Profit dives as AMP bleeds cash

New AMP CEO Francesco De Ferrari yesterday labelled 2019 as a year of structural transformation at the beleaguered group.

New AMP chief executive Francesco De Ferrari yesterday labelled 2019 as a year of “structural transformation” at the beleaguered wealth group, as it looks to stem massive fund outflows, repay customers for misdeeds and reshape its adviser business.

Handing down his first set of profit results at the 170-year-old company, Mr De Ferrari pointed to significant changes ahead at AMP but didn’t provide enough assurances to ease investor angst over the challenges ahead.

“My experience, from having seen this in other markets, is that actually more vertically integrated players in the end get the better customer outcomes,” he told The Australian of his plans to simplify and potentially cut the size of its 2567-strong adviser network.

“You do that effectively by keeping the client at the centre of everything we do and making sure we have robust systems to manage conflicts.”

After investors and analysts questioned how he would improve on two decades of underperformance at AMP since its ASX listing, he suggested a broader overhaul of the company was on the way. “AMP is still a mutual in its DNA … there is an opportunity to become more of a capital-lite performance-based organisation,” he said.

“This is a clean break. We have very important immediate priorities to deliver in 2019.

“These are all mission-critical.”

AMP posted a 97 per cent slump in net profit to $28 million for the 12 months ended December 31, down from $848m in 2017. That was slightly lower than the $30 million AMP said it would deliver last month.

The superannuation and investments division — Australian wealth management — endured mammoth net cash outflows of almost $4 billion in 2018, as the royal commission took a toll and spurred customers to shift, often to industry funds, and AMP paid out regular money to retirees.

That result compared to $931m of net cash inflows the prior year.

The fact net outflows in the fourth quarter amounted to $1.6bn, and that Mr De Ferrari doesn’t see that slowing in the first three months of 2019, unnerved investors, along with a rebasing of earnings that doesn’t bode well for this year.

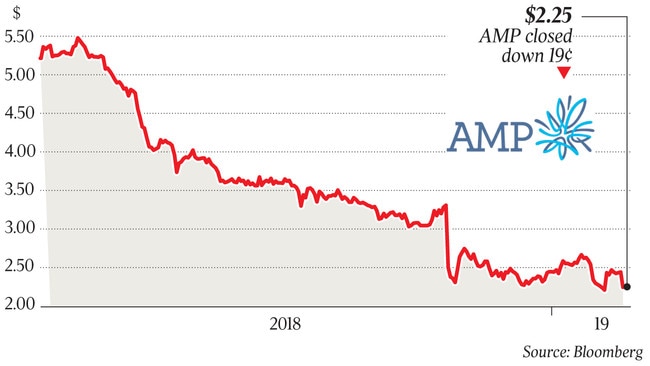

AMP shares sank 7.8 per cent yesterday to $2.25, not far off intraday record lows of $2.15.

“The proforma profits were lower than we expected,” Allan Gray investment chief Simon Mawhinney said. “There were quite a bit of additional costs.”

Mr Mawhinney said while AMP outlined good priorities for this year to repair its brand, the outlook was clouded by weaker prospects for wealth management and AMP Bank.

AMP agreed to divest its life insurance operations to Resolution Life for $3.3bn in a controversial deal last year that is yet to complete. That divestment means the company is left with three units: wealth management, the banking unit and infrastructure and real assets arm AMP Capital.

Mr De Ferrari said he would not provide a three-year plan for the company until it had completed its life insurance sale and had more legislative certainty on the Hayne royal commission’s recommendations.

“We need more legislative certainty. We also need to complete the (life insurance) separation transaction which is critical for capital optimisation,” he said.

“It doesn’t mean that we are not going to do anything until the final legislation comes out — we are outlining a whole series of actions that we are already taking because they make sense for clients.”

Those actions don’t, however, include a near-term plan to stop grandfathered commissions being paid to financial advisers.

AMP said advice remediation and related costs — stemming from various scandals and charging fees where services weren’t provided — came in at $469m for 2018. There were additional royal commission expenses and costs from the strategic review of its assets.

AMP’s sold business units delivered negative operating earnings of $3m for 2018, compared to a positive result of $331m in the previous year. The wealth management division saw operating earnings decline 7 per cent as margins came under pressure, investment markets were softer and fund outflows continued.

AMP Capital was a bright spot delivering a lift in operating earnings to $167m, underpinned by higher fee income and growth in assets under management.

The banking unit posted a 5.7 per cent rise in earnings, helped by mortgage growth.

Merlon Capital’s Hamish Carlisle, a staunch critic of AMP’s life divestment, said AMP’s new boss had correctly identified growth areas including AMP Capital and the bank.

But Shaw and Partners analyst Brett Le Mesurier said: “Most of the important numbers indicate the future performance of the business is falling.”

AMP confirmed yesterday it had not had any regulatory “red flags” relating to plans to return the majority of the life insurance cash sale proceeds to investors.

The group has a capital surplus of $1.65 billion above minimum regulatory requirements and declared a final dividend of 4c per share.

Underlying profit — which removes one-offs and market volatility — printed at $680m for 2018.

However, a number of factors in a guidance statement — including new costs and an unwinding of distribution agreements — saw those numbers rebased.

AMP is also deferring consideration of an IPO of its New Zealand business.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout