the NSW wine township of Cessnock.

The writer was a guest of Ayrburn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout